Question: Modify the NPV Example we discussed in the class so that development lasts for an extra year. Assume that development costs of $7.2 million and

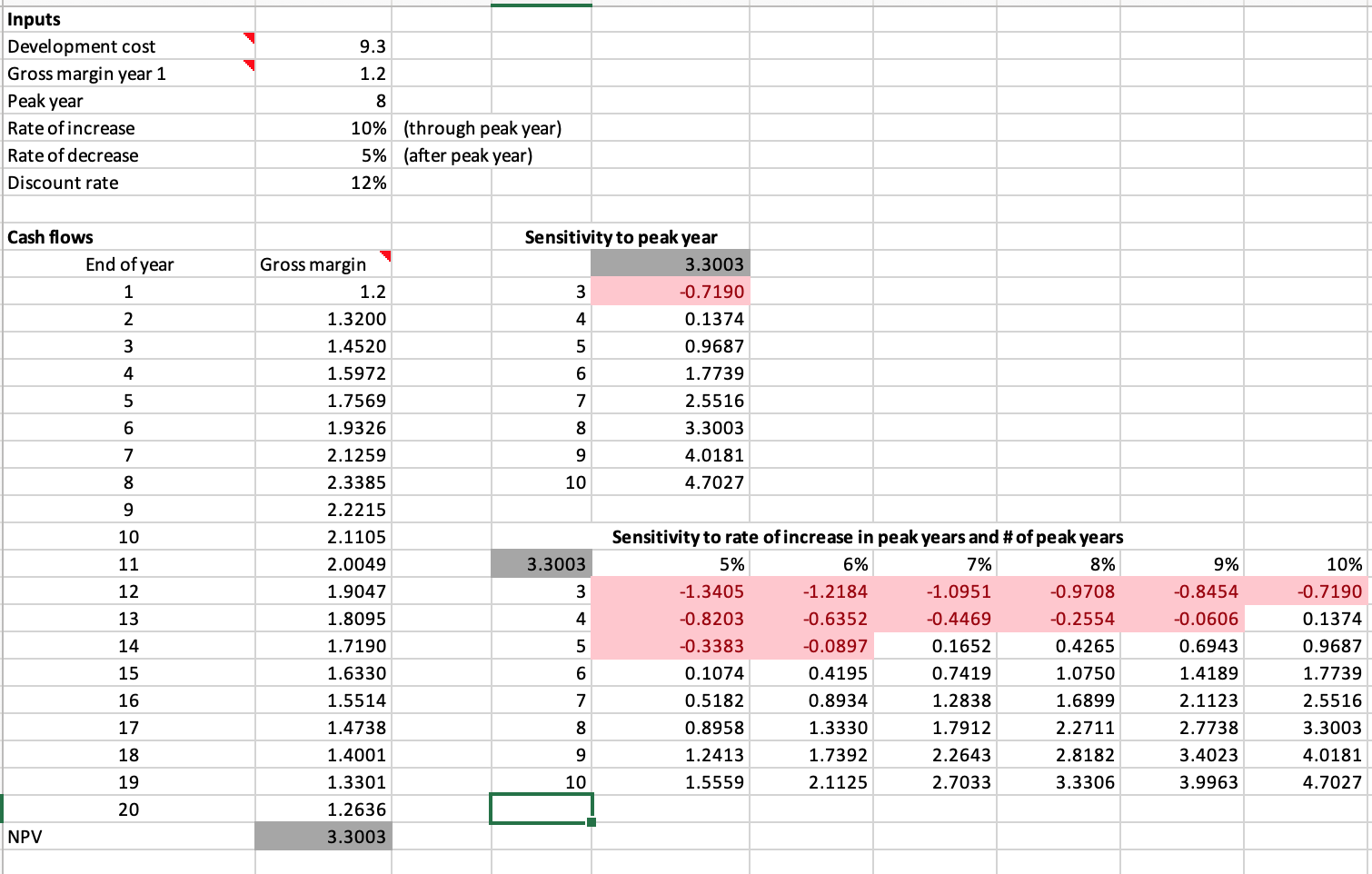

Modify the NPV Example we discussed in the class so that development lasts for an extra year. Assume that development costs of $7.2 million and $2.1 million are incurred at the beginnings of years 1 and 2, and then the sales in the current model occur one year later, that is, from year 2 until 21. Calculate the NPV discounted back to the beginning of year 1.

Specifically looking for guidance on what changes need to be made to incur the development costs in year one and 2 rather than at the conclusion of the project.

Inputs Development cost Gross margin year 1 Peak year Rate of increase Rate of decrease Discount rate 9.3 1.2 8 10% 5% 12% (through peak year) (after peak year) Cash flows End of year 3 4 Sensitivity to peak year 3.3003 -0.7190 4 0.1374 5 0.9687 6 1.7739 2.5516 3.3003 4.0181 4.7027 5.00 von w O 10 Gross margin 1.2 1.3200 1.4520 1.5972 1.7569 1.9326 2.1259 2.3385 2.2215 2.1105 2.0049 1.9047 1.8095 1.7190 1.6330 1.5514 1.4738 1.4001 1.3301 1.2636 3.3003 3.3003 5% 11 12 9% 13 14 Ovouw Sensitivity to rate of increase in peak years and #of peak years 6% 7% 8% -1.3405 -1.2184 -1.0951 -0.9708 -0.8203 -0.6352 -0.4469 -0.2554 -0.3383 -0.0897 0.1652 0.4265 0.1074 0.4195 0.7419 1.0750 0.5182 0.8934 1.2838 1.6899 0.8958 1.3330 1.7912 2.2711 1.2413 1.7392 2.2643 2.8182 1.5559 2.1125 2.7033 3.3306 15 -0.8454 -0.0606 0.6943 1.4189 2.1123 2.7738 3.4023 3.9963 10% -0.7190 0.1374 0.9687 1.7739 2.5516 3.3003 4.0181 4.7027 16 17 18 9 19 10 20 NPV Inputs Development cost Gross margin year 1 Peak year Rate of increase Rate of decrease Discount rate 9.3 1.2 8 10% 5% 12% (through peak year) (after peak year) Cash flows End of year 3 4 Sensitivity to peak year 3.3003 -0.7190 4 0.1374 5 0.9687 6 1.7739 2.5516 3.3003 4.0181 4.7027 5.00 von w O 10 Gross margin 1.2 1.3200 1.4520 1.5972 1.7569 1.9326 2.1259 2.3385 2.2215 2.1105 2.0049 1.9047 1.8095 1.7190 1.6330 1.5514 1.4738 1.4001 1.3301 1.2636 3.3003 3.3003 5% 11 12 9% 13 14 Ovouw Sensitivity to rate of increase in peak years and #of peak years 6% 7% 8% -1.3405 -1.2184 -1.0951 -0.9708 -0.8203 -0.6352 -0.4469 -0.2554 -0.3383 -0.0897 0.1652 0.4265 0.1074 0.4195 0.7419 1.0750 0.5182 0.8934 1.2838 1.6899 0.8958 1.3330 1.7912 2.2711 1.2413 1.7392 2.2643 2.8182 1.5559 2.1125 2.7033 3.3306 15 -0.8454 -0.0606 0.6943 1.4189 2.1123 2.7738 3.4023 3.9963 10% -0.7190 0.1374 0.9687 1.7739 2.5516 3.3003 4.0181 4.7027 16 17 18 9 19 10 20 NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts