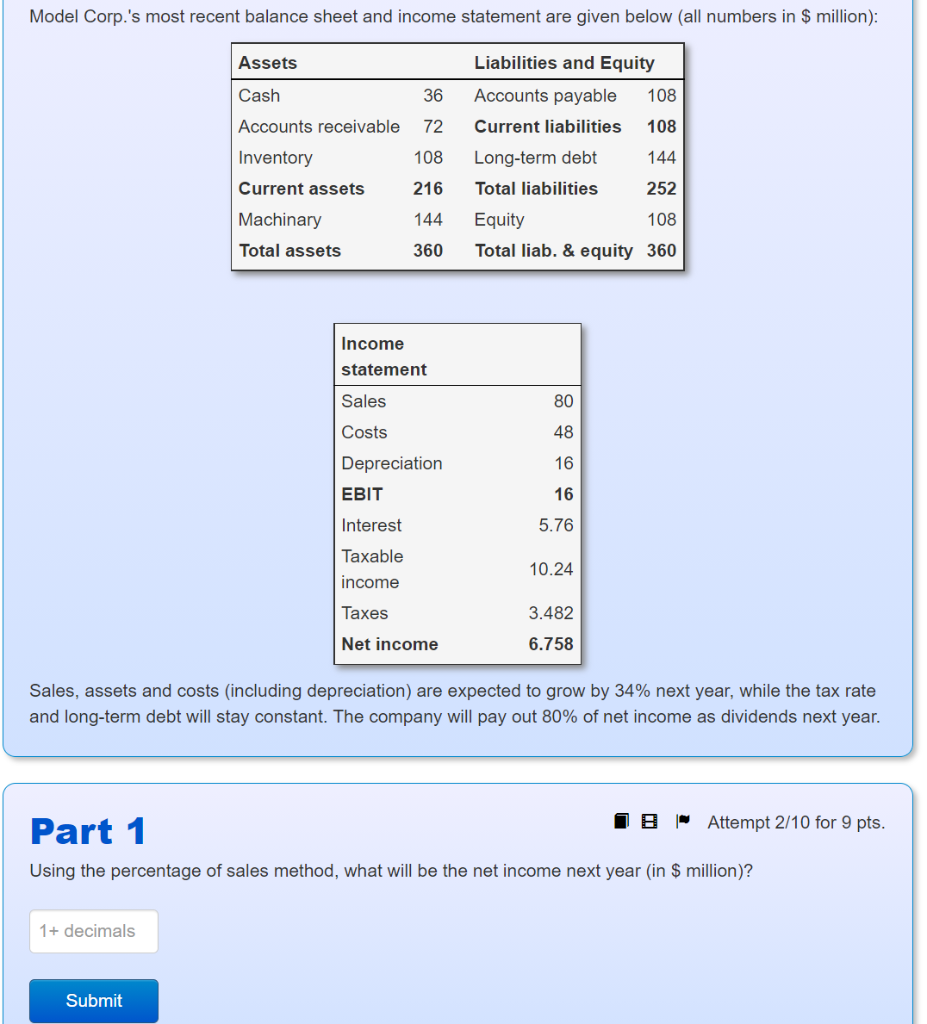

Question: Model Corp.'s most recent balance sheet and income statement are given below (all numbers in $ million): Assets Cash 36 Accounts receivable 72 108 Liabilities

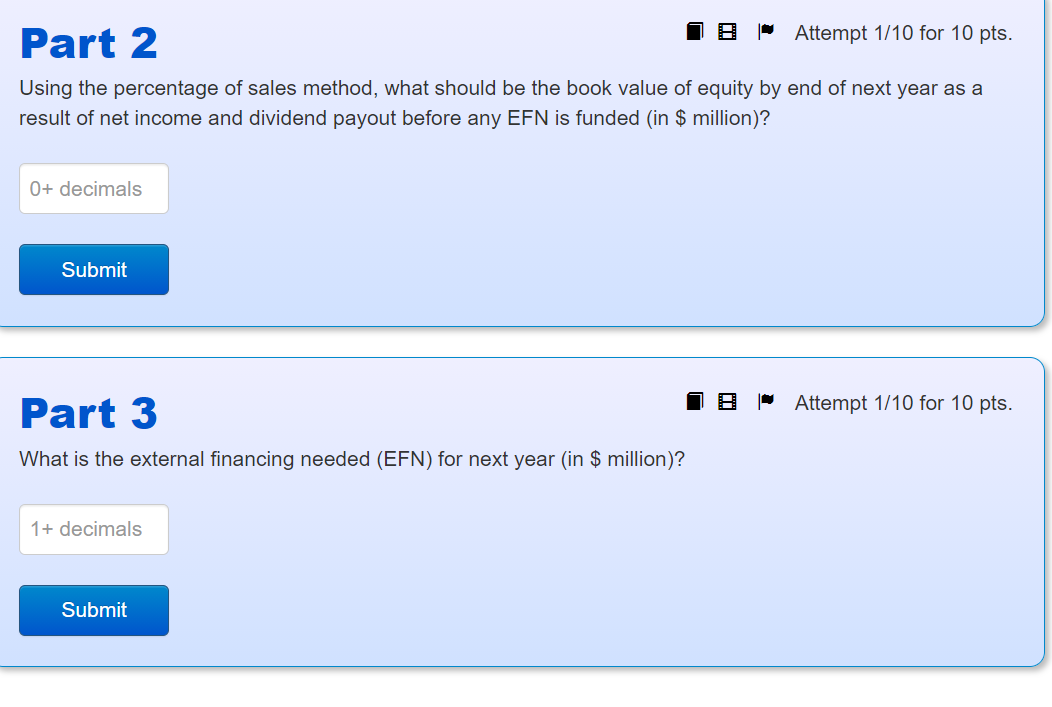

Model Corp.'s most recent balance sheet and income statement are given below (all numbers in $ million): Assets Cash 36 Accounts receivable 72 108 Liabilities and Equity Accounts payable 108 Current liabilities 108 Long-term debt 144 Total liabilities 252 Equity 108 Total liab. & equity 360 Inventory Current assets Machinary Total assets 216 144 360 Income statement 80 48 16 Sales Costs Depreciation EBIT Interest Taxable income 16 5.76 10.24 3.482 Taxes Net income 6.758 Sales, assets and costs (including depreciation) are expected to grow by 34% next year, while the tax rate and long-term debt will stay constant. The company will pay out 80% of net income as dividends next year. Part 1 8 - Attempt 2/10 for 9 pts. Using the percentage of sales method, what will be the net income next year (in $ million)? 1+ decimals Submit Part 2 1 8 Attempt 1/10 for 10 pts. Using the percentage of sales method, what should be the book value of equity by end of next year as a result of net income and dividend payout before any EFN is funded (in $ million)? 0+ decimals Submit | Attempt 1/10 for 10 pts. Part 3 What is the external financing needed (EFN) for next year (in $ million)? 1+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts