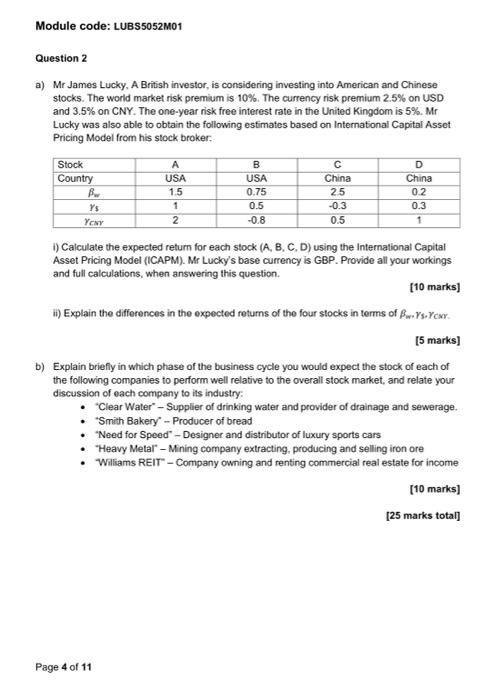

Question: Module code: LUBS5052M01 China A USA 1.5 1 2 B USA 0.75 0.5 -0.8 -0.3 0.5 02 0.3 1 Question 2 a) Mr James Lucky,

Module code: LUBS5052M01 China A USA 1.5 1 2 B USA 0.75 0.5 -0.8 -0.3 0.5 02 0.3 1 Question 2 a) Mr James Lucky, A British investor, is considering investing into American and Chinese stocks. The world market risk premium is 10%. The currency risk premium 2.5% on USD and 3.5% on CNY. The one-year risk free interest rate in the United Kingdom is 5%. Mr Lucky was also able to obtain the following estimates based on International Capital Asset Pricing Model from his stock broker: Stock D Country China Bw 25 Ys YONY 1) Calculate the expected return for each stock (A, B, C, D) using the International Capital Asset Pricing Model (ICAPM). Mr Lucky's base currency is GBP. Provide all your workings and full calculations, when answering this question. [10 marks) ) Explain the differences in the expected retums of the four stocks in torms of Bs.YOXY. [5 marks) b) Explain briefly in which phase of the business cycle you would expect the stock of each of the following companies to perform well relative to the overall stock market, and relate your discussion of each company to its industry: Clear Water - Supplier of drinking water and provider of drainage and sewerage. Smith Bakery - Producer of bread Need for Speed - Designer and distributor of luxury sports cars Heavy Metal - Mining company extracting, producing and selling iron ore Williams REIT"- Company owning and renting commercial real estate for income [10 marks] [25 marks total] Page 4 of 11 Module code: LUBS5052M01 China A USA 1.5 1 2 B USA 0.75 0.5 -0.8 -0.3 0.5 02 0.3 1 Question 2 a) Mr James Lucky, A British investor, is considering investing into American and Chinese stocks. The world market risk premium is 10%. The currency risk premium 2.5% on USD and 3.5% on CNY. The one-year risk free interest rate in the United Kingdom is 5%. Mr Lucky was also able to obtain the following estimates based on International Capital Asset Pricing Model from his stock broker: Stock D Country China Bw 25 Ys YONY 1) Calculate the expected return for each stock (A, B, C, D) using the International Capital Asset Pricing Model (ICAPM). Mr Lucky's base currency is GBP. Provide all your workings and full calculations, when answering this question. [10 marks) ) Explain the differences in the expected retums of the four stocks in torms of Bs.YOXY. [5 marks) b) Explain briefly in which phase of the business cycle you would expect the stock of each of the following companies to perform well relative to the overall stock market, and relate your discussion of each company to its industry: Clear Water - Supplier of drinking water and provider of drainage and sewerage. Smith Bakery - Producer of bread Need for Speed - Designer and distributor of luxury sports cars Heavy Metal - Mining company extracting, producing and selling iron ore Williams REIT"- Company owning and renting commercial real estate for income [10 marks] [25 marks total] Page 4 of 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts