Question: Module 3 Ongoing Analysis Project ( Illinois Tool Works ) operating in roughly the same industry: Illinois Tool Works and Parker Hannifin. mastered financial reporting

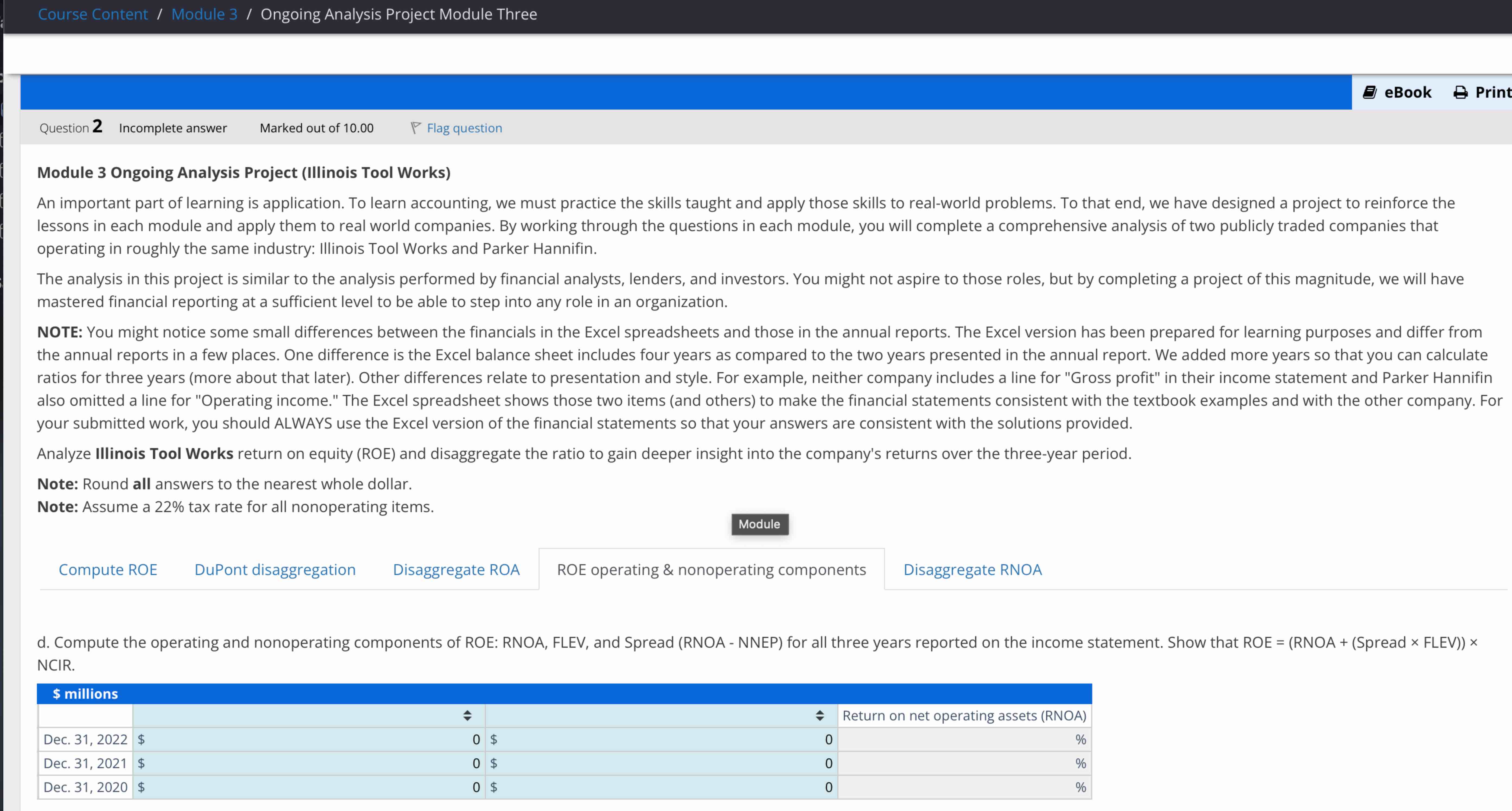

Module Ongoing Analysis Project Illinois Tool Works operating in roughly the same industry: Illinois Tool Works and Parker Hannifin. mastered financial reporting at a sufficient level to be able to step into any role in an organization. your submitted work, you should ALWAYS use the Excel version of the financial statements so that your answers are consistent with the solutions provided. Analyze Illinois Tool Works return on equity ROE and disaggregate the ratio to gain deeper insight into the company's returns over the threeyear period. Note: Round all answers to the nearest whole dollar. Note: Assume a tax rate for all nonoperating items. Compute ROE DuPont disaggregation Disaggregate ROA ROE operating & nonoperating components Disaggregate RNOA NCIR. begintabularllllll

hline multicolumnl$ millions

hline & & & square & & Net operating asset turnover NOAT

hline Dec. & $ & & $ & &

hline Dec. & $ & & $ & &

hline Dec. & $ & & $ & &

hline

endtabularbegintabularllll

hline multicolumncNOPM times NOAT RNOA

hline & Net operating profit margin NOPM & Net operating asset turnover NOAT & RNOA

hline Dec. & & &

hline Dec. & & &

hline Dec. & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock