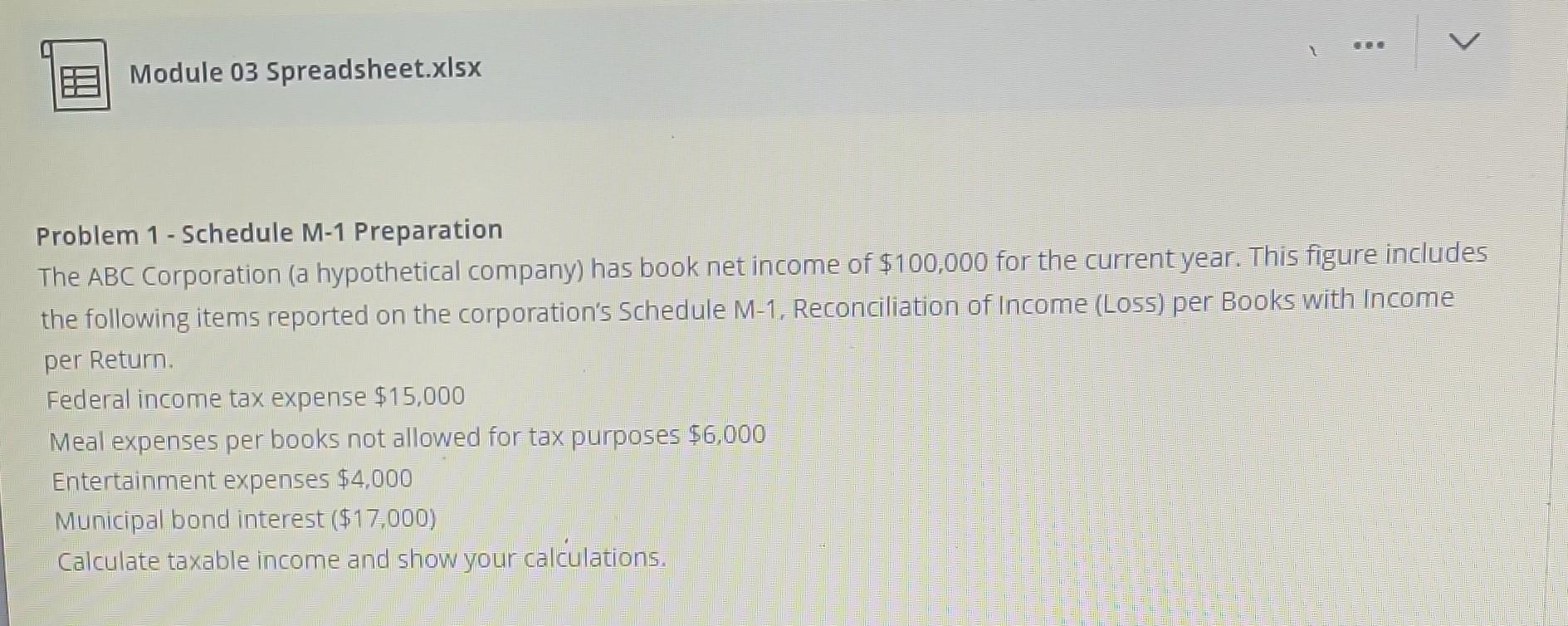

Question: Module 03 Spreadsheet.x|sx Problem 1 - Schedule M-1 Preparation The ABC Corporation (a hypothetical company) has book net income of $100,000 for the current year.

Module 03 Spreadsheet.x|sx Problem 1 - Schedule M-1 Preparation The ABC Corporation (a hypothetical company) has book net income of $100,000 for the current year. This figure includes the following items reported on the corporation's Schedule M-1. Reconciliation of Income (Loss) per Books with Income per Return. Federal income tax expense $15,000 Meal expenses per books not allowed for tax purposes $6,000 Entertainment expenses $4,000 Municipal bond interest ($17,000) Calculate taxable income and show your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts