Question: MODULE 1 2 GRADED ASSIGNMENT Question 1 2 Linda Leasing Company signs an agreement on January 1 , 2 0 2 5 , to lease

MODULE GRADED ASSIGNMENT

Question

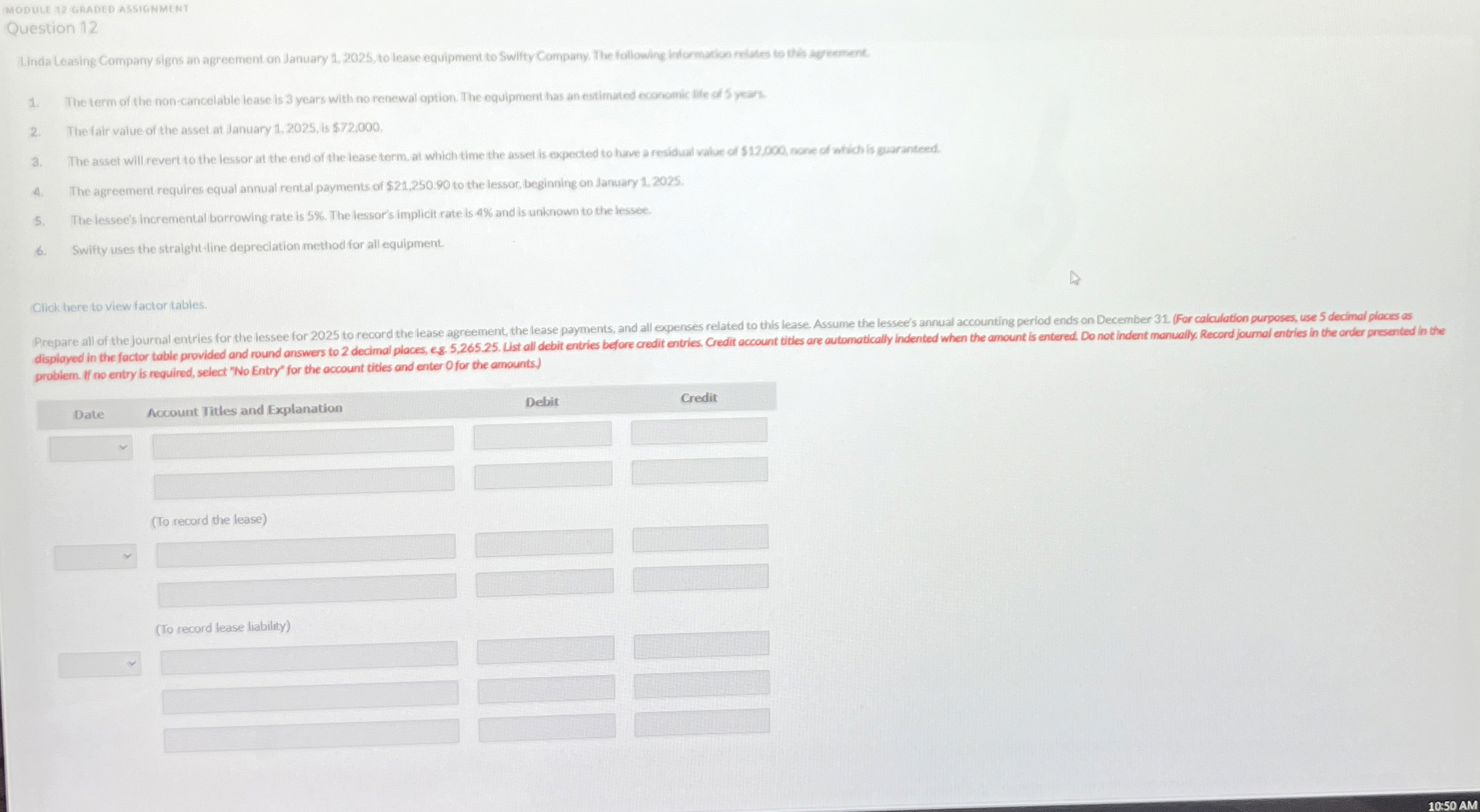

Linda Leasing Company signs an agreement on January to lease equipment to Swifty Company. The folliowing informatice relates ts thats ageemene.

The fair value of the asset at January is $

The asset will revert to the lecsor at the end of the lease term, at which time the asset is expected to have a residual value of mone of stich is guaranted.

The agreement requires equal annual rental payments of $ to the lessor, beginning on January

The lessee's incremental borrowing rate is The lessor's implicit rate is and is unknown to the lessee.

Sivifty wec the ctralghtline depreciation method for all equipment.

Click here to view factor tables. problem. If no entry is required, select No Entry' for the account tities and enter Ofor the amounts.

tableDate Account Titles and Explanation CreditTo record the lease

To record lease liability

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock