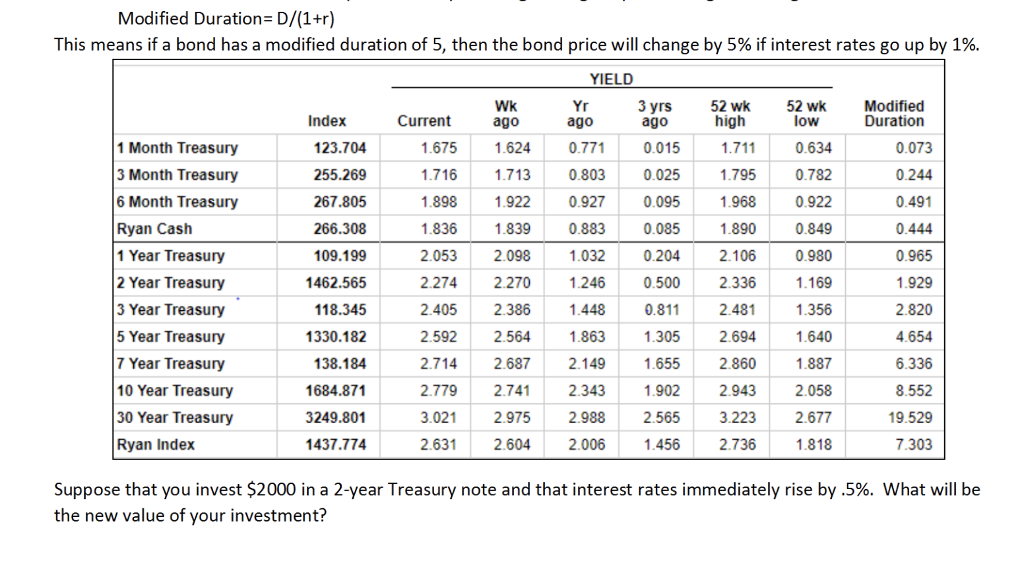

Question: Modified Duration D/(1+r) This means if a bond has a modified duration of 5, then the bond price will change by 5% if interest rates

Modified Duration D/(1+r) This means if a bond has a modified duration of 5, then the bond price will change by 5% if interest rates go up by 1%. YIELD 52 wk Wk ago 3 yrs ago high Modified Duration Index Current ago low 1 Month Treasury 3 Month Treasury 6 Month Treasury Ryan Cash 1 Year Treasury 2 Year Treasury 3 Year Treasury 5 Year Treasury 7 Year Treasury 10 Year Treasury 30 Year Treasury Ryan Index 123.704 255.269 267.805 266.308 109.199 1462.565 118.345 1330.182 138.184 1684.871 3249.801 1437.774 0.634 0.782 0.095 1.968 0922 0.849 0.980 1.169 1.356 640 1.887 2.343 1.902 2.943 2.058 2.677 1.818 0.073 0.244 0.491 0.444 0.965 1.929 2.820 4.654 6.336 8.552 19.529 7.303 1.675 1.624 0.771 0.015 1.7161.713 0.803 0.025 1.898 1922 0.927 0 1.836 1.839 0.883 0.085 1.795 1.890 2.053 2.098 1032 0.2042.106 2.274 2.270 1246 0.500 2.336 0.811 2.481 1.305 2.694 1.655 2.860 2.405 2.386 1.448 2.592 2.564 1863 2.714 2.687 2.149 2.779 2.741 3.021 2.9752.988 2.565 2.6312.6042.006 3.223 1.456 2.736 Suppose that you invest $2000 in a 2-year Treasury note and that interest rates immediately rise by .5%, what will be the new value of your investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts