Question: Model Test (75 pts): It's your first day as an analyst and you have been asked to prepare a valuation for an energy drink company

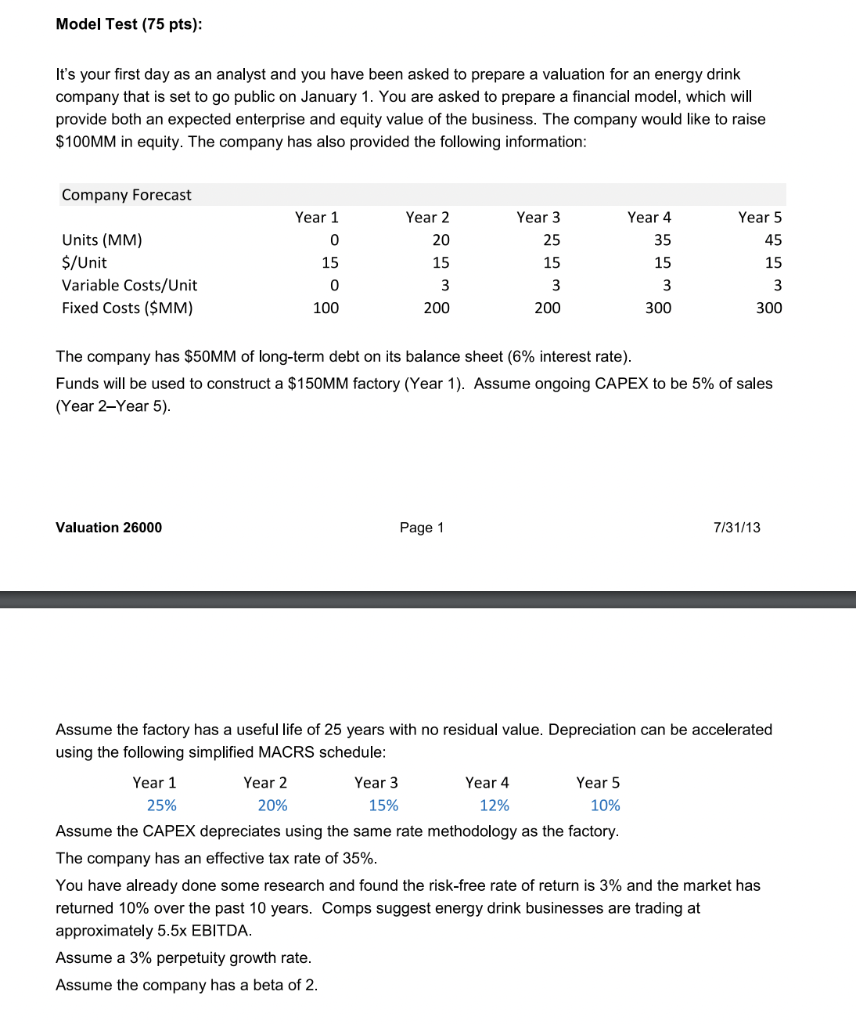

Model Test (75 pts): It's your first day as an analyst and you have been asked to prepare a valuation for an energy drink company that is set to go public on January 1. You are asked to prepare a financial model, which will provide both an expected enterprise and equity value of the business. The company would like to raise $100MM in equity. The company has also provided the following information: The company has $50MM of long-term debt on its balance sheet (6\% interest rate). Funds will be used to construct a $150MM factory (Year 1). Assume ongoing CAPEX to be 5% of sales (Year 2-Year 5). Valuation 26000 Page 1 7/31/13 Assume the factory has a useful life of 25 years with no residual value. Depreciation can be accelerated using the following simplified MACRS schedule: Assume the CAPEX depreciates using the same rate methodology as the factory. The company has an effective tax rate of 35%. You have already done some research and found the risk-free rate of return is 3% and the market has returned 10% over the past 10 years. Comps suggest energy drink businesses are trading at approximately 5.5x EBITDA. Assume a 3% perpetuity growth rate. Assume the company has a beta of 2 . Model Test (75 pts): It's your first day as an analyst and you have been asked to prepare a valuation for an energy drink company that is set to go public on January 1. You are asked to prepare a financial model, which will provide both an expected enterprise and equity value of the business. The company would like to raise $100MM in equity. The company has also provided the following information: The company has $50MM of long-term debt on its balance sheet (6\% interest rate). Funds will be used to construct a $150MM factory (Year 1). Assume ongoing CAPEX to be 5% of sales (Year 2-Year 5). Valuation 26000 Page 1 7/31/13 Assume the factory has a useful life of 25 years with no residual value. Depreciation can be accelerated using the following simplified MACRS schedule: Assume the CAPEX depreciates using the same rate methodology as the factory. The company has an effective tax rate of 35%. You have already done some research and found the risk-free rate of return is 3% and the market has returned 10% over the past 10 years. Comps suggest energy drink businesses are trading at approximately 5.5x EBITDA. Assume a 3% perpetuity growth rate. Assume the company has a beta of 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts