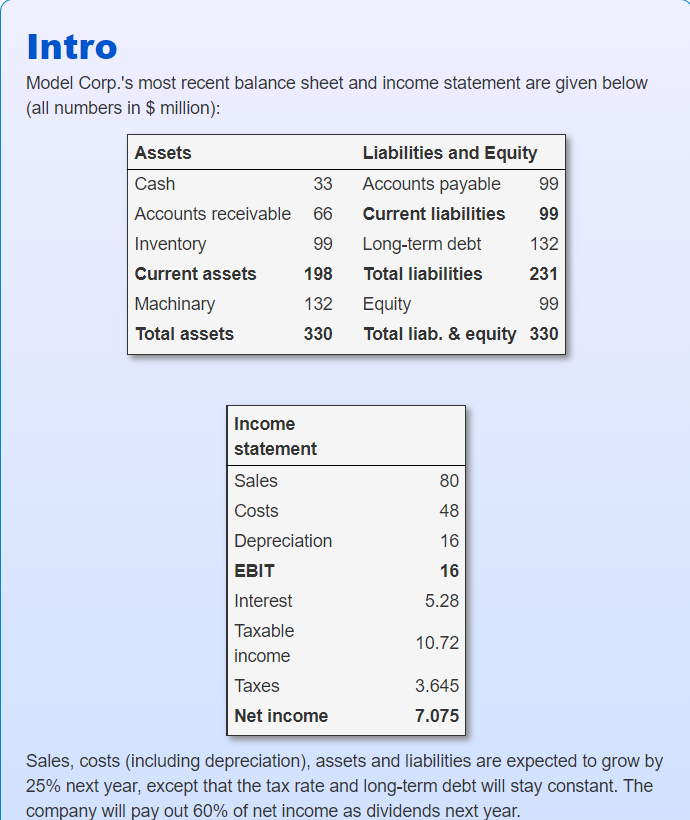

Question: Model Corp.'s most recent balance sheet and income statement are given below (all numbers in $ million): Sales, costs (including depreciation), assets and liabilities are

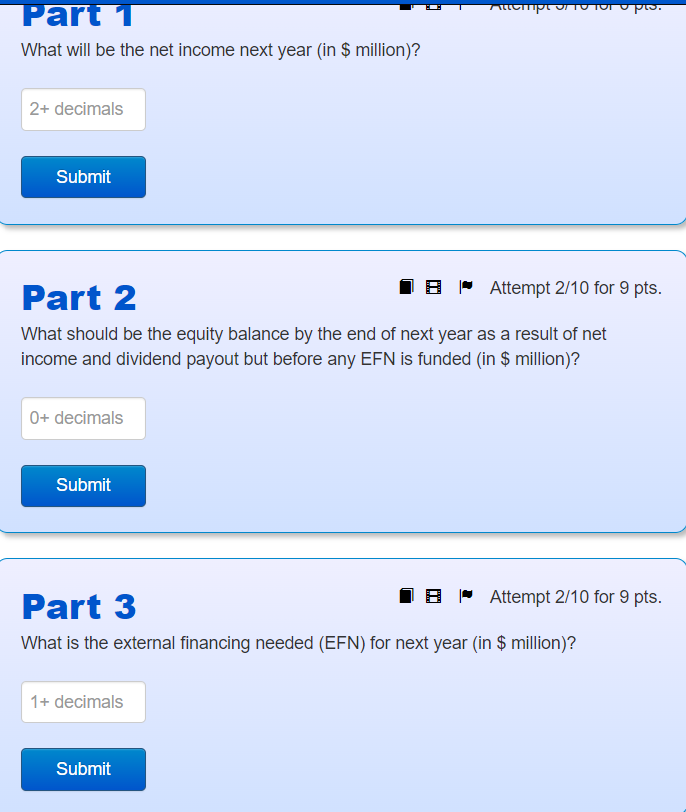

Model Corp.'s most recent balance sheet and income statement are given below (all numbers in $ million): Sales, costs (including depreciation), assets and liabilities are expected to grow by 25% next year, except that the tax rate and long-term debt will stay constant. The company will pay out 60% of net income as dividends next year. What will be the net income next year (in \$ million)? What should be the equity balance by the end of next year as a result of net income and dividend payout but before any EFN is funded (in \$ million)? Part 3 Attempt 2/10 for 9pt What is the external financing needed (EFN) for next year (in \$ million)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts