Question: Module 1/Chapter 3b 1 Part 1 of 2 Saved ! Required information Exercise 3-14A Prepare an adjusted trial balance (LO3-3, 3-4) [The following information

![applies to the questions displayed below.] The December 31, 2021, unadjusted trial](https://s3.amazonaws.com/si.experts.images/answers/2024/05/6659161e2cb3d_3976659161da686f.jpg)

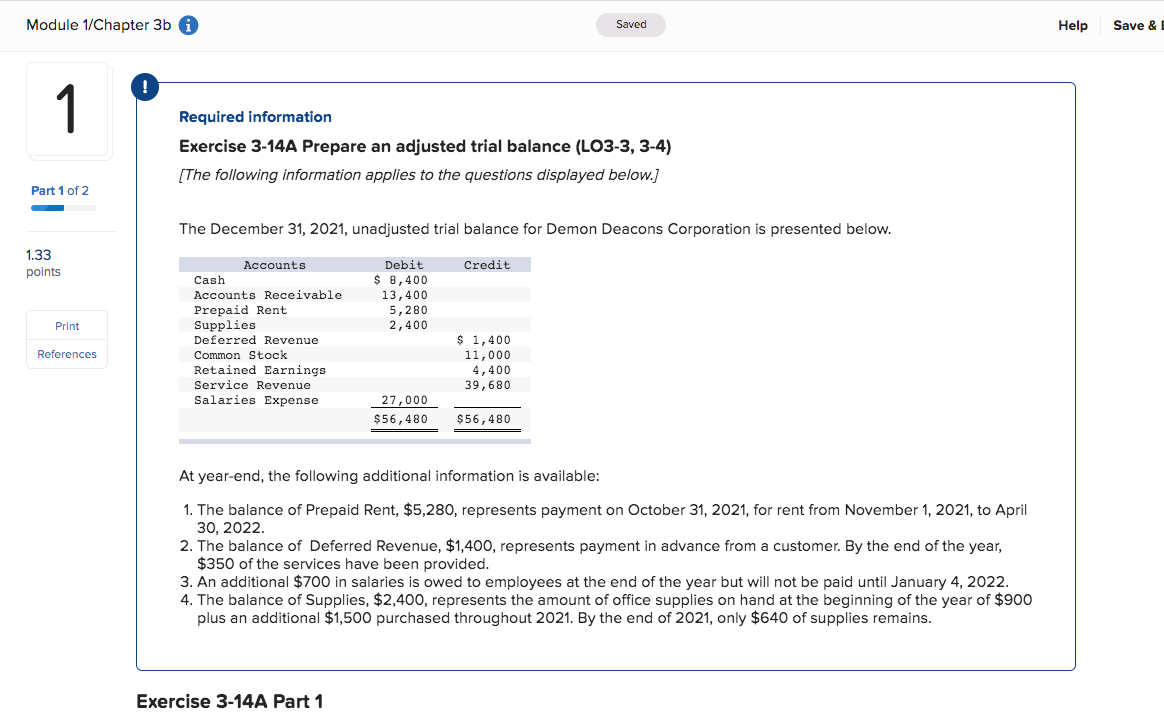

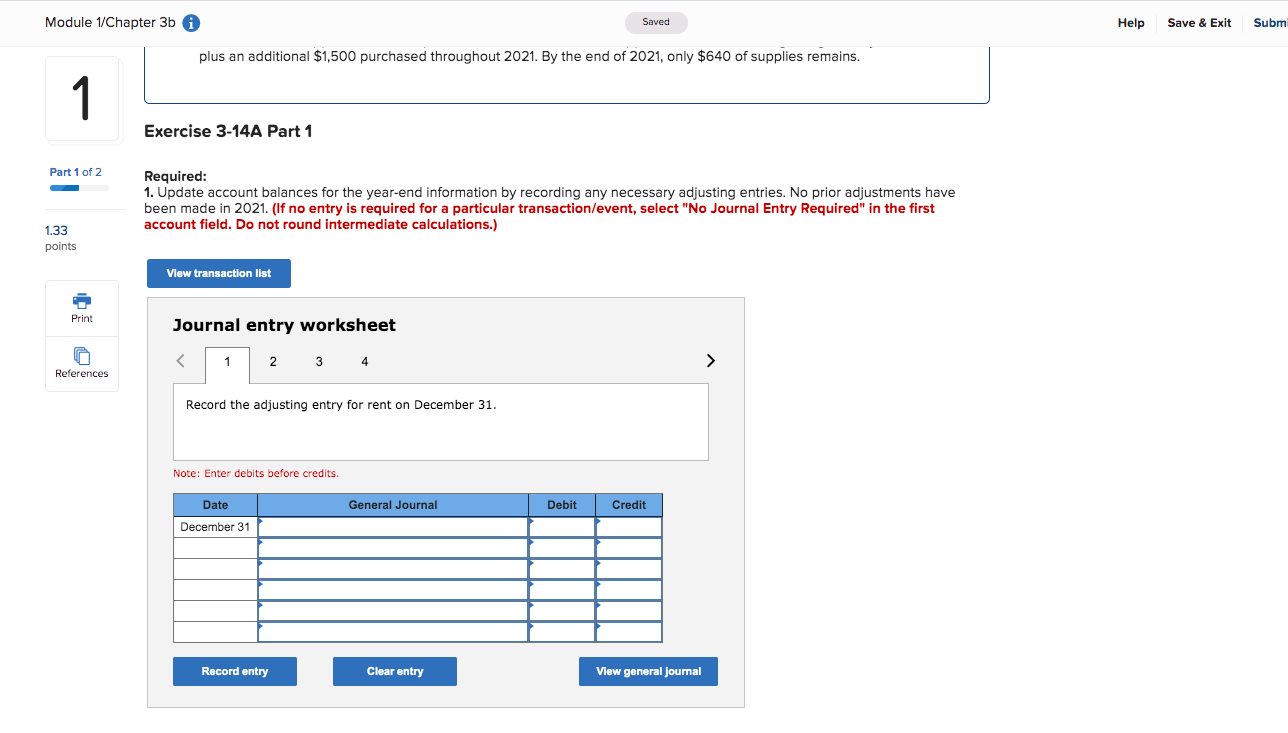

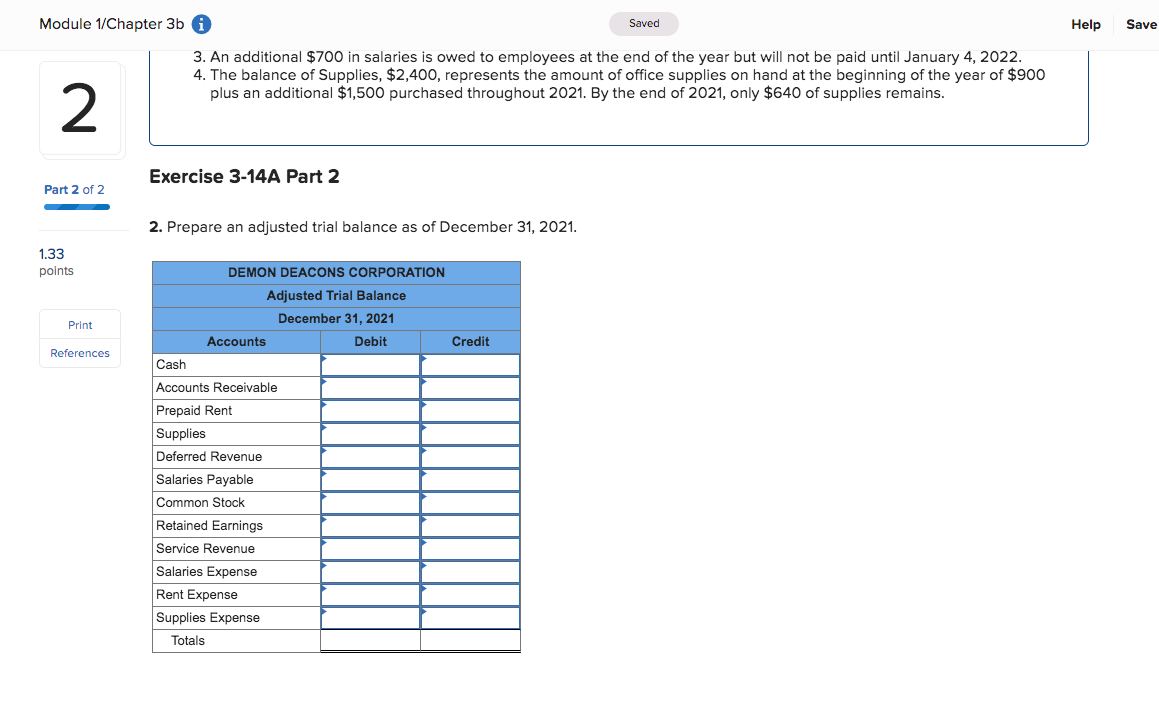

Module 1/Chapter 3b 1 Part 1 of 2 Saved ! Required information Exercise 3-14A Prepare an adjusted trial balance (LO3-3, 3-4) [The following information applies to the questions displayed below.] The December 31, 2021, unadjusted trial balance for Demon Deacons Corporation is presented below. Accounts 1.33 points Cash Debit $ 8,400 Credit Accounts Receivable Prepaid Rent 13,400 5,280 Print Supplies 2,400 Deferred Revenue $ 1,400 References Common Stock 11,000 Retained Earnings Service Revenue Salaries Expense 4,400 39,680 27,000 $56,480 $56,480 At year-end, the following additional information is available: 1. The balance of Prepaid Rent, $5,280, represents payment on October 31, 2021, for rent from November 1, 2021, to April 30, 2022. 2. The balance of Deferred Revenue, $1,400, represents payment in advance from a customer. By the end of the year, $350 of the services have been provided. 3. An additional $700 in salaries is owed to employees at the end of the year but will not be paid until January 4, 2022. 4. The balance of Supplies, $2,400, represents the amount of office supplies on hand at the beginning of the year of $900 plus an additional $1,500 purchased throughout 2021. By the end of 2021, only $640 of supplies remains. Exercise 3-14A Part 1 Help Save &

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts