Question: Module Seven Homework Saved Help Save & Exit Submit 3 ( Part 3 of 3 3 3 . 3 4 points 8 0 1 :

Module Seven Homework

Saved

Help

Save & Exit

Submit

Part of

points

::

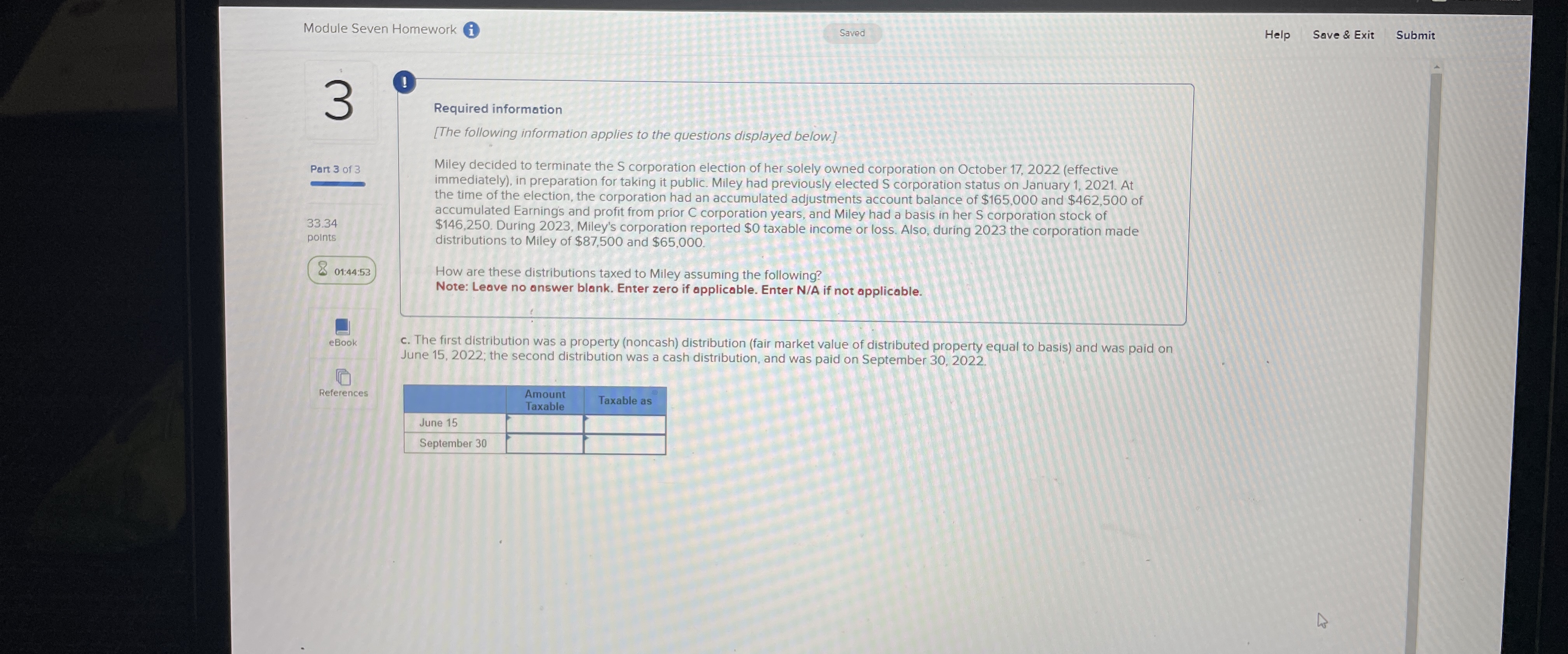

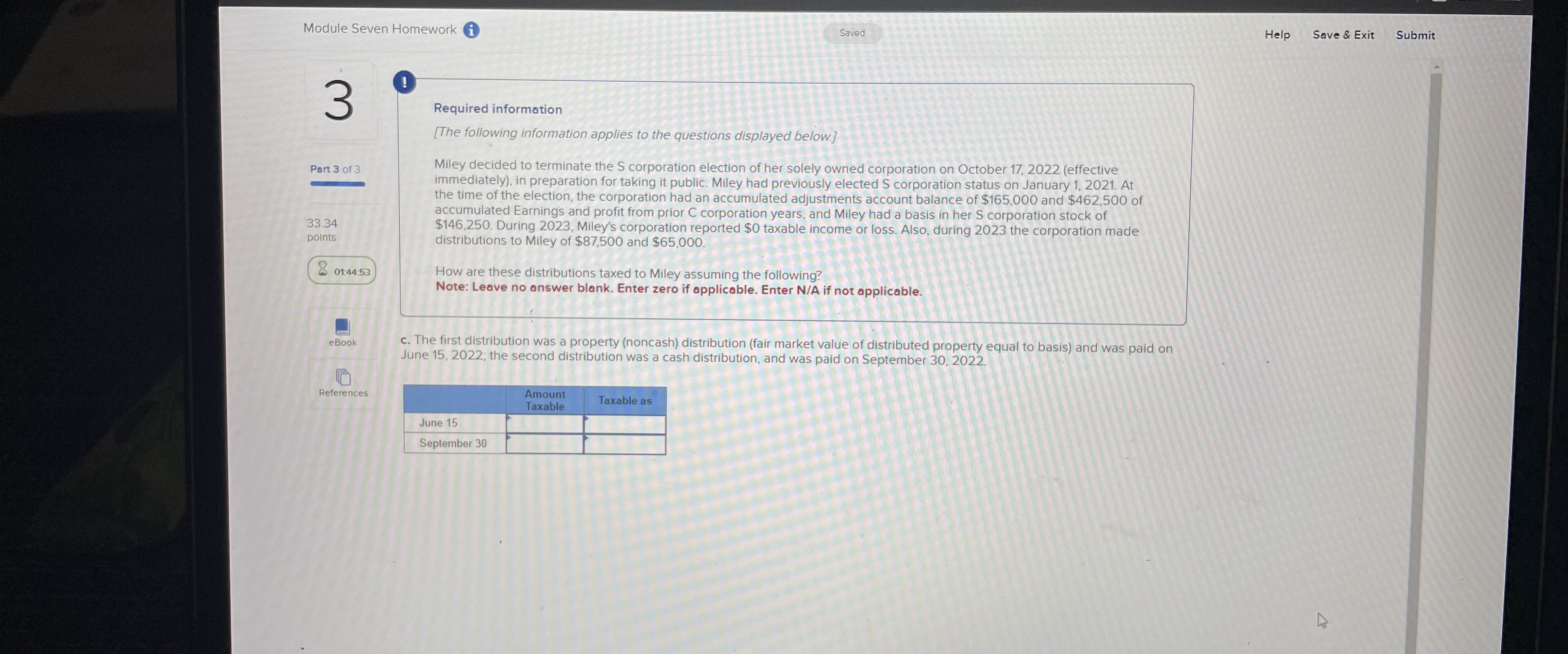

Required information

The following information applies to the questions displayed below.

Miley decided to terminate the S corporation election of her solely owned corporation on October effective immediately in preparation for taking it public. Miley had previously elected S corporation status on January At the time of the election, the corporation had an accumulated adjustments account balance of $ and $ of accumulated Earnings and profit from prior C corporation years, and Miley had a basis in her corporation stock of $ During Miley's corporation reported $ taxable income or loss. Also, during the corporation made distributions to Miley of $ and $

How are these distributions taxed to Miley assuming the following?

Note: Leave no answer blank. Enter zero if applicable. Enter NA if not applicable.

c The first distribution was a property noncash distribution fair market value of distributed property equal to basis and was paid on June ; the second distribution was a cash distribution, and was paid on September

tabletableAmountTaxableTaxable asJune September

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock