Question: mo Question 9 (3.33 points) In which case will locational arbitrage most likely be feasible? One bank's bid price for a currency is greater than

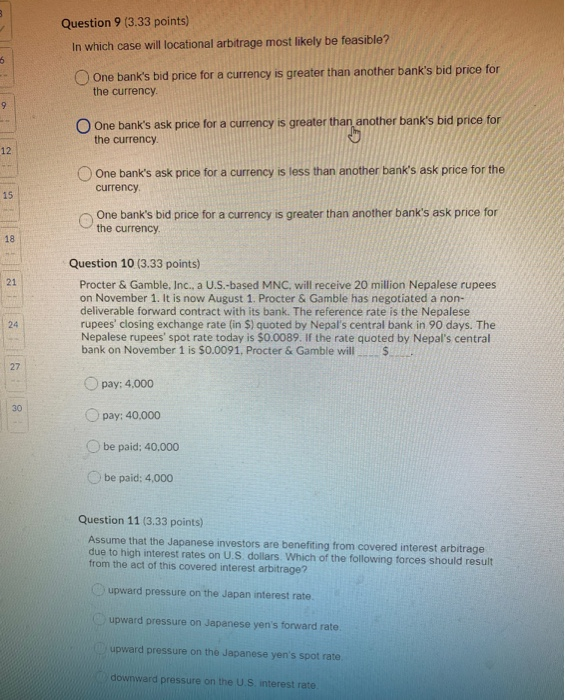

mo Question 9 (3.33 points) In which case will locational arbitrage most likely be feasible? One bank's bid price for a currency is greater than another bank's bid price for the currency One bank's ask price for a currency is greater than another bank's bid price for the currency One bank's ask price for a currency is less than another bank's ask price for the currency One bank's bid price for a currency is greater than another bank's ask price for the currency Question 10 (3.33 points) Procter & Gamble, Inc., a U.S.-based MNC, will receive 20 million Nepalese rupees on November 1. It is now August 1. Procter & Gamble has negotiated a non- deliverable forward contract with its bank. The reference rate is the Nepalese rupees' closing exchange rate (in $) quoted by Nepal's central bank in 90 days. The Nepalese rupees' spot rate today is $0.0089. If the rate quoted by Nepal's central bank on November 1 is $0.0091, Procter & Gamble will Per 1 is $0.0091 is $0.0089. If the als central bar pay: 4.000 pay: 40,000 be paid: 40.000 be paid: 4,000 Question 11 (3.33 points) Assume that the Japanese investors are benefiting from covered interest arbitrage due to high interest rates on US dollars. Which of the following forces should result from the act of this covered interest arbitrage? upward pressure on the Japan interest rate upward pressure on Japanese yen's forward rate upward pressure on the Japanese yen's spot rate downward pressure on the U.S. interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts