Question: . - Modules > Module 6 - Accounting for Assets: Plant, Property, & Equi... > 6.7 - Homework: MyAccountingLab Homework 6 MGMT 210 Financial Accounting

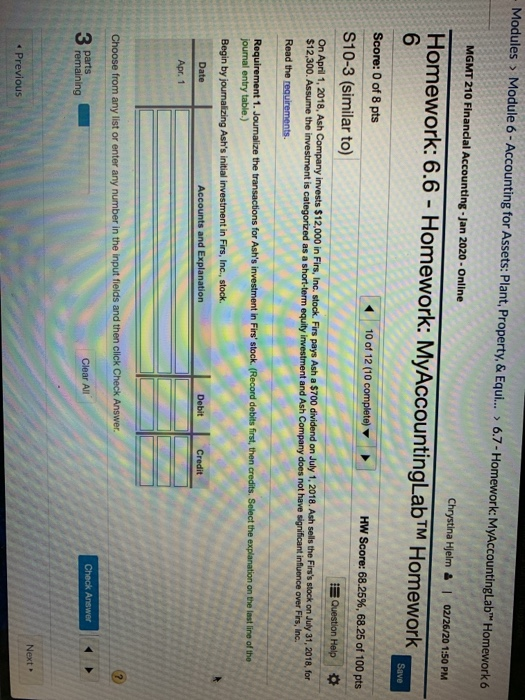

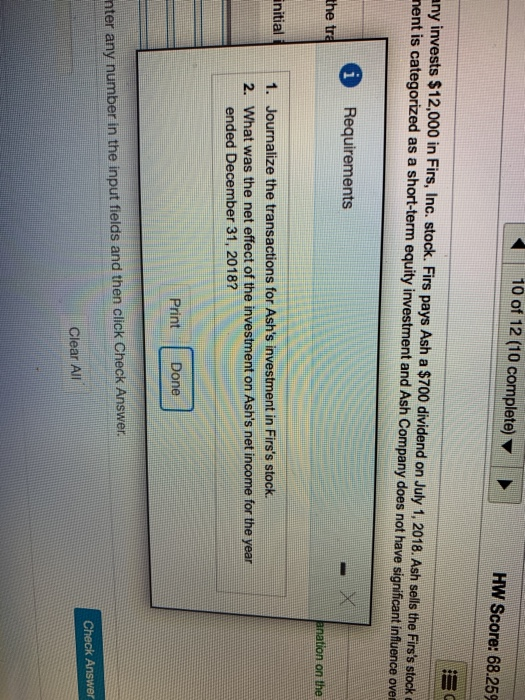

- Modules > Module 6 - Accounting for Assets: Plant, Property, & Equi... > 6.7 - Homework: MyAccountingLab Homework 6 MGMT 210 Financial Accounting - Jan 2020 - Online Chrystina Hjelm | 02/26/20 1:50 PM Homework: 6.6 - Homework: MyAccountingLab Homework Save Score: 0 of 8 pts S10-3 (similar to) 10 of 12 (10 complete) HW Score: 68.25%, 68.25 of 100 pts Question Help On April 1, 2018, Ash Company invests $12,000 in Firs, Inc. stock. Firs pays Ash a $700 dividend on July 1, 2018. Ash sells the Firs's stock on July 31, 2018, for $12,300. Assume the investment is categorized as a short-term equity investment and Ash Company does not have significant influence over Firs, Inc. Read the requirements. Requirement 1. Joumalize the transactions for Ash's investment in Firs' stock. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing Ash's initial investment in Firs, Inc., stock. Date Accounts and Explanation Debit Credit Apr. 1 Choose from any list or enter any number in the input fields and then click Check Answer. 3 parts Clear All Check Answer remaining Next Previous 2 10 of 12 (10 complete) HW Score: 68.259 any invests $12,000 in Firs, Inc. stock. Firs pays Ash a $700 dividend on July 1, 2018. Ash sells the Firs's stock nent is categorized as a short-term equity investment and Ash Company does not have significant influence over i Requirements the tra anation on the initial 1. Journalize the transactions for Ash's investment in Firs's stock. 2. What was the net effect of the investment on Ash's net income for the year ended December 31, 2018? Print Done nter any number in the input fields and then click Check Answer. Check Answer Clear All

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts