Question: Mock Test over Ch 1 1 Standard cost system Each question is worth 5% of Final] Q9. Which manager or who is most likely responsible

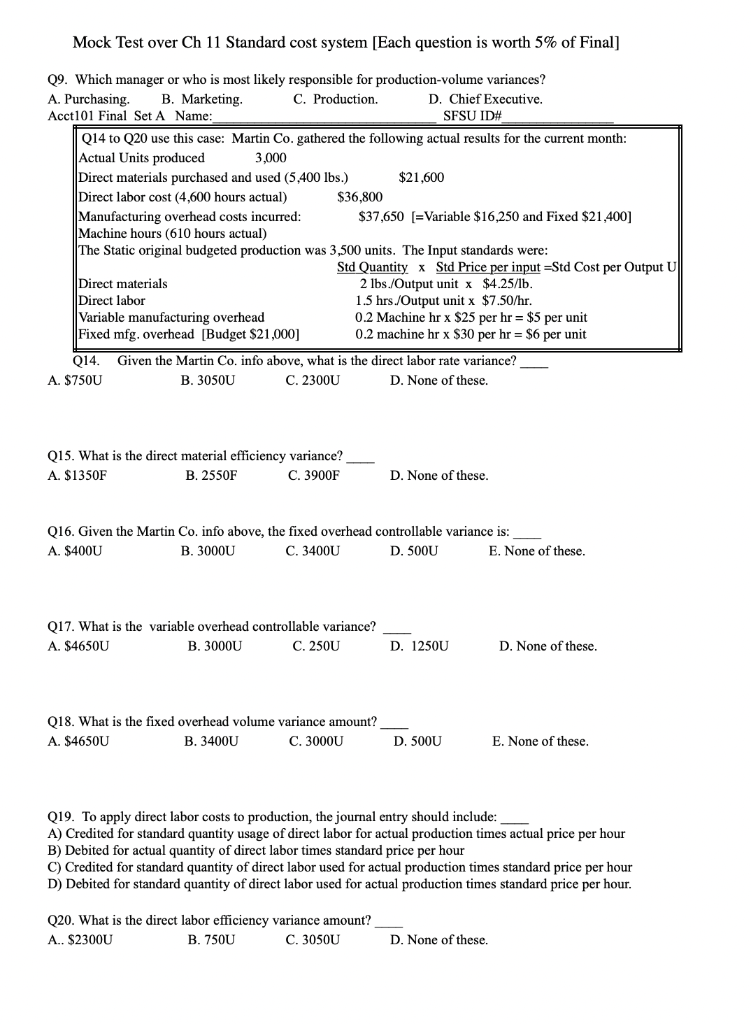

Mock Test over Ch 1 1 Standard cost system Each question is worth 5% of Final] Q9. Which manager or who is most likely responsible for production-volume variances? A. Purchasing. Acct101 Final Set A Name B. Marketing C. Production. D. Chief Executive. SFSU ID# Q14 to Q20 use this case: Martin Co. gathered the following actual results for the current month: Actual Units produced Direct materials purchased and used (5,400 lbs.) Direct labor cost (4,600 hours actual) Manufacturing overhead costs incurred: Machine hours (610 hours actual) The Static original budgeted production was 3,500 units. The Input standards were 3,000 $21,600 $36,800 S37,650 [-Variable $16,250 and Fixed $21,400] Std Quantity x Std Price per input-Std Cost per Output U 2 lbs./Output unit x $4.25/lb 1.5 hrs JOutput unit x $7.50/hr. 0.2 Machine hr x $25 per hr = $5 per unit 0.2 machine hr x S30 per hr $6 per unit Direct materials Direct labor Variable manufacturing ove Fixed mfg. overhead Budget $21,000] rhead Q14. Given the Martin Co. info above, what is the direct labor rate variance? C. 2300U A. $750U B. 3050U D. None of these. Q15. What is the direct material efficiency variance? A. $1350F B. 2550F C. 3900F D. None of these Q16. Given the Martin Co. info above, the fixed overhead controllable variance is A. $400U B. 3000U C. 3400U D. 500U E. None of these. Q17. What is the variable overhead controllable variance? A. $46500U C. 250U B. 3000U D. 1250U D. None of these. Q18. What is the fixed overhead volume variance amount? A. $4650U B. 3400U C. 3000U D. 500U E. None of these Q19. To apply direct labor costs to production, the journal entry should include: A) Credited for standard quantity usage of direct labor for actual production times actual price per hour B) Debited for actual quantity of direct labor times standard price per hour C) Credited for standard quantity of direct labor used for actual production times standard price per hour D) Debited for standard quantity of direct labor used for actual production times standard price per hour Q20. What is the direct labor efficiency variance amount? A. $2300U C. 3050U D. None of these. B. 750U Mock Test over Ch 1 1 Standard cost system Each question is worth 5% of Final] Q9. Which manager or who is most likely responsible for production-volume variances? A. Purchasing. Acct101 Final Set A Name B. Marketing C. Production. D. Chief Executive. SFSU ID# Q14 to Q20 use this case: Martin Co. gathered the following actual results for the current month: Actual Units produced Direct materials purchased and used (5,400 lbs.) Direct labor cost (4,600 hours actual) Manufacturing overhead costs incurred: Machine hours (610 hours actual) The Static original budgeted production was 3,500 units. The Input standards were 3,000 $21,600 $36,800 S37,650 [-Variable $16,250 and Fixed $21,400] Std Quantity x Std Price per input-Std Cost per Output U 2 lbs./Output unit x $4.25/lb 1.5 hrs JOutput unit x $7.50/hr. 0.2 Machine hr x $25 per hr = $5 per unit 0.2 machine hr x S30 per hr $6 per unit Direct materials Direct labor Variable manufacturing ove Fixed mfg. overhead Budget $21,000] rhead Q14. Given the Martin Co. info above, what is the direct labor rate variance? C. 2300U A. $750U B. 3050U D. None of these. Q15. What is the direct material efficiency variance? A. $1350F B. 2550F C. 3900F D. None of these Q16. Given the Martin Co. info above, the fixed overhead controllable variance is A. $400U B. 3000U C. 3400U D. 500U E. None of these. Q17. What is the variable overhead controllable variance? A. $46500U C. 250U B. 3000U D. 1250U D. None of these. Q18. What is the fixed overhead volume variance amount? A. $4650U B. 3400U C. 3000U D. 500U E. None of these Q19. To apply direct labor costs to production, the journal entry should include: A) Credited for standard quantity usage of direct labor for actual production times actual price per hour B) Debited for actual quantity of direct labor times standard price per hour C) Credited for standard quantity of direct labor used for actual production times standard price per hour D) Debited for standard quantity of direct labor used for actual production times standard price per hour Q20. What is the direct labor efficiency variance amount? A. $2300U C. 3050U D. None of these. B. 750U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts