Question: Module 05 Content Use this spreadsheet to show your answers to the problems below Problem 1 Amy owns 35 percent of a partnership, and her

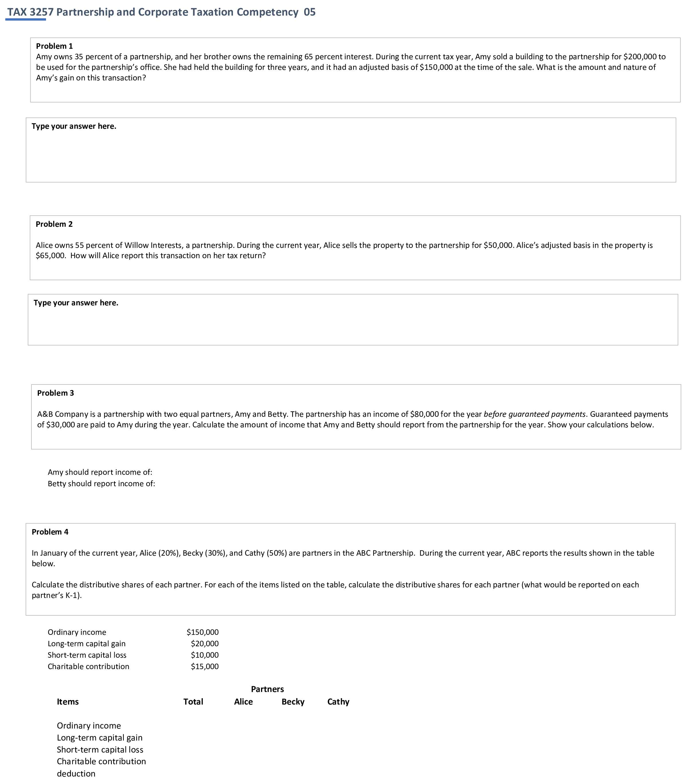

Module 05 Content

Use this spreadsheet to show your answers to the problems below

Problem 1

Amy owns 35 percent of a partnership, and her brother owns the remaining 65 percent interest. During the current tax year, Amy sold a building to the partnership for $200,000 to be used for the partnership's office. She had held the building for three years, and it had an adjusted basis of $150,000 at the time of the sale. What is the amount and nature of Amy's gain on this transaction?

Problem 2

Alice owns 55 percent of Willow Interests, a partnership. During the current year, Alice sells property to the partnership for $50,000. Alice's adjusted basis in the property is $65,000. How will Alice report this transaction on her tax return?

Problem 3

A&B Company is a partnership with two equal partners, Amy and Betty. The partnership has an income of $80,000 for the yearbefore guaranteed payments. Guaranteed payments of $30,000 are paid to Amy during the year. Calculate the amount of income that should be reported by Amy and Betty from the partnership for the year. Show your calculations.

Problem 4

On January of the current year, Alice (20%), Becky (30%), and Cathy (50%) are partners in the ABC Partnership. During the current year, ABC reports the following results:

Ordinary Income - $150,000

Long-term capital gain - $20,000

Short-term capital loss - $10.000

Charitable contribution - $15,000

Calculate the distributive shares of each partner. For each of the above items, calculate the distributive shares for each partner (what would be reported on each partner's K-1).

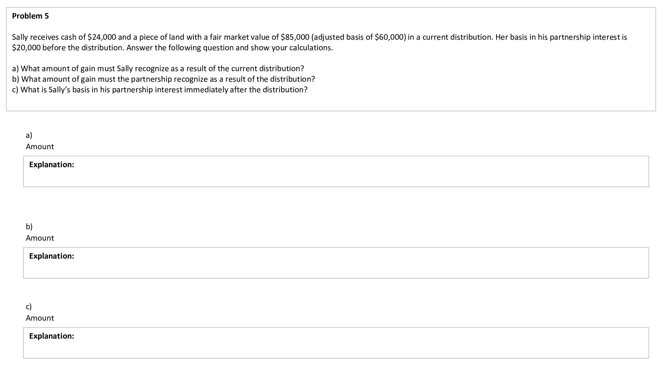

Problem 5

Sally receives cash of $24,000 and a piece of land with a fair market value of $85,000 (adjusted basis of $60,000) in a current distribution. Her basis in his partnership interest is $20,000 before the distribution. Answer the following question and show your calculations.

- What amount of gain must Sally recognize as a result of the current distribution?

- What amount of gain must the partnership recognize as a result of the distribution?

- What is Sally's basis in his partnership interest immediately after the distribution?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts