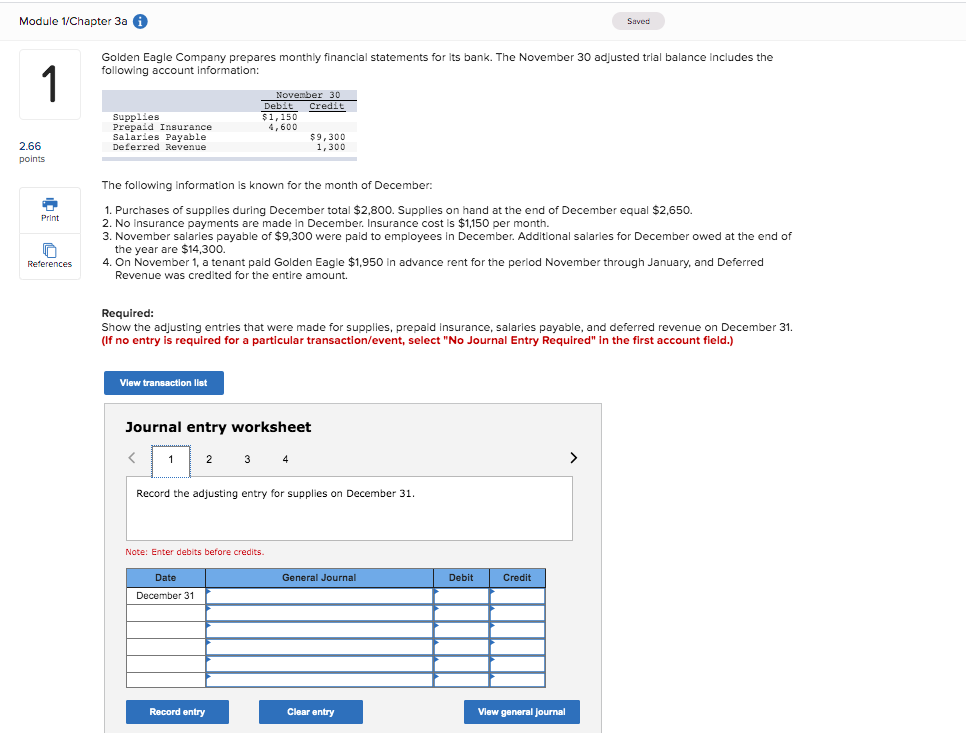

Question: Module 1/Chapter 3a 1 Saved Golden Eagle Company prepares monthly financial statements for its bank. The November 30 adjusted trial balance includes the following

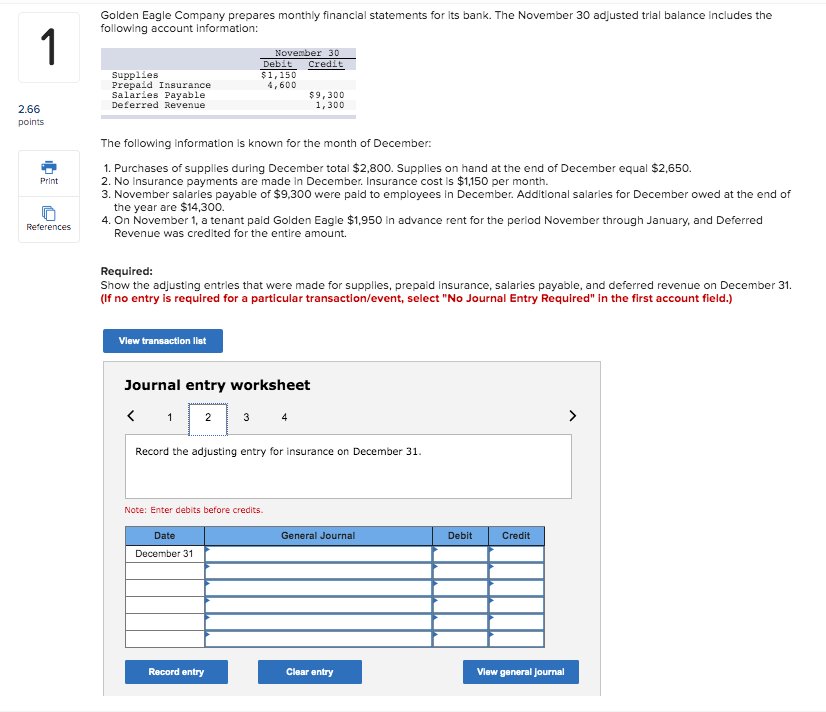

Module 1/Chapter 3a 1 Saved Golden Eagle Company prepares monthly financial statements for its bank. The November 30 adjusted trial balance includes the following account information: November 30 Supplies Debit $1,150 Credit Prepaid Insurance 4,600 Salaries Payable 2.66 points Print References Deferred Revenue $9,300 1,300 The following information is known for the month of December: 1. Purchases of supplies during December total $2,800. Supplies on hand at the end of December equal $2,650. 2. No Insurance payments are made in December. Insurance cost is $1,150 per month. 3. November salaries payable of $9,300 were paid to employees in December. Additional salaries for December owed at the end of the year are $14,300. 4. On November 1, a tenant paid Golden Eagle $1,950 in advance rent for the period November through January, and Deferred Revenue was credited for the entire amount. Required: Show the adjusting entries that were made for supplies, prepaid insurance, salaries payable, and deferred revenue on December 31. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 Record the adjusting entry for supplies on December 31. Note: Enter debits before credits. Date December 31 General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts