Question: Module 3: Bond Valuation Assignment Saved Help Save & Exit Submit Check my work 1 A 27-year U.S. Treasury bond with a face value of

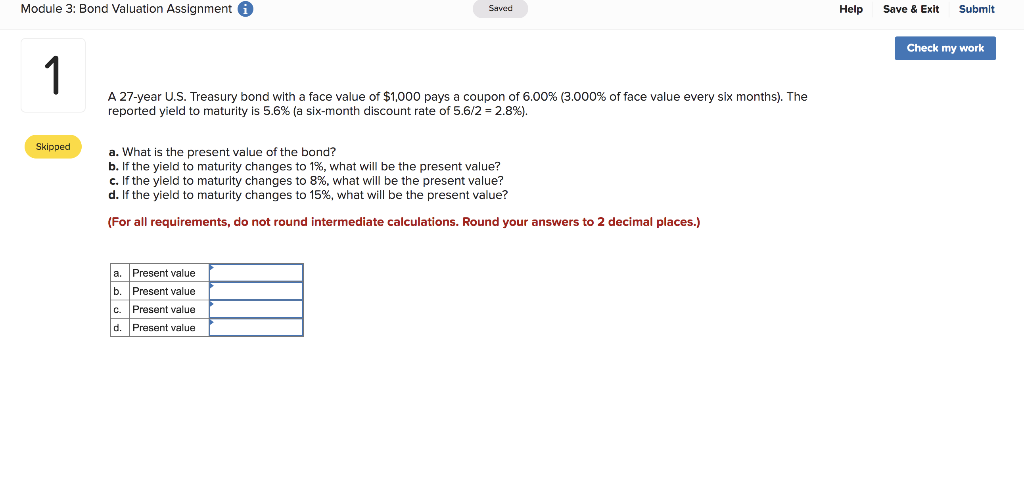

Module 3: Bond Valuation Assignment Saved Help Save & Exit Submit Check my work 1 A 27-year U.S. Treasury bond with a face value of $1,000 pays a coupon of 6.00% (3.000% of face value every six months). The reported yield to maturity is 5.6% (a six-month discount rate of 5.6/2 = 2.8%). Skipped a. What is the present value of the bond? b. If the yield to maturity changes to 1%, what will be the present value? c. If the yield to maturity changes to 8%, what will be the present value? d. If the yield to maturity changes to 15%, what will be the present value? (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places.) a. Present value b. Present value c. Present value d. Present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts