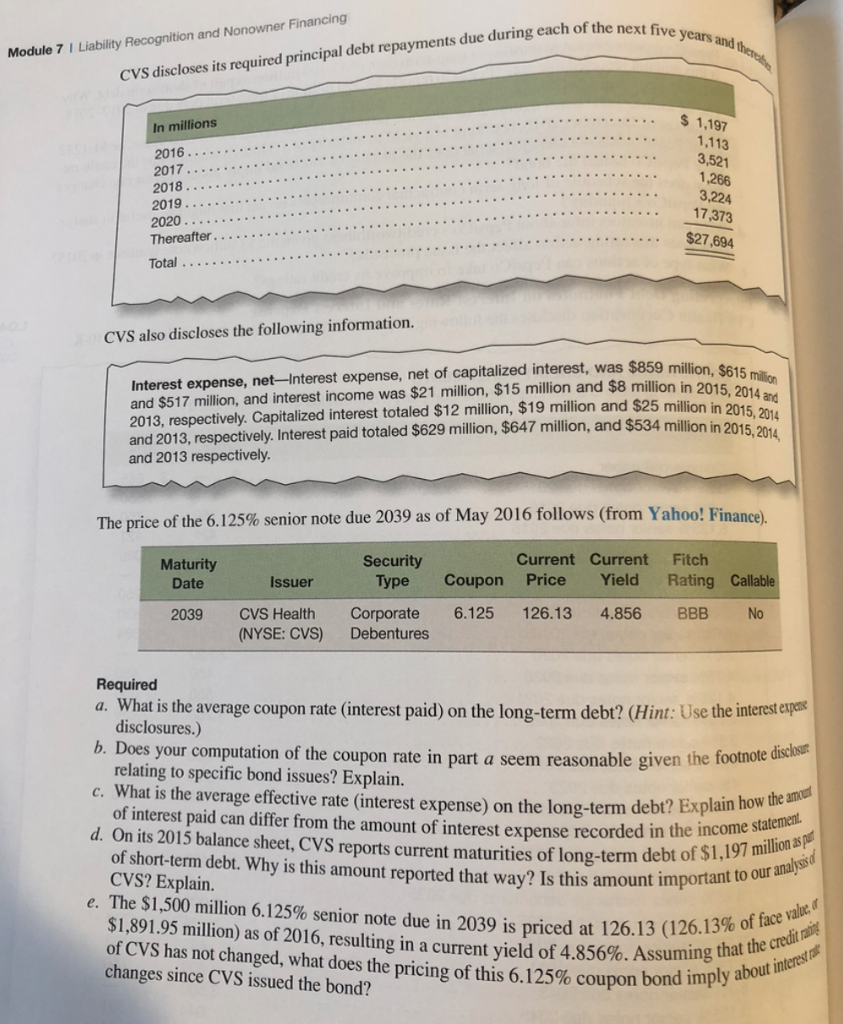

Question: Module 7 I Liability Recognition and Nonowner Financing CVS discloses its required principal debt repayments due during each of the next five 1,197 1,113 3,521

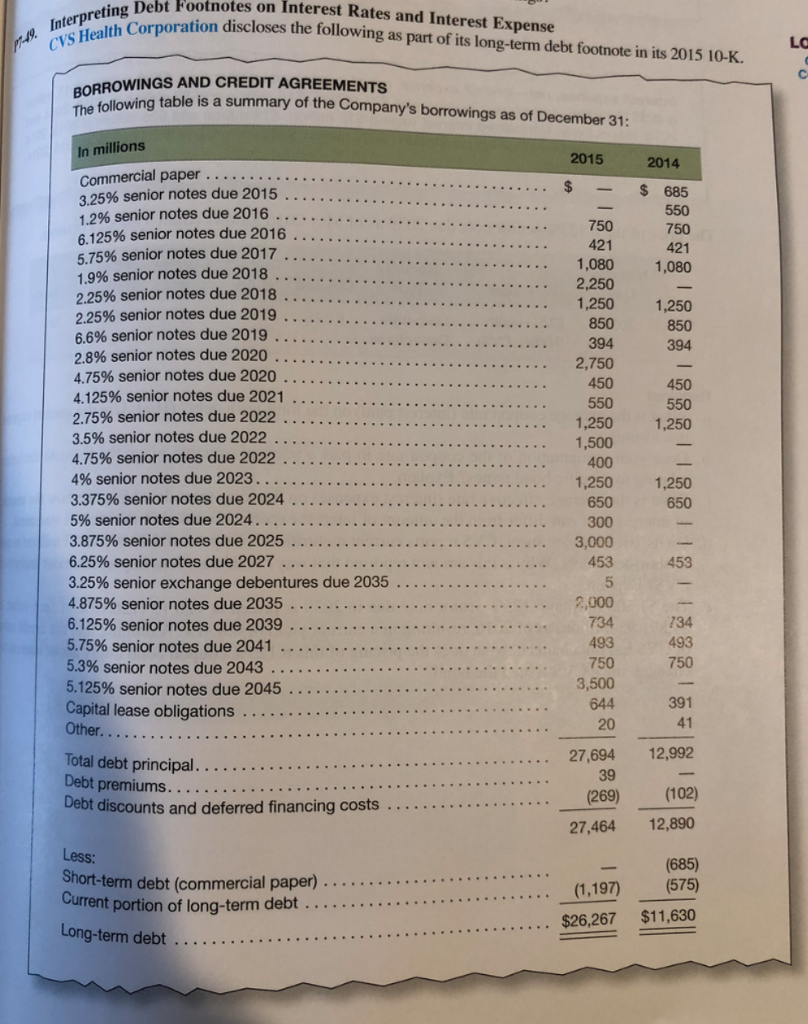

Module 7 I Liability Recognition and Nonowner Financing CVS discloses its required principal debt repayments due during each of the next five 1,197 1,113 3,521 1,266 3,224 In millions 2016. ._ 2017 2018 2020 CVS also discloses the following information. Interest expense, net-Interest expense, net of capitalized interest, was $859 million, $6 and $517 million, and interest income was $21 million, $15 million and $8 million in 201 2013, respectively. Capitalized interest totaled $12 million, $19 million and $25 million in and 2013, respectively. Interest paid totaled $629 million, $647 million, and $534 million in 2015 and 2013 respectively. inion andn 25 milin in 2015,204, 615 million The price of the 6.125% senior note due 2039 as of May 2016 follows (from Yahoo! Finance). Current Current Fitch Yield Rating Maturity Security Date Issuer Type Coupon Price Callable 2039 CVS Health Corporate 6.125 126.13 4.856 BBB No (NYSE: CVS) Debentures Required b. Does your computation of the coupon rate in part a seem reasonable given the f c. What is the average effective rate (interest expense) on the long-term debt d. On its 2015 balance sheet, CVS reports current maturities of long-term debt of i a. What is the average coupon rate (interest paid) on the long-term debt? (Hint: Use the interest eupeas footnote disclosur Explain how the amut to our analys value disclosures.) relating to specific bond issues? Explain. of interest paid can differ from the amount of interest expense recorded in the $1 , 197 million of short-term debt. Why is this amount reported that way? Is this amount important CVS? Explain. e. The $1,500 million 0.125% senior note due in 2039 is priced at 126.13 (12613% of $1,891.95 million) as of 2016, resulting in a current yield of 4.856%. Assuming about inte of CVS has not changed, what does the pricing of this 6.125% coupon bond imply changes since CVS issued the bond? 112A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts