Question: Module 4 Excel Workbook Assignment MBA 6315 B1. Create the Statement of Cash Flows using the Indirect Method from the information provided. Include the required

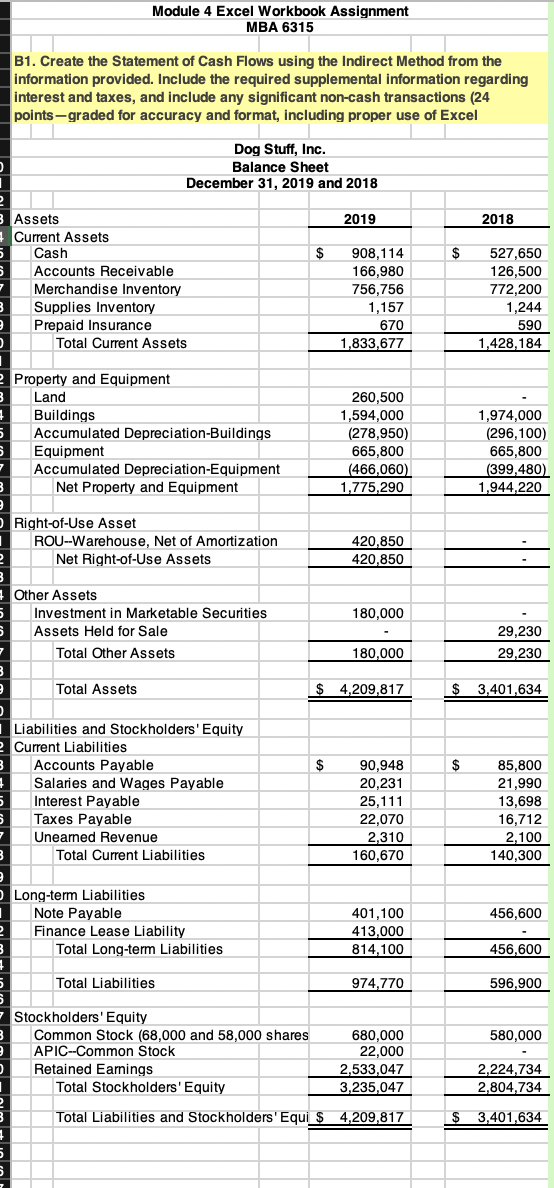

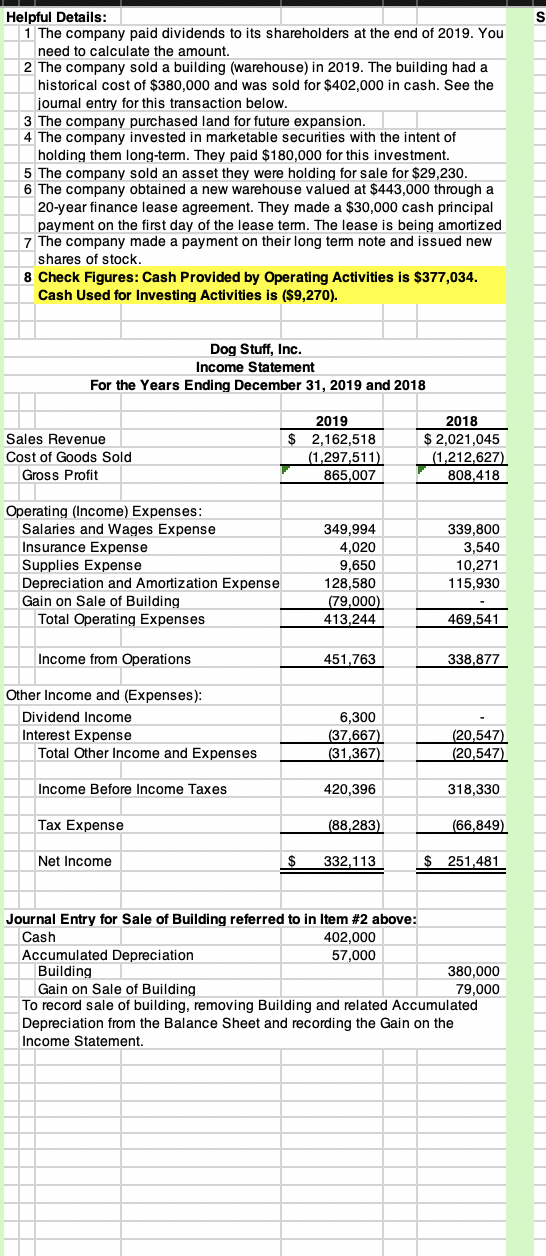

Module 4 Excel Workbook Assignment MBA 6315 B1. Create the Statement of Cash Flows using the Indirect Method from the information provided. Include the required supplemental information regarding interest and taxes, and include any significant non-cash transactions (24 points-graded for accuracy and format, including proper use of Excel Dog Stuff, Inc. Balance Sheet December 31, 2019 and 2018 2019 2018 3 Assets Current Assets Cash Accounts Receivable Merchandise Inventory Supplies Inventory Prepaid Insurance Total Current Assets 908,114 166,980 756,756 1,157 670 1,833,677 527.650 126,500 772,200 1,244 590 1,428,184 2 Property and Equipment Land Buildings Accumulated Depreciation-Buildings Equipment Accumulated Depreciation-Equipment Net Property and Equipment 260,500 1,594,000 (278,950) 665,800 (466,060) 1,775,290 1,974,000 (296,100) 665,800 (399,480) 1,944,220 Right-of-Use Asset ROU--Warehouse, Net of Amortization Net Right-of-Use Assets 420,850 420,850 180,000 Other Assets Investment in Marketable Securities Assets Held for Sale Total Other Assets 29,230 29,230 180,000 Total Assets $ 4,209,817 $ 3,401,634 $ Liabilities and Stockholders' Equity 2 Current Liabilities Accounts Payable Salaries and Wages Payable Interest Payable Taxes Payable Unearned Revenue Total Current Liabilities 90,948 20,231 25,111 22,070 2,310 160,670 85,800 21,990 13,698 16,712 2,100 140,300 456,600 Long-term Liabilities Note Payable Finance Lease Liability Total Long-term Liabilities 401,100 413,000 814,100 456,600 Total Liabilities 974,770 596.900 580,000 - Stockholders' Equity Common Stock (68,000 and 58,000 shares APIC-Common Stock Retained Earnings Total Stockholders' Equity 680,000 22,000 2,533,047 3,235,047 2,224,734 2,804,734 Total Liabilities and Stockholders' Equi $ 4,209,817 $ 3,401,634 Helpful Details: 1 The company paid dividends to its shareholders at the end of 2019. You need to calculate the amount. 2 The company sold a building (warehouse) in 2019. The building had a historical cost of $380,000 and was sold for $402,000 in cash. See the journal entry for this transaction below. 3 The company purchased land for future expansion. 4 The company invested in marketable securities with the intent of holding them long-term. They paid $180,000 for this investment. 5 The company sold an asset they were holding for sale for $29,230. 6 The company obtained a new warehouse valued at $443,000 through a 20-year finance lease agreement. They made a $30,000 cash principal payment on the first day of the lease term. The lease is being amortized 7 The company made a payment on their long term note and issued new shares of stock. 8 Check Figures: Cash Provided by Operating Activities is $377,034. Cash Used for Investing Activities is ($9,270). Dog Stuff, Inc. Income Statement For the Years Ending December 31, 2019 and 2018 $ Sales Revenue Cost of Goods Sold Gross Profit 2019 2,162,518 (1,297,511) 865,007 2018 $ 2,021,045 (1.212,627) 808,418 Operating (Income) Expenses: Salaries and Wages Expense Insurance Expense Supplies Expense Depreciation and Amortization Expense Gain on Sale of Building Total Operating Expenses 349,994 4,020 9,650 128,580 (79,000) 413,244 339,800 3,540 10,271 115,930 469,541 Income from Operations 451,763 338,877 Other Income and (Expenses): Dividend Income Interest Expense Total Other Income and Expenses 6,300 (37,667) (31,367) (20,547) (20,547) Income Before Income Taxes 420,396 318,330 Tax Expense (88,283) (66,849) Net Income $ 332,113 $ 251,481 Journal Entry for Sale of Building referred to in Item #2 above: Cash 402,000 Accumulated Depreciation 57,000 Building 380,000 Gain on Sale of Building 79,000 To record sale of building, removing Building and related Accumulated Depreciation from the Balance Sheet and recording the Gain on the Income Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts