Question: modified duration? Explain the difference. Review Only Click the icon to see the Worked Solution (Formula Use). Click the icon to see the Worked Solution

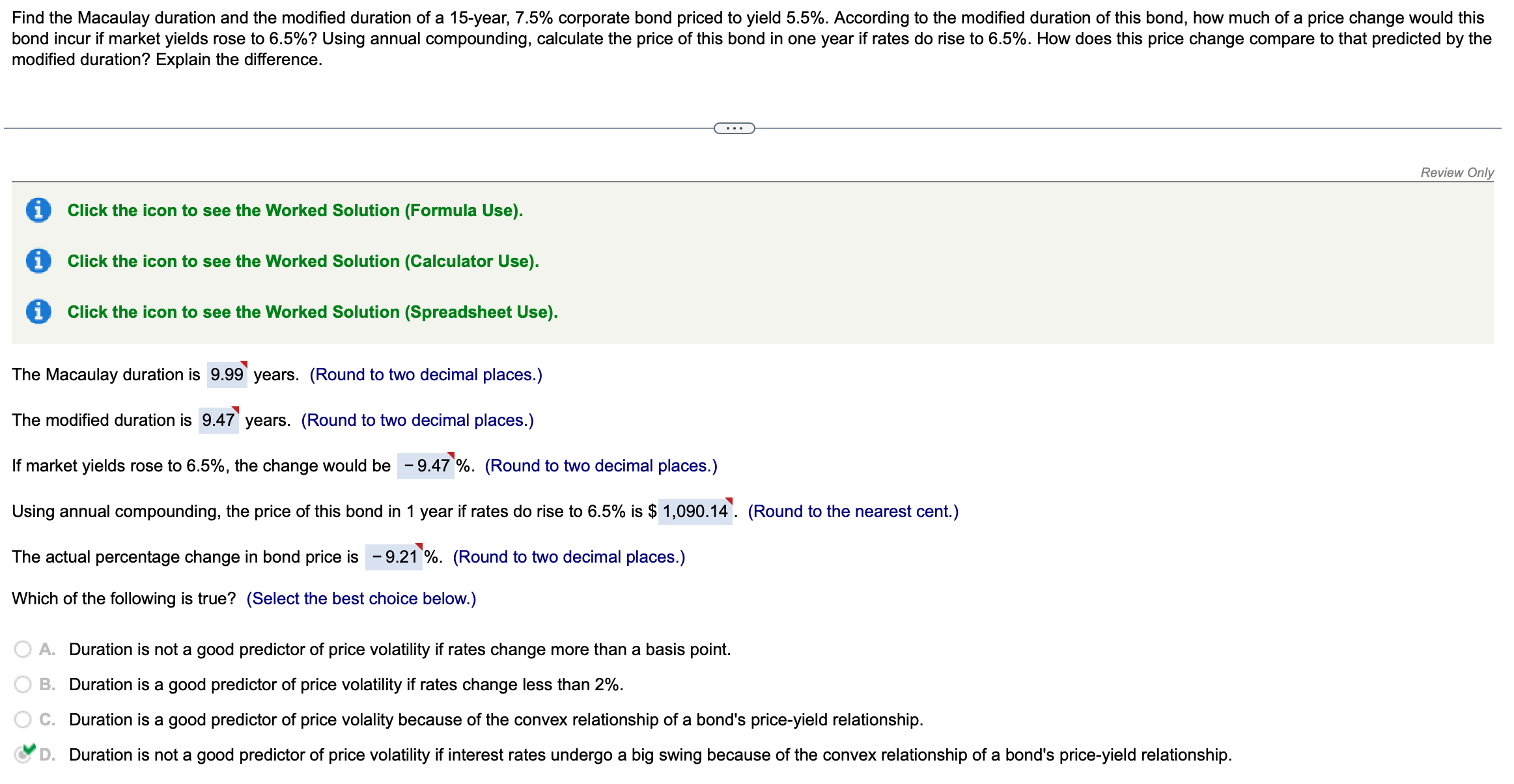

modified duration? Explain the difference. Review Only Click the icon to see the Worked Solution (Formula Use). Click the icon to see the Worked Solution (Calculator Use). Click the icon to see the Worked Solution (Spreadsheet Use). The Macaulay duration is 9.99 years. (Round to two decimal places.) The modified duration is years. (Round to two decimal places.) If market yields rose to 6.5%, the change would be \%. (Round to two decimal places.) Using annual compounding, the price of this bond in 1 year if rates do rise to 6.5% is $ (Round to the nearest cent.) The actual percentage change in bond price is ( Round to two decimal places.) Which of the following is true? (Select the best choice below.) A. Duration is not a good predictor of price volatility if rates change more than a basis point. B. Duration is a good predictor of price volatility if rates change less than 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts