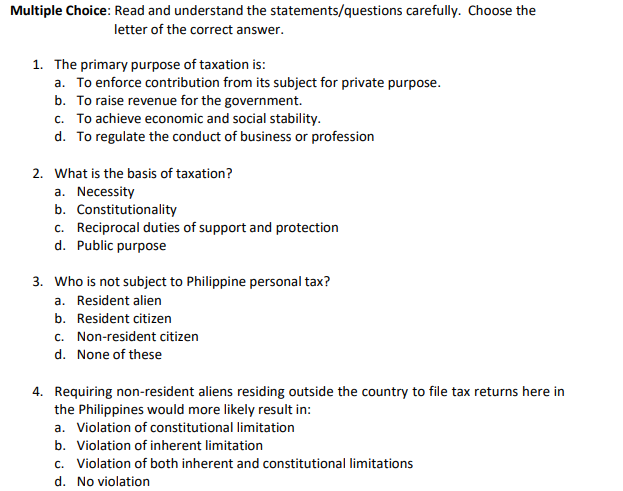

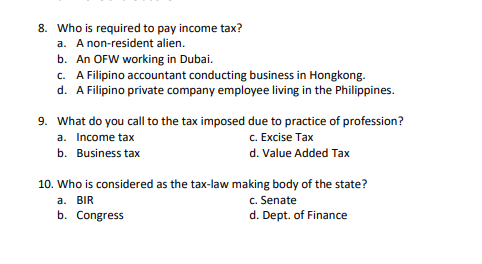

Question: MODULE 8: TAXATION PLEASE COPY THE LINK AND PASTE IT IN NEW TAB https://gofile.io/d/4c35YL THE NOTES WILL GUIDE YOU TO ANSWER THE QUESTIONS BELOW. Multiple

MODULE 8: TAXATION PLEASE COPY THE LINK AND PASTE IT IN NEW TAB https://gofile.io/d/4c35YL THE NOTES WILL GUIDE YOU TO ANSWER THE QUESTIONS BELOW.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts