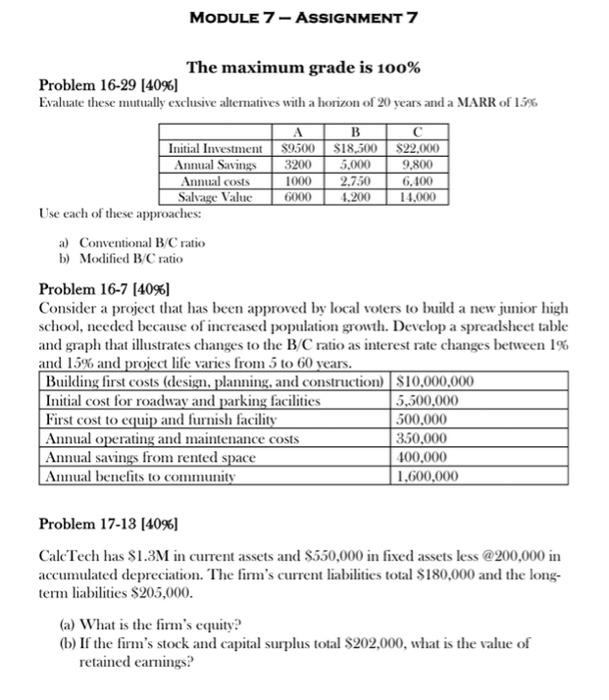

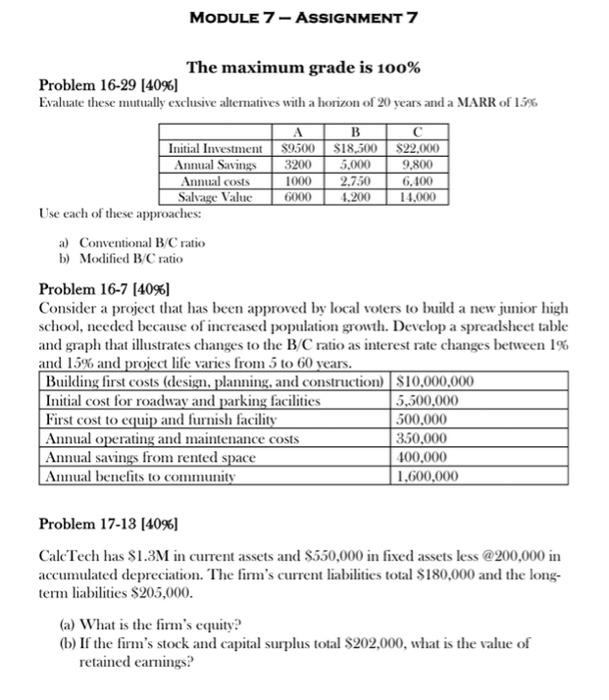

Question: MODULE 7 ASSIGNMENT 7 The maximum grade is 100% Problem 16-29 [40%] Evaluate these mutually exclusive alternatives with a horizon of 20 years and a

MODULE 7 ASSIGNMENT 7 The maximum grade is 100% Problem 16-29 [40%] Evaluate these mutually exclusive alternatives with a horizon of 20 years and a MARR of 15% Initial Investment Annual Savings Annual costs Salvage Value Use each of these approaches: a) Conventional B/C ratio b) Modified B/C ratio A $9500 3200 1000 6000 B $18,500 5,000 2,750 4,200 Annual operating and maintenance costs Annual savings from rented space Annual benefits to community C $22,000 9,800 6,400 14,000 Problem 16-7 [40%] Consider a project that has been approved by local voters to build a new junior high school, needed because of increased population growth. Develop a spreadsheet table and graph that illustrates changes to the B/C ratio as interest rate changes between 1% and 15% and project life varies from 5 to 60 years. Building first costs (design, planning, and construction) Initial cost for roadway and parking facilities First cost to equip and furnish facility $10,000,000 5,500,000 500,000 350,000 400,000 1,600,000 Problem 17-13 [40%] CalcTech has $1.3M in current assets and $550,000 in fixed assets less @200,000 in accumulated depreciation. The firm's current liabilities total $180,000 and the long- term liabilities $205,000. (a) What is the firm's equity? (b) If the firm's stock and capital surplus total $202,000, what is the value of retained earnings?

The maximum grade is 100% Problem 16-29 [40\%] Evaluate these mutually exclusive altematives with a horizon of 20 years and a MARR of 15% Use each of these approacnes: a) Conventional B/C ratio b) Modified B/C ratio Problem 16-7 [40\%] Consider a project that has been approved by local voters to build a new junior high school, needed because of increased population growth. Develop a spreadsheet table and graph that illustrates changes to the B/C ratio as interest rate changes between 1% and 15% and proiect life varies from 5 to 60 vears. Problem 17-13 [40\%] Calc Tech has $1.3M in current assets and $550,000 in fixed assets less @200,000 in accumulated depreciation. The firm's current liabilities total $180,000 and the longterm liabilities $205,000. (a) What is the firm's equity? (b) If the firm's stock and capital surplus total $202,000, what is the value of retained earnings