Question: Molly Grey ( single ) acquired a 3 0 percent limited partnership interest in Beau Geste LLP several years ago for $ 5 0 ,

Molly Grey single acquired a percent limited partnership interest in Beau Geste LLP several years ago for $ At the

beginning of year Molly has tax basis and an atrisk amount of $ In year Beau Geste incurs a loss of $ and does

not make any distributions to the partners.

In year Molly's AGI excluding any income or loss from Beau Geste is $ This includes $ of passive income from

other passive activities.

In year Beau Geste earns income of $ In addition, Molly contributes an additional $ to Beau Geste during year

Molly's AGI in year is $excluding any income or loss from Beau Geste This amount includes $ in income from

her other passive investments.

Required:

a Based on the above information, complete the requirements to

b Based on the above information, complete the requirements B to B

Complete this question by entering your answers in the tabs below.

Required A

Required A

Required A

Required B

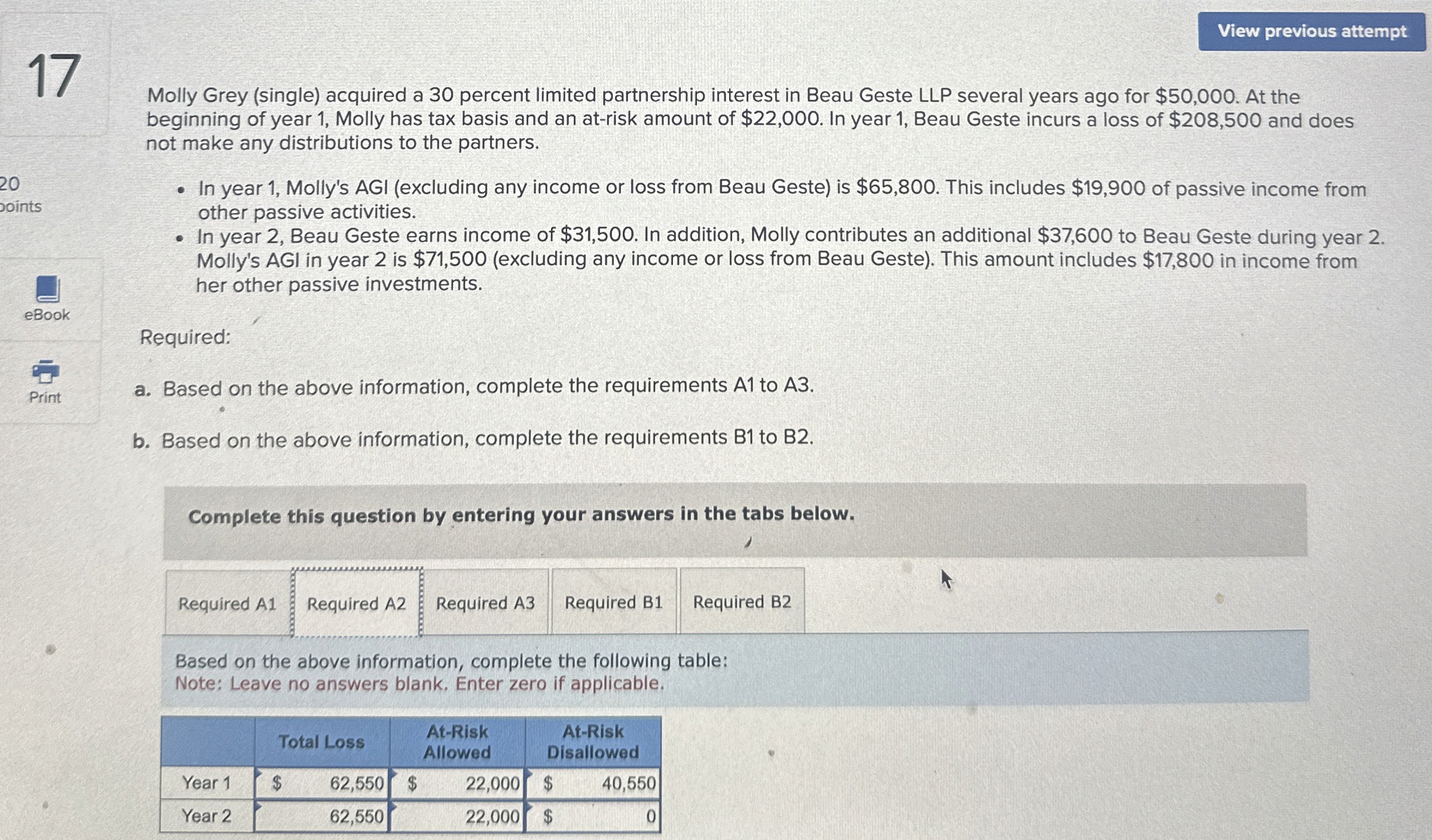

Based on the above information, complete the following table:

Note: Leave no answers blank. Enter zero if applicable.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock