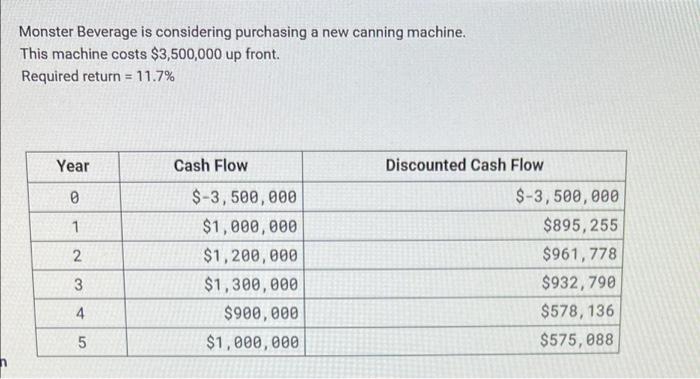

Question: Monster Beverage is considering purchasing a new canning machine. This machine costs $3,500,000 up front. Required return = 11.7% Year Cash Flow 0 1 2

Monster Beverage is considering purchasing a new canning machine. This machine costs $3,500,000 up front. Required return = 11.7% Year Cash Flow 0 1 2 $-3,500,000 $1,000,000 $1,200,000 $1,300,000 $900,000 $1,000,000 Discounted Cash Flow $-3,500,000 $895,255 $961,778 $932, 790 $578,136 $575, 088 3 4 5 Hint: This is the future discounted cash flows calculated earlier plus the cash outlay for purchasing the machine. What is the NPV if the required return were to be 11.7%? Enter a response then click Submit below $ Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts