Question: Module Title: Corporate Reporting Module Code: ACCA33305 Question Two You have recently started your graduate job at Falcon Ltd and the FD has asked for

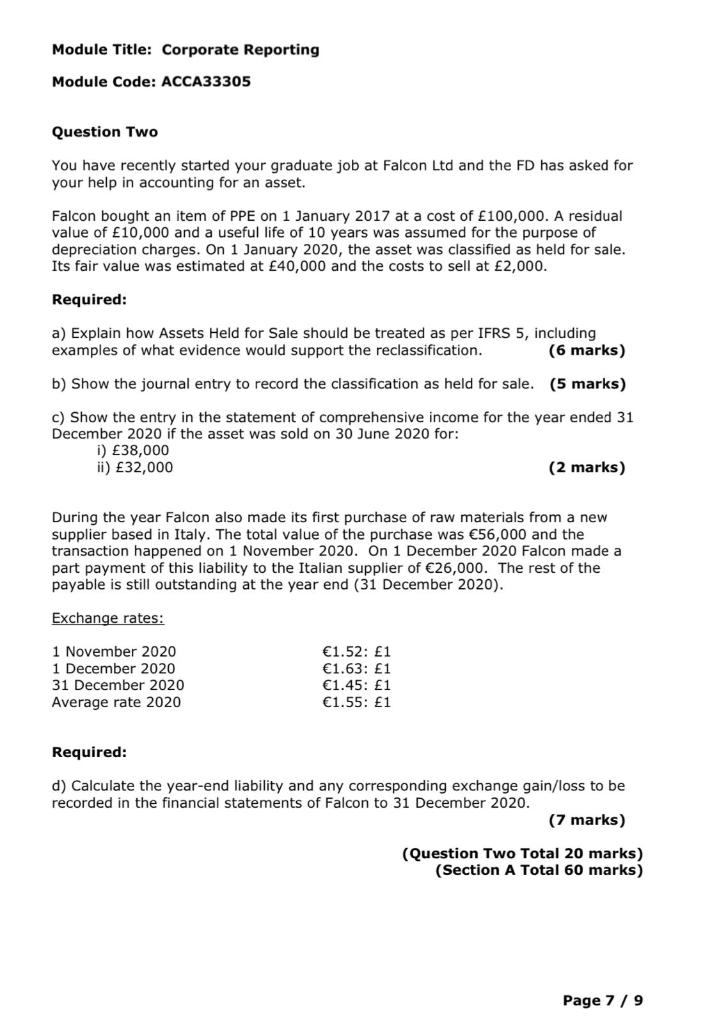

Module Title: Corporate Reporting Module Code: ACCA33305 Question Two You have recently started your graduate job at Falcon Ltd and the FD has asked for your help in accounting for an asset. Falcon bought an item of PPE on 1 January 2017 at a cost of 100,000. A residual value of 10,000 and a useful life of 10 years was assumed for the purpose of depreciation charges. On 1 January 2020, the asset was classified as held for sale. Its fair value was estimated at 40,000 and the costs to sell at 2,000. Required: a) Explain how Assets Held for Sale should be treated as per IFRS 5, including examples of what evidence would support the reclassification. (6 marks) b) Show the journal entry to record the classification as held for sale. (5 marks) c) Show the entry in the statement of comprehensive income for the year ended 31 December 2020 if the asset was sold on 30 June 2020 for: i) 38,000 ii) 32,000 (2 marks) During the year Falcon also made its first purchase of raw materials from a new supplier based in Italy. The total value of the purchase was 56,000 and the transaction happened on 1 November 2020. On 1 December 2020 Falcon made a part payment of this liability to the Italian supplier of 26,000. The rest of the payable is still outstanding at the year end (31 December 2020). Exchange rates: 1 November 2020 1 December 2020 31 December 2020 Average rate 2020 1.52: 1 1.63: 1 1.45: 1 1.55: 1 Required: d) Calculate the year-end liability and any corresponding exchange gain/loss to be recorded in the financial statements of Falcon to 31 December 2020. (7 marks) (Question Two Total 20 marks) (Section A Total 60 marks) Page 7/9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts