Question: Module Three Homework Template - Excel * Home Insert Page Layout Formulas * Cut Arial 10 Copy Format Painter BIU.E.O. A Clipboard Font x P7-5

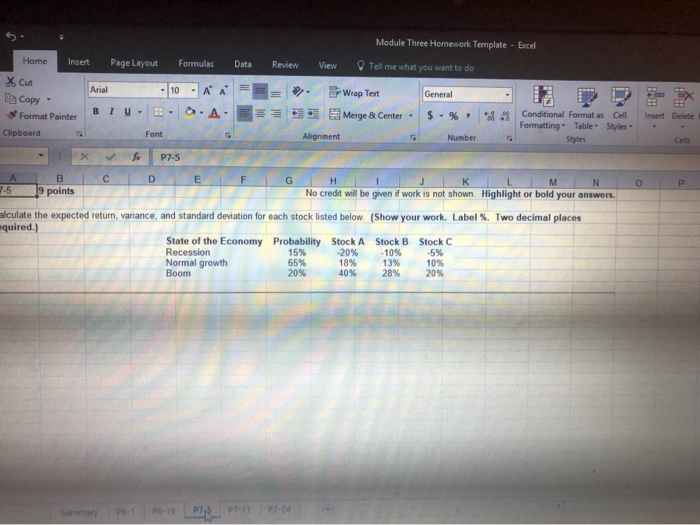

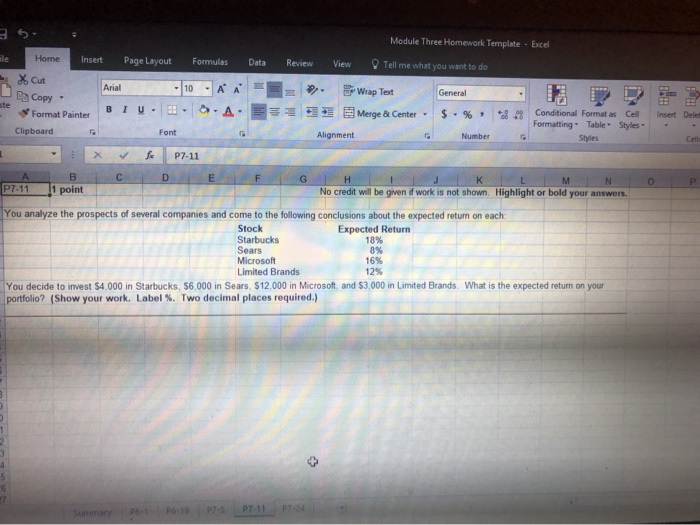

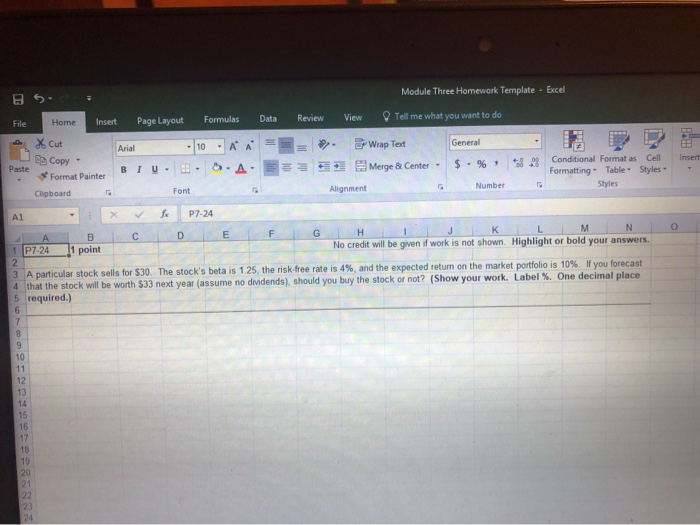

Module Three Homework Template - Excel * Home Insert Page Layout Formulas * Cut Arial 10 Copy Format Painter BIU.E.O. A Clipboard Font x P7-5 Data Review View Tell me what you want to do =*=> # Wrap Test General z . Merge & Center - $ % Alignment - & D D Conditional Format as Cell Formatting Table Styles Styles - Number - Cells A C D E G 7- 5 B points H I J K L M No po No credit will be given if work is not shown. Highlight or bold your answers. 9 alculate the expected return, variance, and standard deviation for each stock listed below. (Show your work. Label %. Two decimal places equired.) State of the Economy Probability Stock A Stock B Stock C Recession 15% -20% - 10% -5% Normal growth 65% 18% 13% 10% Boom 20% 28% 209 40% Summary PotP6:10 P75_P7 P724 4 Module Three Homework Template - Excel Review View Tell me what you want to do Copy General - D D . Wrap Text Mergea Center. Alignment $. % le Home Insert Page Layout Formulas Data A X cut Arial -10 - A = Format Painter BIU. . . A. Clipboard Font 1 x B P7-11 A B C D P7-111 point * Conditional Format as Cell Formatting Table Styles Insert De - - HT K L M N No credit will be given work is not shown Highlight or bold your answers. O P You analyze the prospects of several companies and come to the following conclusions about the expected return on each: Stock Expected Return Starbucks 18% Sears 8% Microsoft 16% Limited Brands You decide to invest $4,000 in Starbucks, S6,000 in Sears. $12,000 in Microsoft and $3,000 in Limited Brands. What is the expected return on your portfolio? (Show your work. Label %. Two decimal places required.) 129

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts