Question: Module code: LUBS5052M01 Question 4 a) The annualized performance in U.S. dollars, of the U.S. and European stock indices are: Returnus 10% dus 16% Returneu.

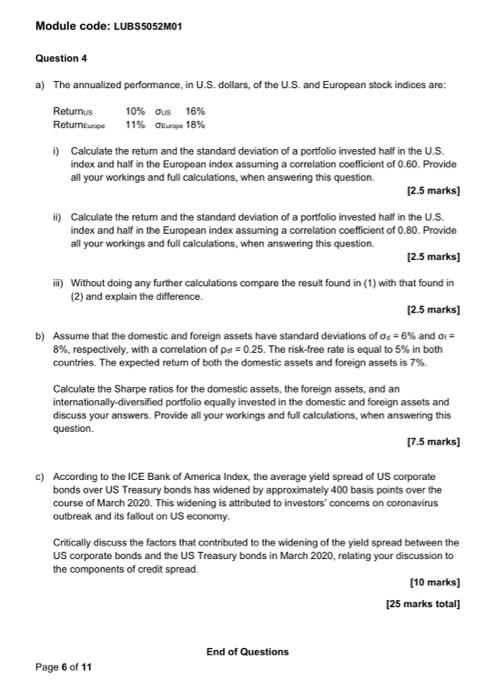

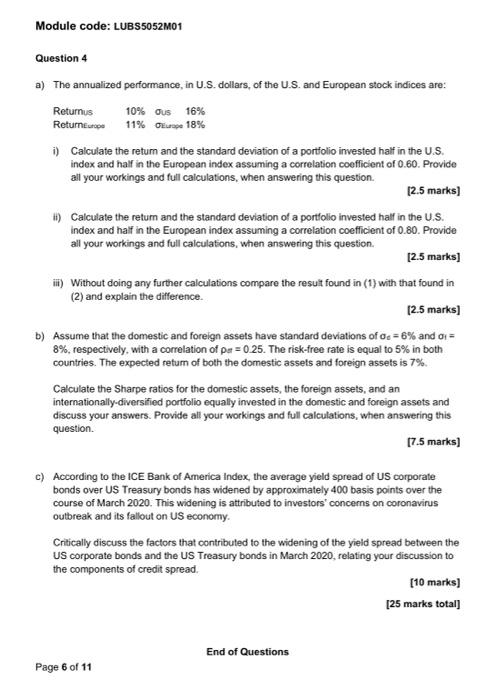

Module code: LUBS5052M01 Question 4 a) The annualized performance in U.S. dollars, of the U.S. and European stock indices are: Returnus 10% dus 16% Returneu. 11% Oise 18% i) Calculate the retum and the standard deviation of a portfolio invested half in the U.S. index and half in the European index assuming a correlation coefficient of 0.60. Provide all your workings and full calculations, when answering this question. 12.5 marks] #) Calculate the return and the standard deviation of a portfolio invested half in the U.S. index and half in the European index assuming a correlation coefficient of 0.80. Provide all your workings and full calculations, when answering this question 12.5 marks) ) Without doing any further calculations compare the result found in (1) with that found in (2) and explain the difference. 12.5 marks) b) Assume that the domestic and foreign assets have standard deviations of c = 6% and Oi = 8%, respectively, with a correlation of per = 0.25. The risk-free rate is equal to 5% in both countries. The expected retum of both the domestic assets and foreign assets is 7% Calculate the Sharpe ratios for the domestic assets, the foreign assets, and an internationally-diversified portfolio equally invested in the domestic and foreign assets and discuss your answers. Provide all your workings and full calculations, when answering this [7.5 marks] question c) According to the ICE Bank of America Index, the average yield spread of US corporate bonds over US Treasury bonds has widened by approximately 400 basis points over the course of March 2020. This widening is attributed to investors' concerns on coronavirus outbreak and its fallout on US economy. Critically discuss the factors that contributed to the widening of the yield spread between the US corporate bonds and the US Treasury bonds in March 2020, relating your discussion to the components of credit spread [10 marks] [25 marks total] End of Questions Page 6 of 11 Module code: LUBS5052M01 Question 4 a) The annualized performance in U.S. dollars, of the U.S. and European stock indices are: Returnus 10% dus 16% Returneu. 11% Oise 18% i) Calculate the retum and the standard deviation of a portfolio invested half in the U.S. index and half in the European index assuming a correlation coefficient of 0.60. Provide all your workings and full calculations, when answering this question. 12.5 marks] #) Calculate the return and the standard deviation of a portfolio invested half in the U.S. index and half in the European index assuming a correlation coefficient of 0.80. Provide all your workings and full calculations, when answering this question 12.5 marks) ) Without doing any further calculations compare the result found in (1) with that found in (2) and explain the difference. 12.5 marks) b) Assume that the domestic and foreign assets have standard deviations of c = 6% and Oi = 8%, respectively, with a correlation of per = 0.25. The risk-free rate is equal to 5% in both countries. The expected retum of both the domestic assets and foreign assets is 7% Calculate the Sharpe ratios for the domestic assets, the foreign assets, and an internationally-diversified portfolio equally invested in the domestic and foreign assets and discuss your answers. Provide all your workings and full calculations, when answering this [7.5 marks] question c) According to the ICE Bank of America Index, the average yield spread of US corporate bonds over US Treasury bonds has widened by approximately 400 basis points over the course of March 2020. This widening is attributed to investors' concerns on coronavirus outbreak and its fallout on US economy. Critically discuss the factors that contributed to the widening of the yield spread between the US corporate bonds and the US Treasury bonds in March 2020, relating your discussion to the components of credit spread [10 marks] [25 marks total] End of Questions Page 6 of 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts