Question: Monetary Policy Test Review Sheet This will count as two daily grades and 10 extra-credit points on your Monetary Policy Exam. 1. Answer the following

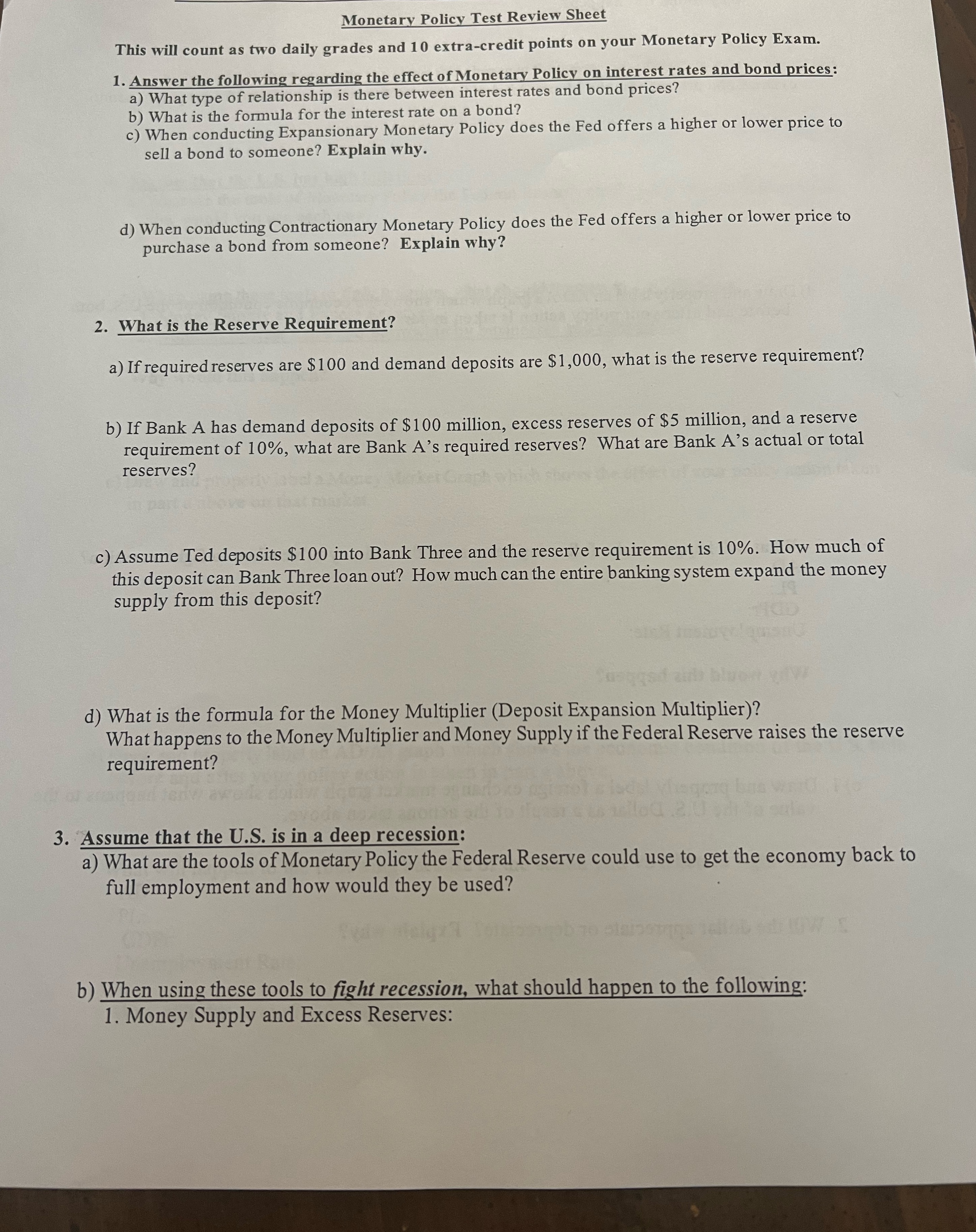

Monetary Policy Test Review Sheet This will count as two daily grades and 10 extra-credit points on your Monetary Policy Exam. 1. Answer the following regarding the effect of Monetary Policy on interest rates and bond prices: a) What type of relationship is there between interest rates and bond prices? b) What is the formula for the interest rate on a bond? c) When conducting Expansionary Monetary Policy does the Fed offers a higher or lower price to sell a bond to someone? Explain why. d) When conducting Contractionary Monetary Policy does the Fed offers a higher or lower price to purchase a bond from someone? Explain why? 2. What is the Reserve Requirement? a) If required reserves are $100 and demand deposits are $1,000, what is the reserve requirement? b) If Bank A has demand deposits of $100 million, excess reserves of $5 million, and a reserve requirement of 10%, what are Bank A's required reserves? What are Bank A's actual or total reserves? c) Assume Ted deposits $100 into Bank Three and the reserve requirement is 10%. How much of this deposit can Bank Three loan out? How much can the entire banking system expand the money supply from this deposit? d) What is the formula for the Money Multiplier (Deposit Expansion Multiplier)? What happens to the Money Multiplier and Money Supply if the Federal Reserve raises the reserve requirement? 3. Assume that the U.S. is in a deep recession: a) What are the tools of Monetary Policy the Federal Reserve could use to get the economy back to full employment and how would they be used? b) When using these tools to fight recession, what should happen to the following: 1. Money Supply and Excess Reserves

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts