Question: Module 2 Venture Aviation case analysis need help solving Hangar NPV spreadsheet Loan amortization sheet , and breakeven sheet shown below is all the relevant

Module Venture Aviation case analysis need help solving Hangar NPV spreadsheet Loan amortization sheet and breakeven sheet shown below is all the relevant information for all sheets

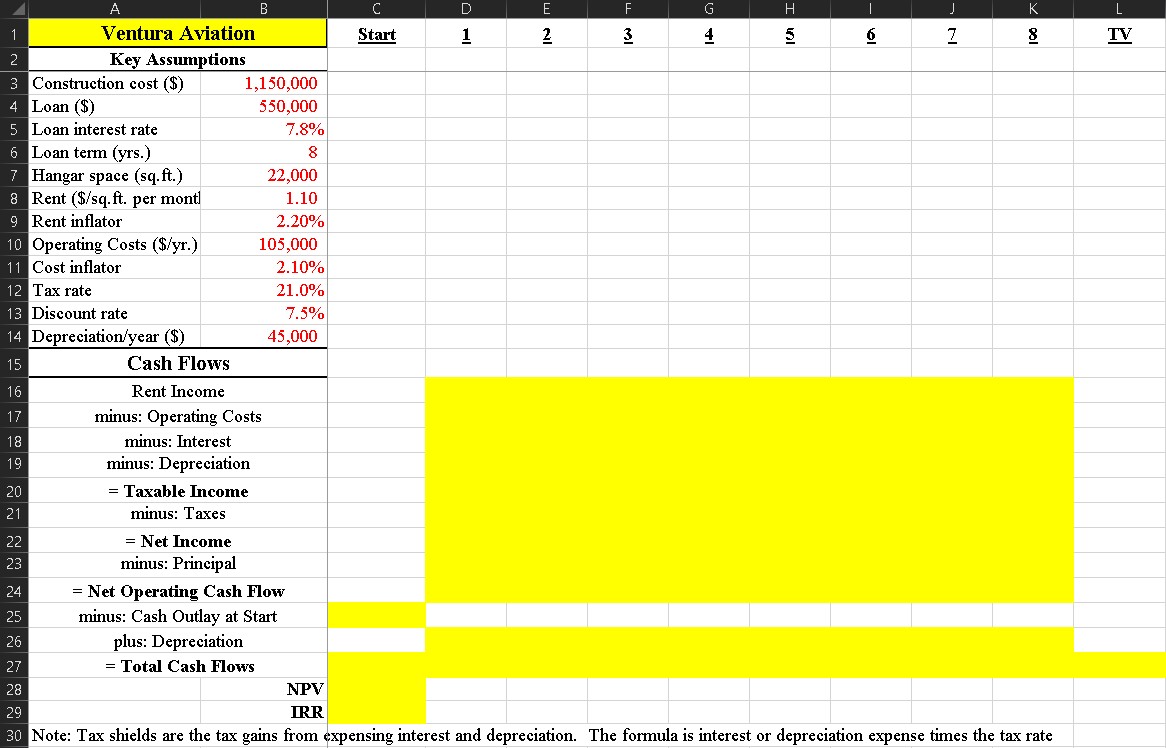

Ventura Aviation Start TV Key Assumptions Construction cost $ Loan $ Loan interest rate Loan term yrs Hangar space sqft Rent $sqft per month Rent inflator Operating Costs $yr Cost inflator Tax rate Discount rate Depreciationyear $ Cash Flows Rent Income minus: Operating Costs minus: Interest minus: Depreciation Taxable Income minus: Taxes Net Income minus: Principal Net Operating Cash Flow minus: Cash Outlay at Start plus: Depreciation Total Cash Flows NPV IRR Note: Tax shields are the tax gains from expensing interest and depreciation. The formula is interest or depreciation expense times the tax rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock