Question: Module 5 Chapter 5 CASE IX ( Bonds ) : Corporate Bond Credit Risk Changes and Bond Prices Land'o'Toys is a profitable, medium - sized,

Module Chapter CASE IX Bonds:

Corporate Bond Credit Risk Changes and Bond Prices

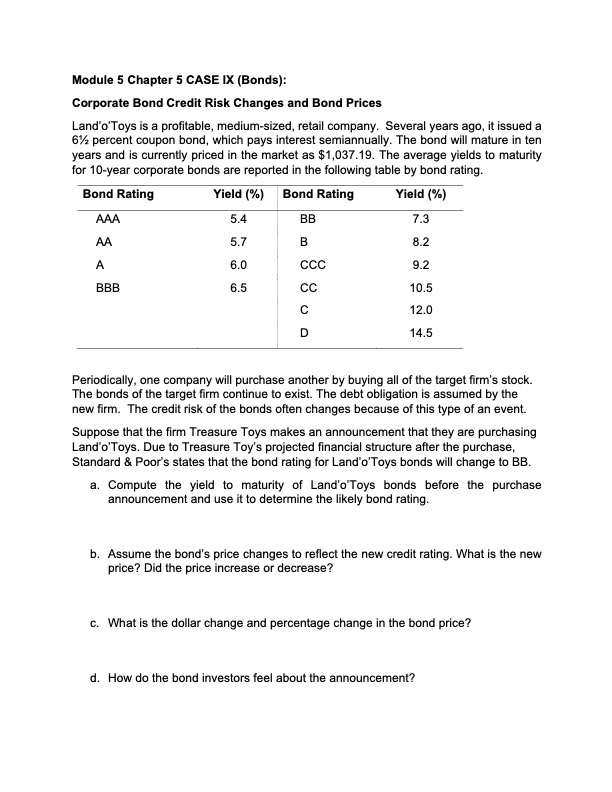

Land'o'Toys is a profitable, mediumsized, retail company. Several years ago, it issued a

percent coupon bond, which pays interest semiannually. The bond will mature in ten

years and is currently priced in the market as $ The average yields to maturity

for year corporate bonds are reported in the following table by bond rating.

Periodically, one company will purchase another by buying all of the target firm's stock.

The bonds of the target firm continue to exist. The debt obligation is assumed by the

new firm. The credit risk of the bonds often changes because of this type of an event.

Suppose that the firm Treasure Toys makes an announcement that they are purchasing

Land'o'Toys. Due to Treasure Toy's projected financial structure after the purchase,

Standard & Poor's states that the bond rating for Land'o'Toys bonds will change to BB

a Compute the yield to maturity of Land'o'Toys bonds before the purchase

announcement and use it to determine the likely bond rating.

b Assume the bond's price changes to reflect the new credit rating. What is the new

price? Did the price increase or decrease?

c What is the dollar change and percentage change in the bond price?

d How do the bond investors feel about the announcement?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock