Question: Module #2: Preparing your di entries The below journal entries were prepared by a first year accounting student. Unfortunately, the student was not feeling well

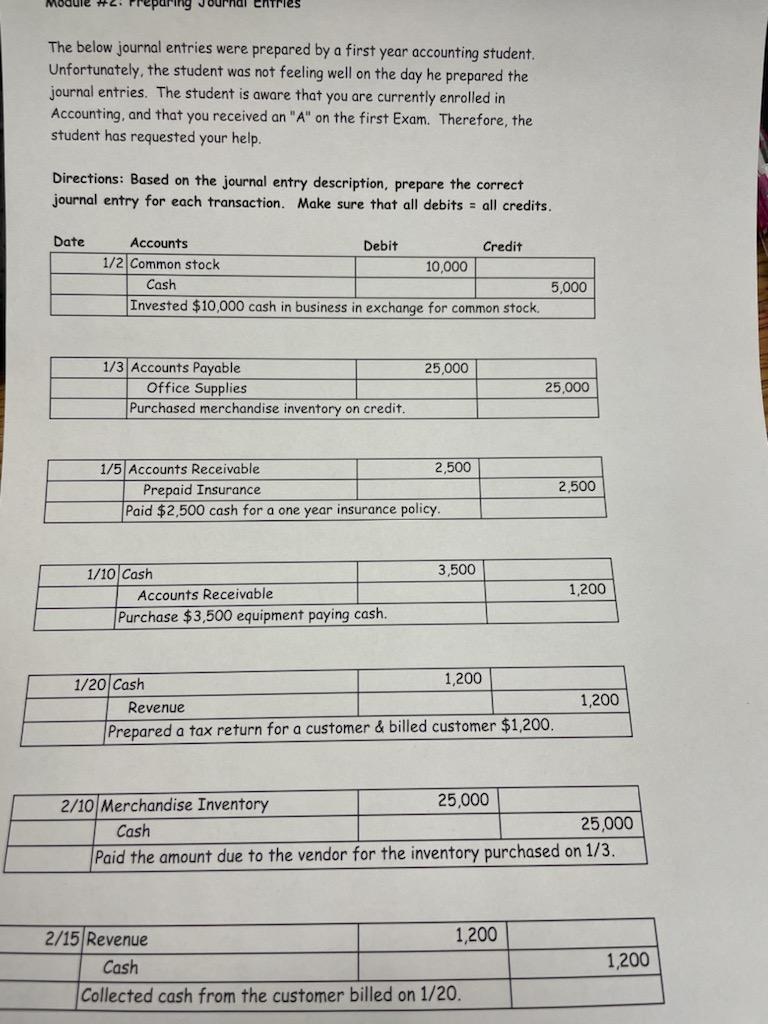

Module #2: Preparing your di entries The below journal entries were prepared by a first year accounting student. Unfortunately, the student was not feeling well on the day he prepared the journal entries. The student is aware that you are currently enrolled in Accounting, and that you received an "A" on the first Exam. Therefore, the student has requested your help. Directions: Based on the journal entry description, prepare the correct journal entry for each transaction. Make sure that all debits = all credits. Date Accounts Debit Credit 1/2 Common stock 10,000 Cash Invested $10,000 cash in business in exchange for common stock 5,000 25,000 1/3 Accounts Payable Office Supplies Purchased merchandise inventory on credit. 25,000 1/5 Accounts Receivable 2,500 Prepaid Insurance Paid $2,500 cash for a one year insurance policy. 2,500 3,500 1/10 Cash Accounts Receivable Purchase $3,500 equipment paying cash. 1,200 1,200 1/20 Cash 1,200 Revenue Prepared a tax return for a customer & billed customer $1,200. 2/10 Merchandise Inventory 25,000 Cash 25,000 Paid the amount due to the vendor for the inventory purchased on 1/3. 2/15 Revenue 1,200 Cash Collected cash from the customer billed on 1/20 1,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts