Question: MOL5903 Module overview - Strategic francial management QUESTION 3 20 marks Rand Water is evaluating five possible projects to enhance the efficiency of its water

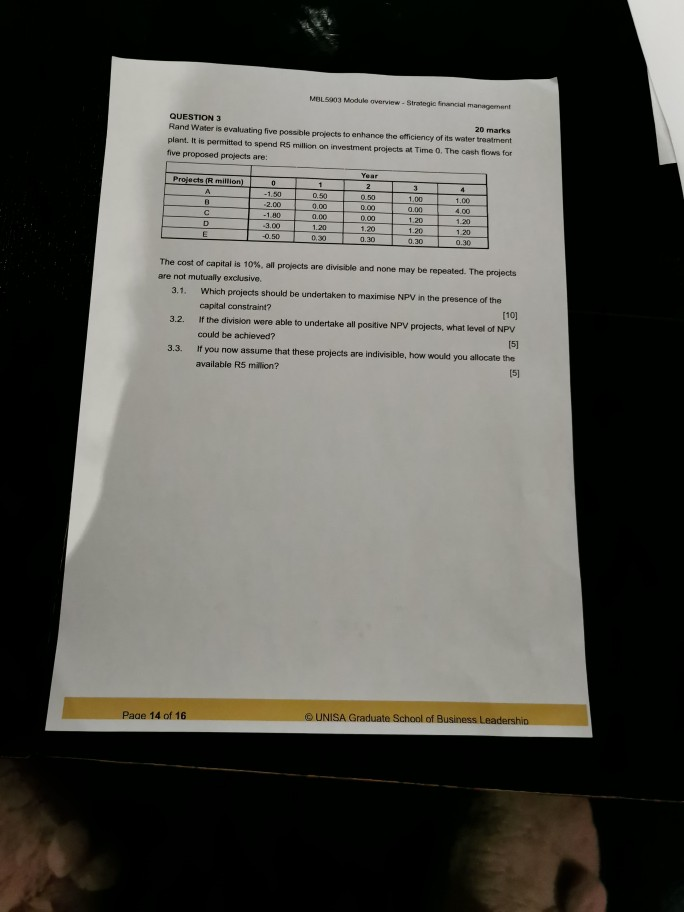

MOL5903 Module overview - Strategic francial management QUESTION 3 20 marks Rand Water is evaluating five possible projects to enhance the efficiency of its water treatment plant. It is permitted to spend R5 million on investment projects at Time 0. The cash flows for five proposed projects are: 0 Year 2 0.50 Projects ( million) B D E -1.50 -2.00 -1.80 -3.00 -0.50 1 0.50 0.00 0.00 1.20 0.30 3 1.00 0.00 1.20 1.20 0.30 4 1,00 4.00 1.20 1.20 0.00 1.20 0.30 0.30 The cost of capital is 10%. all projects are divisible and none may be repeated. The projects are not mutually exclusive 3.1. Which projects should be undertaken to maximise NPV in the presence of the capital constraint? [10] 3.2. if the division were able to undertake all positive NPV projects, what level of NPV could be achieved? [5] 3.3 If you now assume that these projects are indivisible, how would you allocate the available R5 milion? [5] Page 14 of 16 UNISA Graduate School of Business Leadership

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts