Question: Module 02 - Lesson 2 1. The pros and cons of expanding a company by issuing new stock: 1.1. Pro: I 1.2. Con: 2. What

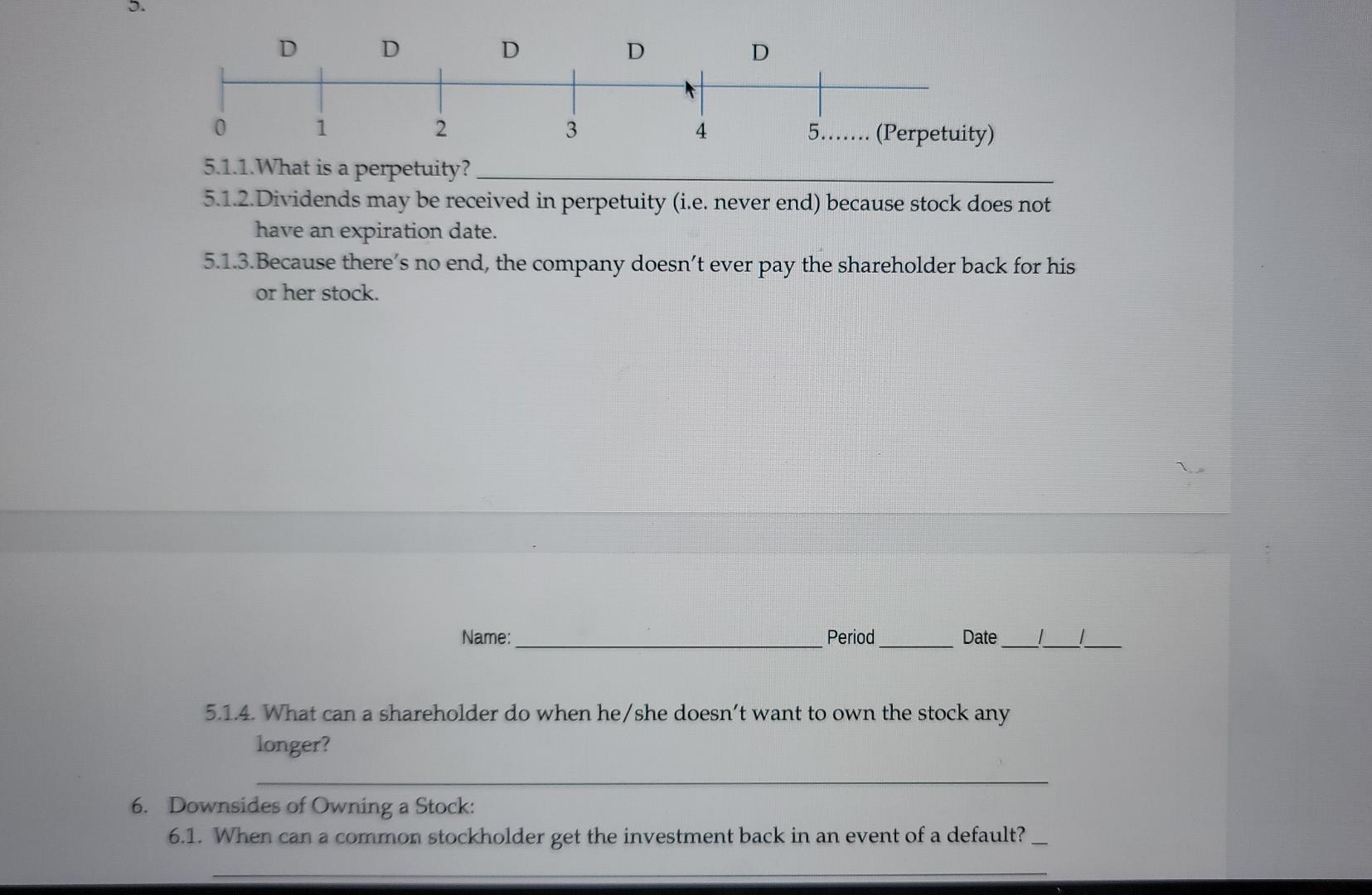

Module 02 - Lesson 2 1. The pros and cons of expanding a company by issuing new stock: 1.1. Pro: I 1.2. Con: 2. What is a common) stock? 2.1. Each unit is known as a Stockholders gain more ownership as they buy more 2.2. The more new shares stock a company issues to raise money, the ownership percentage the founders will retain. 2.3. It is easy for anyone to buy shares once a company goes public. What does going public mean? 3. What are the three benefits of owning a stock? 3.1. 3.2. 3.3. 4. What are the major characteristics of Dividends? 4.1. 4.2. 4.3. 4.4. D D D D 4 1 2 3 5....... (Perpetuity) 5.1.1. What is a perpetuity? 5.1.2.Dividends may be received in perpetuity (i.e. never end) because stock does not have an expiration date. 5.1.3. Because there's no end, the company doesn't ever pay the shareholder back for his or her stock. Name: Period Date L 5.1.4. What can a shareholder do when he/she doesn't want to own the stock any longer? 6. Downsides of Owning a Stock: 6.1. When can a common stockholder get the investment back in an event of a default? 6. Downsides of Owning a Stock: 6.1. When can a common stockholder get the investment back in an event of a default? 6.2. Bondholders and those who have loaned the company money are entitled to be paid back everything common shareholders get their investment back. 6.3. Common shareholder are also known as owners because in if the company goes under, they only get what's left after all debts have been paid. 7. What is liquidation? 8. What are the major advantages of issuing a stock? 8.1.1.1. 8.1.1.3. a 8.1.2. What are the major disadvantages of issuing a stock? 8.1.2.1. 8.1.2.1.1. This effect is called because the founder's ownership is watered down with each new share sold to the investors. 9. Since both Stocks and Bonds have their own advantages and disadvantages, what should we do while investing? 9.1. 9.1.1. Because it takes from both, it is known as a security. 9.1.2. This stock is known as stock 9.1.3.While every publicly traded company has common stock, most offer preferred 10. The characteristics of Preferred Stock are: 10.4. 11. Arrange the following in the order of the recipient of money at the time of liquidation with 1 being the first one to get money and 3 being the last one. I Preferred Stockholders, Common Stockholders, Bondholders 12. Web Challenge #1: Research three companies that are planning to go public. Answer: 1. How long have they been in business? 2._Are they currently making profits? 3. Which investment bank is in charge of the Initial Public Offering (IPO)? 4. How much money does the company intend to raise? Name: Period Date 13. Web Challenge #2: Search using "dividend growers" or "rising dividends for three companies that have raised their dividends year after year. How much have they risen? Which company holds the record for most consecutive increases? icino money and also Name: Period Date 13. Web Challenge #2: Search using "dividend growers" or "rising dividends" for three companies that have raised their dividends year after year. How much have they risen? Which company holds the record for most consecutive increases? 14. Web Challenge #3: Some company founders are very interested in raising money and also keeping control of their businesses. Two such companies are Facebook and Google. Research what each company did when issuing shares and raising money to ensure that the founders would retain control! Module 02 - Lesson 2 1. The pros and cons of expanding a company by issuing new stock: 1.1. Pro: I 1.2. Con: 2. What is a common) stock? 2.1. Each unit is known as a Stockholders gain more ownership as they buy more 2.2. The more new shares stock a company issues to raise money, the ownership percentage the founders will retain. 2.3. It is easy for anyone to buy shares once a company goes public. What does going public mean? 3. What are the three benefits of owning a stock? 3.1. 3.2. 3.3. 4. What are the major characteristics of Dividends? 4.1. 4.2. 4.3. 4.4. D D D D 4 1 2 3 5....... (Perpetuity) 5.1.1. What is a perpetuity? 5.1.2.Dividends may be received in perpetuity (i.e. never end) because stock does not have an expiration date. 5.1.3. Because there's no end, the company doesn't ever pay the shareholder back for his or her stock. Name: Period Date L 5.1.4. What can a shareholder do when he/she doesn't want to own the stock any longer? 6. Downsides of Owning a Stock: 6.1. When can a common stockholder get the investment back in an event of a default? 6. Downsides of Owning a Stock: 6.1. When can a common stockholder get the investment back in an event of a default? 6.2. Bondholders and those who have loaned the company money are entitled to be paid back everything common shareholders get their investment back. 6.3. Common shareholder are also known as owners because in if the company goes under, they only get what's left after all debts have been paid. 7. What is liquidation? 8. What are the major advantages of issuing a stock? 8.1.1.1. 8.1.1.3. a 8.1.2. What are the major disadvantages of issuing a stock? 8.1.2.1. 8.1.2.1.1. This effect is called because the founder's ownership is watered down with each new share sold to the investors. 9. Since both Stocks and Bonds have their own advantages and disadvantages, what should we do while investing? 9.1. 9.1.1. Because it takes from both, it is known as a security. 9.1.2. This stock is known as stock 9.1.3.While every publicly traded company has common stock, most offer preferred 10. The characteristics of Preferred Stock are: 10.4. 11. Arrange the following in the order of the recipient of money at the time of liquidation with 1 being the first one to get money and 3 being the last one. I Preferred Stockholders, Common Stockholders, Bondholders 12. Web Challenge #1: Research three companies that are planning to go public. Answer: 1. How long have they been in business? 2._Are they currently making profits? 3. Which investment bank is in charge of the Initial Public Offering (IPO)? 4. How much money does the company intend to raise? Name: Period Date 13. Web Challenge #2: Search using "dividend growers" or "rising dividends for three companies that have raised their dividends year after year. How much have they risen? Which company holds the record for most consecutive increases? icino money and also Name: Period Date 13. Web Challenge #2: Search using "dividend growers" or "rising dividends" for three companies that have raised their dividends year after year. How much have they risen? Which company holds the record for most consecutive increases? 14. Web Challenge #3: Some company founders are very interested in raising money and also keeping control of their businesses. Two such companies are Facebook and Google. Research what each company did when issuing shares and raising money to ensure that the founders would retain control

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts