Question: Mo , Lu , and Barb formed the MLB Partnership by making investments of $ 7 3 , 8 0 0 , $ 2 8

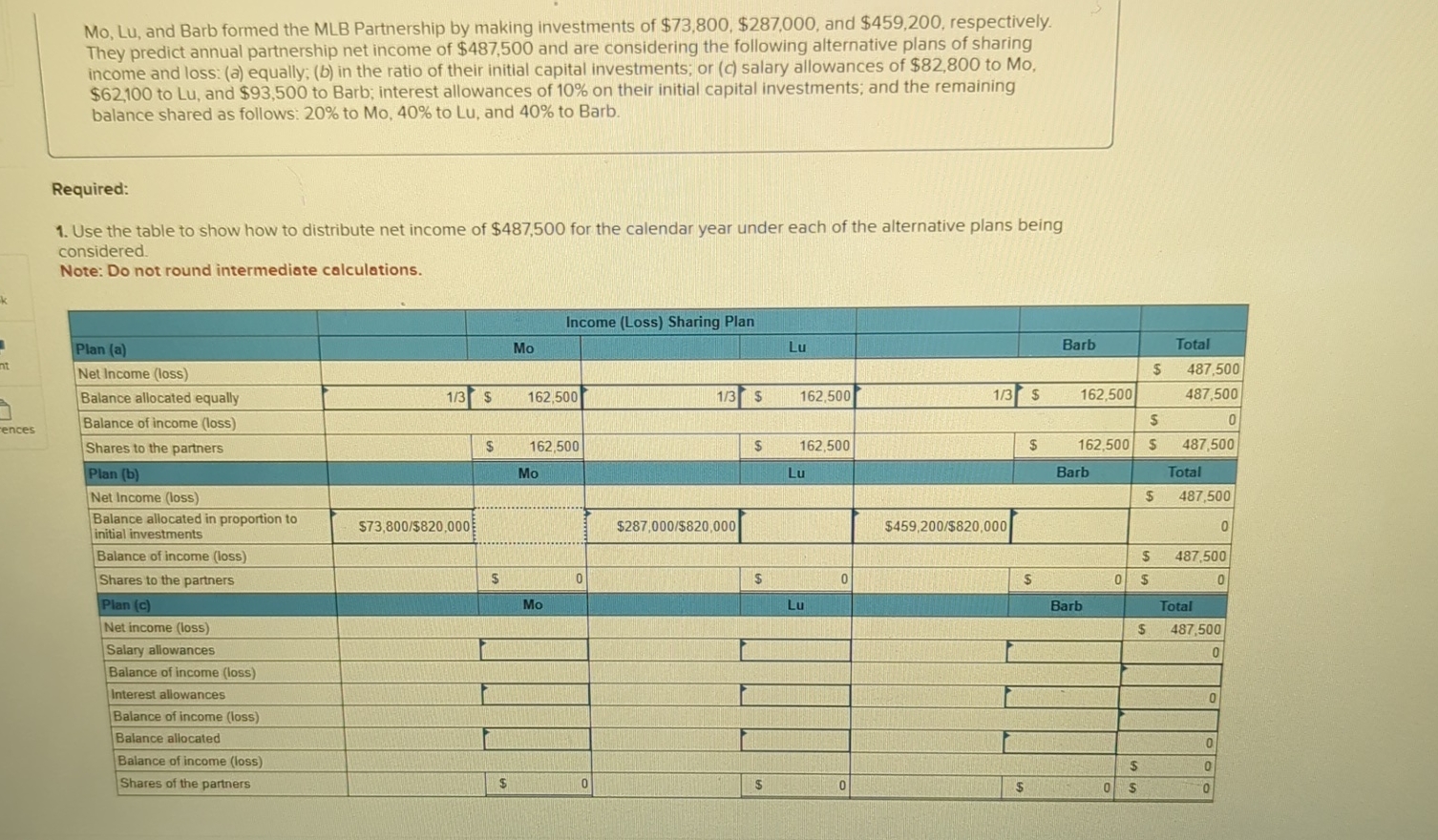

Mo Lu and Barb formed the MLB Partnership by making investments of $$ and $ respectively. They predict annual partnership net income of $ and are considering the following alternative plans of sharing income and loss: a equally; b in the ratio of their initial capital investments; or c salary allowances of $ to Mo $ to Lu and $ to Barb; interest allowances of on their initial capital investments; and the remaining balance shared as follows: to Mo to Lu and to Barb.

Required:

Use the table to show how to distribute net income of $ for the calendar year under each of the alternative plans being considered.

Note: Do not round intermediate calculations.

tablePlan aIncome Loss Sharing Plan,,Barb,TotalMoLuNet Income loss$Balance allocated equally,$$$Balance of income loss$Shares to the partners,$$$$Plan bMoLuBarb,,TotalNet Income loss$tableBalance allocated in proportion toinitial investments$$$Balance of income loss$Shares to the partners,$$$$Plan cMoLuBarb,,TotalNet income loss$Salary aliowances,TLBalance of income lossInterest allowances,LLLBalance of income lossBalance allocated,LLBalance of income loss$Shares of the partners,$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock