Question: Module 5 - Part 2 HOMEWORK - Equity Financing and Securities Markets 8 . Assume the risk - free rate is 6 % and the

Module Part HOMEWORK Equity Financing and Securities Markets

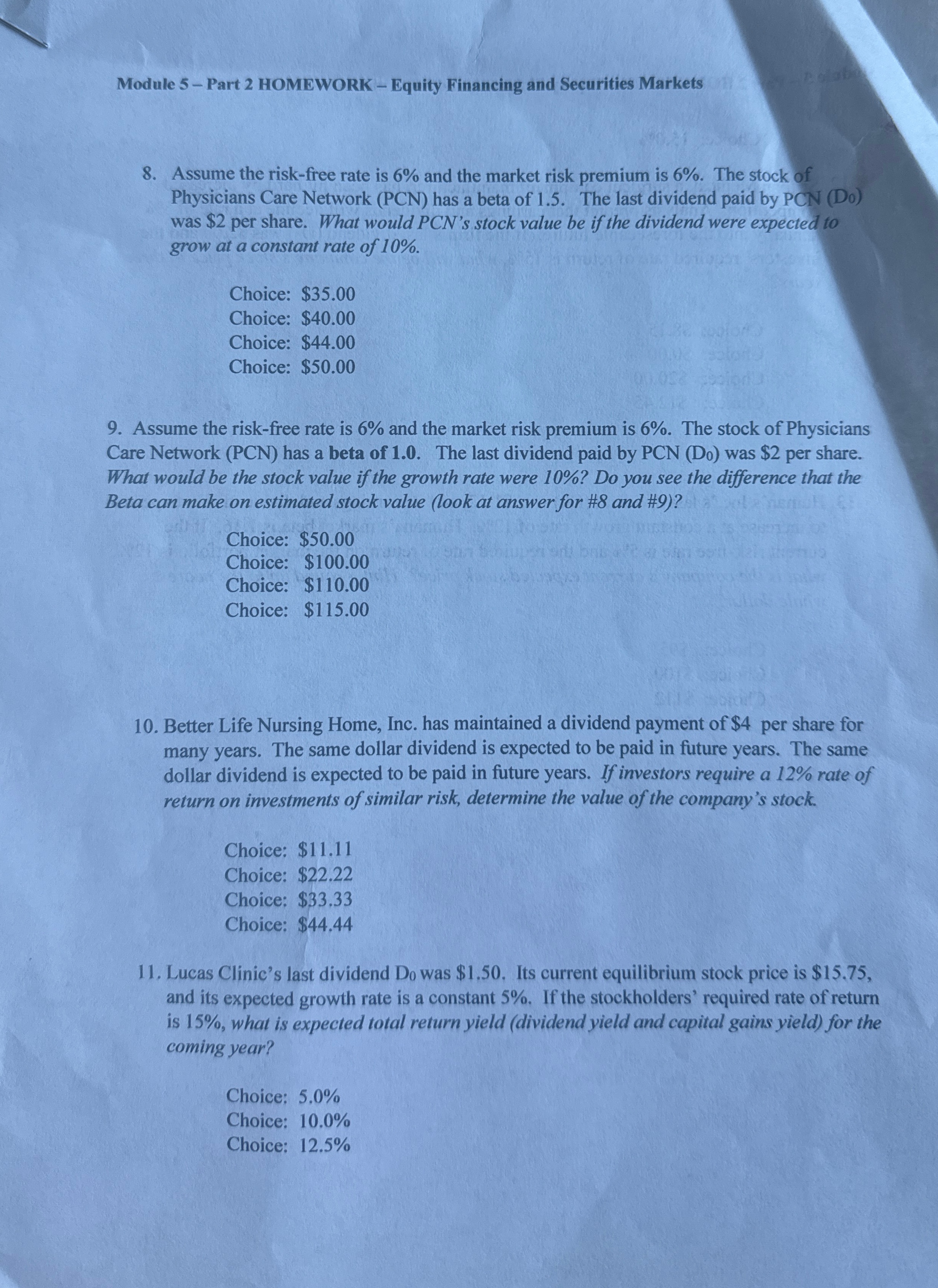

Assume the riskfree rate is and the market risk premium is The stock of Physicians Care Network PCN has a beta of The last dividend paid by PCN D was $ per share. What would PCNs stock value be if the dividend were expected to grow at a constant rate of

Choice: $

Choice: $

Choice: $

Choice: $

Assume the riskfree rate is and the market risk premium is The stock of Physicians Care Network PCN has a beta of The last dividend paid by PCN was $ per share. What would be the stock value if the growth rate were Do you see the difference that the Beta can make on estimated stock value look at answer for # and #

Choice: $

Choice: $

Choice: $

Choice: $

Better Life Nursing Home, Inc. has maintained a dividend payment of $ per share for many years. The same dollar dividend is expected to be paid in future years. The same dollar dividend is expected to be paid in future years. If investors require a rate of return on investments of similar risk, determine the value of the company's stock.

Choice: $

Choice: $

Choice: $

Choice: $

Lucas Clinic's last dividend was $ Its current equilibrium stock price is $ and its expected growth rate is a constant If the stockholders' required rate of return is what is expected total return yield dividend yield and capital gains yield for the coming year?

Choice:

Choice:

Choice:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock