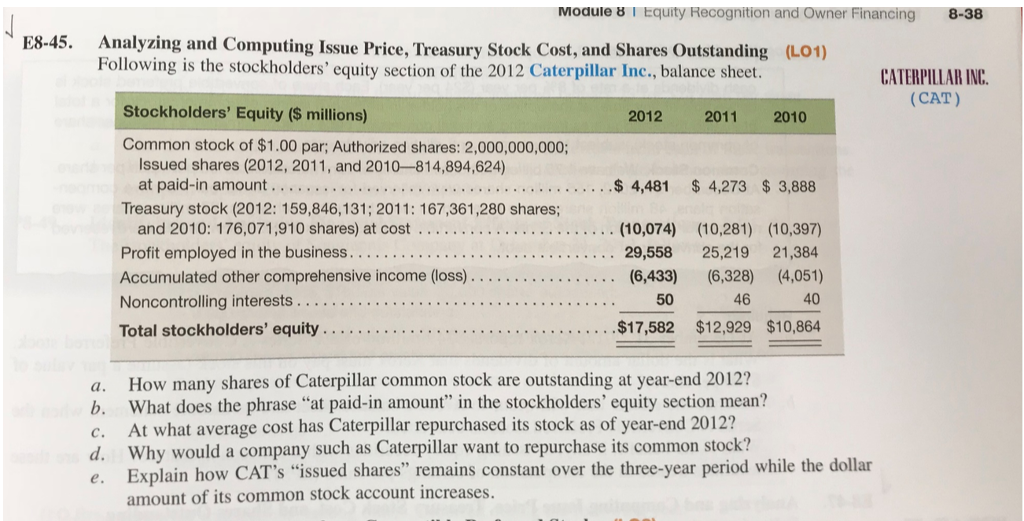

Question: Module 8 l equity Recognition and Owner Financin 8-38 E8-45. Analyzing and Computing Issue Price, Treasury Stock Cost, and Shares Outstanding (LO1) Following is the

Module 8 l equity Recognition and Owner Financin 8-38 E8-45. Analyzing and Computing Issue Price, Treasury Stock Cost, and Shares Outstanding (LO1) Following is the stockholders' equity section of the 2012 Caterpillar Inc., balance sheet. CATERPILLAR INC (CAT) Stockholders' Equity (S millions) 2012 2011 2010 Common stock of $1.00 par; Authorized shares: 2,000,000,000; Issued shares (2012, 2011, and 2010-814,894,624) $4,481 4,273 $3,888 Treasury stock (2012: 159,846,131;2011: 167,361,280 shares; Accumulated other comprehensive income (loss). . . . . . . . . . . . . Noncontrolling interests. (6,433) 50 (6,328) 46 (4,051) 40 a. How many shares of Caterpillar common stock are outstanding at year-end 2012? b. What does the phrase "at paid-in amount" in the stockholders' equity section mean? c. At what average cost has Caterpillar repurchased its stock as of year-end 2012? d. Why would a company such as Caterpillar want to repurchase its common stock? e. Explain how CAT's "issued shares" remains constant over the three-year period while the dollar amount of its common stock account increases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts