Question: Monetary Policy: End o f Chapter Problem W e discussed how hard i t i s t o keep A D stable o r put

Monetary Policy: End Chapter Problem

discussed how hard keep stable put back "where belongs" after a shock. Sometimes better taking two years slowly and carefully undo shock rather than shift back quickly one year. illustrate, let's see how things turn out you take two years rather than one year react a negative velocity shock.

this question, your ultimate goal get back per year. The potential growth rate and expected inflation always per year. Starting point:

: Inflation Real Growth Rate

SRAS: Inflation Expected Inflation

Slow approach: Add per year for two years

some mix money growth and higher confidence

What will real growth equal each year?

Real growth rate the start:

Real growth rate the end year one:

Real growth rate the end year two:

IVionetary Policy: End Cnapter Probiem

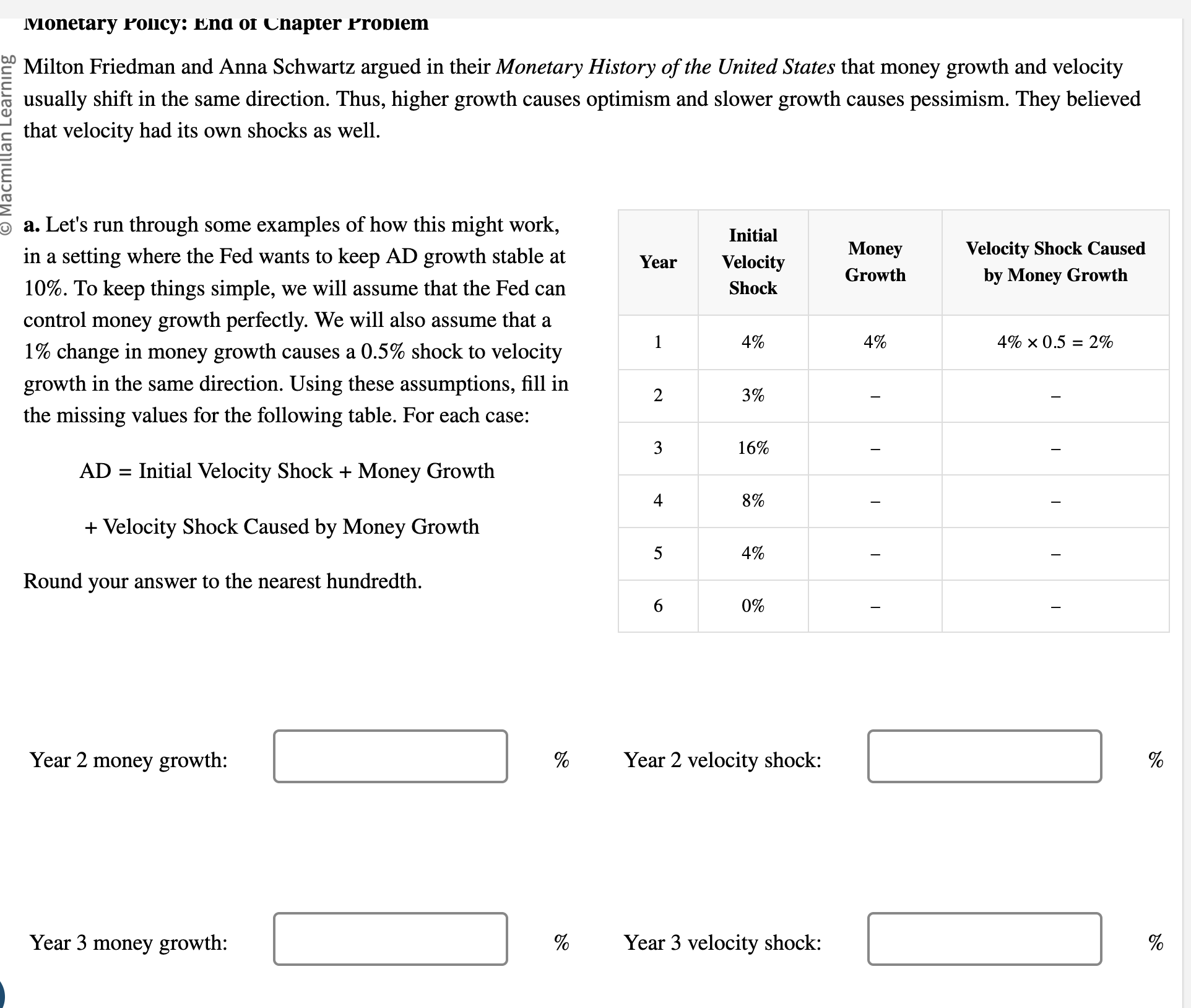

Milton Friedman and Anna Schwartz argued their Monetary History the United States that money growth and velocity

usually shift the same direction. Thus, higher growth causes optimism and slower growth causes pessimism. They believed

that velocity had its own shocks well.

Let's run through some examples how this might work,

a setting where the Fed wants keep growth stable

keep things simple, will assume that the Fed can

control money growth perfectly. will also assume that

change money growth causes shock velocity

growth the same direction. Using these assumptions, fill

the missing values for the following table. For each case:

Initial Velocity Shock Money Growth

Velocity Shock Caused Money Growth

Round your answer the nearest hundredth.

Year money growth:

Year velocity shock:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock