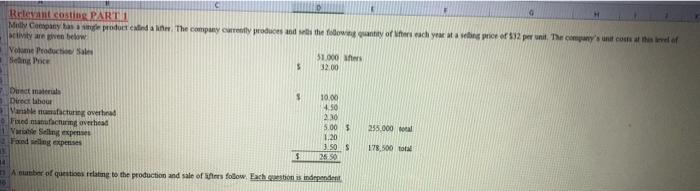

Question: Molly comapny has a single product called a lifeter. The conpany currently produces and sells the following quantity of lifters each year at a price

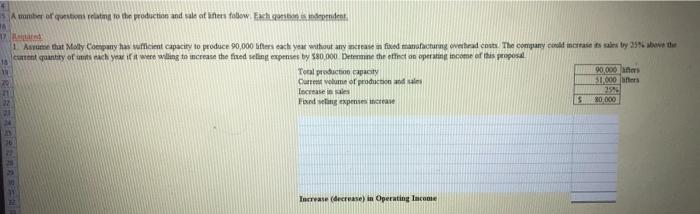

Relevant costing PART 1 Melly Company tas ng product extind in the company produces and the following ty of the each yeasta ing price of 532 p. The count contre of scility are bebw Volume Product Sale 51.000 Senge $ 32.00 Dunct materiale Direct labour Vanable naturveta Fited nuching ovrhed Selling expe ang expenses 10.00 450 2.30 5.00 $ 1.20 3.50 26 SO 255.000 178,500 to $ Auber of questions inlating to the production and sale of the follow. Each gestion is independent A minber of arm relating to the production and sale of after folow Each demndent 1 Asume that Moly Company has sufficient capacity to produce 90,000 after each year without any crease in fixed manufacturing ovated costs. The company could increase its sales by 25 beve the content quantity of units each year if it were willing to increase the fired selling expenses by 580,000 Determne the tinct an operating income of this proposal Total production capacity 90,000 anos Current volume of production and 1.000 liters Increase in les 254 Foeding expenses increase 80,000 5 Inervase (decrease) in Operating Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts