Question: mning Software | M X M Question 2 - Chapter 3 Homew X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/que er 3 Homework i Saved ok t nces Exercise

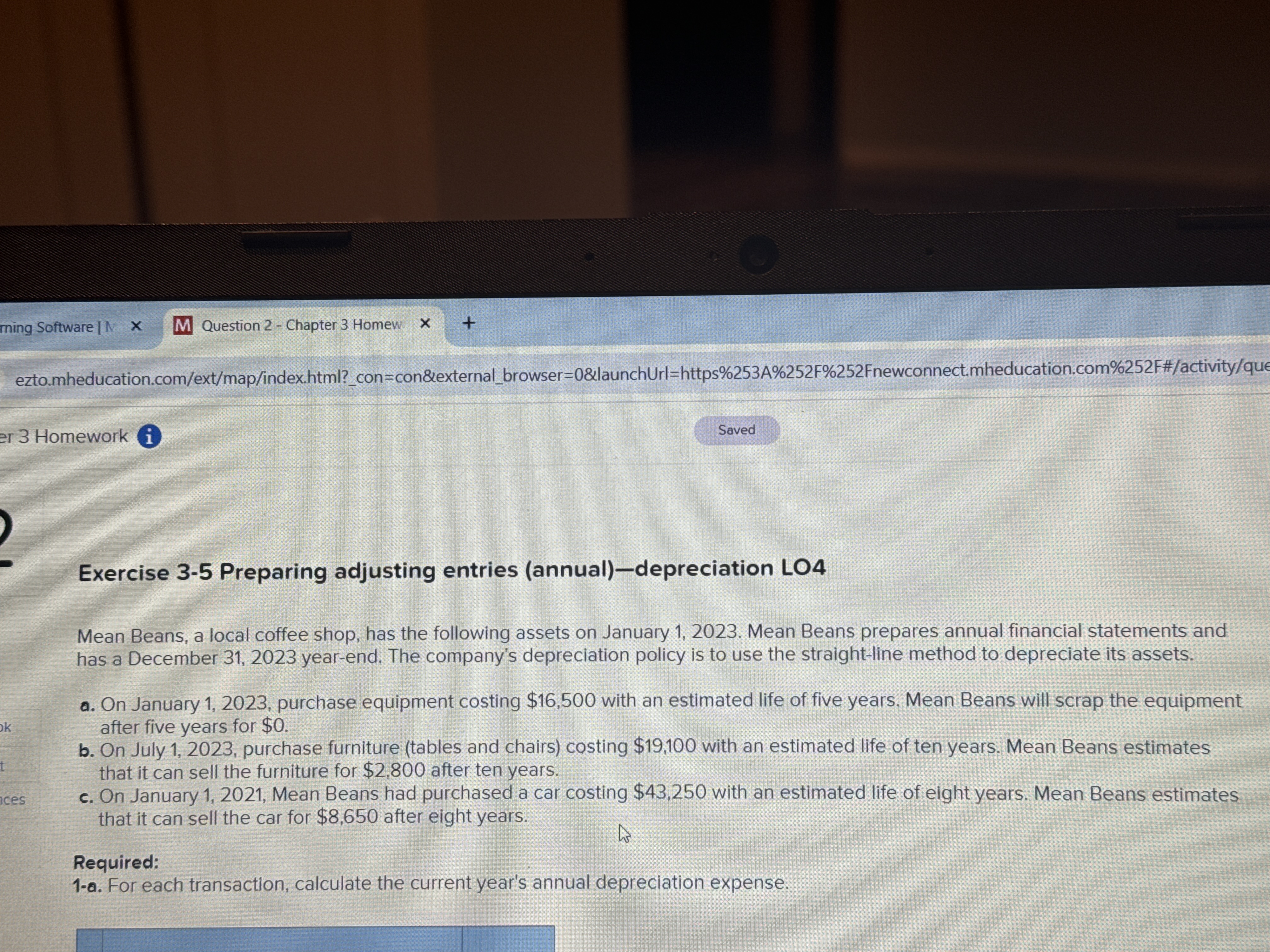

mning Software | M X M Question 2 - Chapter 3 Homew X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/que er 3 Homework i Saved ok t nces Exercise 3-5 Preparing adjusting entries (annual)-depreciation LO4 Mean Beans, a local coffee shop, has the following assets on January 1, 2023. Mean Beans prepares annual financial statements and has a December 31, 2023 year-end. The company's depreciation policy is to use the straight-line method to depreciate its assets. a. On January 1, 2023, purchase equipment costing $16,500 with an estimated life of five years. Mean Beans will scrap the equipment after five years for $0. b. On July 1, 2023, purchase furniture (tables and chairs) costing $19,100 with an estimated life of ten years. Mean Beans estimates that it can sell the furniture for $2,800 after ten years. c. On January 1, 2021, Mean Beans had purchased a car costing $43,250 with an estimated life of eight years. Mean Beans estimates that it can sell the car for $8,650 after eight years. Required: 1-a. For each transaction, calculate the current year's annual depreciation expense.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts