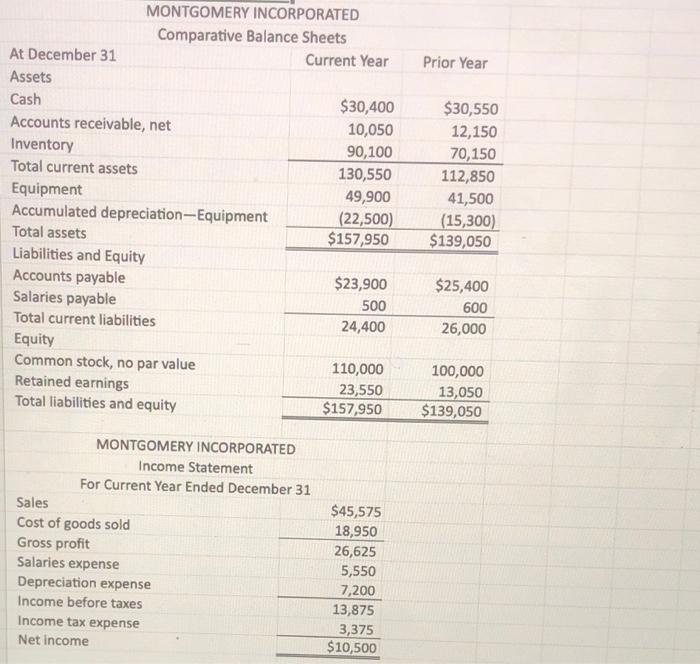

Question: MONTGOMERY INCORPORATED Comparative Balance Sheets At December 31 Current Year Prior Year Assets Cash Accounts receivable, net Inventory Total current assets Equipment Accumulated depreciation-Equipment Total

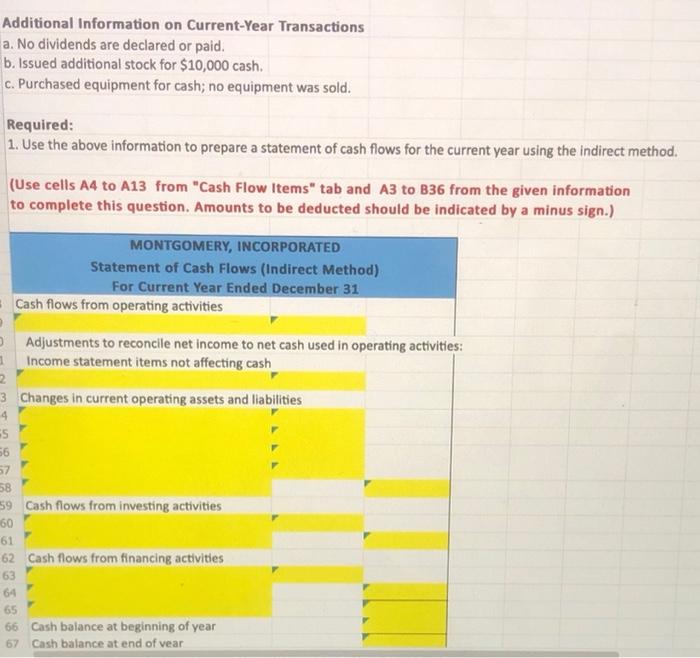

MONTGOMERY INCORPORATED Comparative Balance Sheets At December 31 Current Year Prior Year Assets Cash Accounts receivable, net Inventory Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Salaries payable Total current liabilities \begin{tabular}{|rr} \hline$30,400 & $30,550 \\ 10,050 & 12,150 \\ 90,100 & 70,150 \\ \hline 130,550 & 112,850 \\ 49,900 & 41,500 \\ (22,500) & (15,300) \\ \hline$157,950 & $139,050 \\ \hline \hline \end{tabular} Equity \begin{tabular}{rr} $23,900 & $25,400 \\ 500 & 600 \\ \hline 24,400 & 26,000 \end{tabular} Common stock, no par value Retained earnings Total liabilities and equity \begin{tabular}{rr} 110,000 & 100,000 \\ 23,550 & 13,050 \\ \hline$157,950 & $139,050 \\ \hline \end{tabular} MONTGOMERY INCORPORATED Income Statement For Current Year Ended December 31 \begin{tabular}{lr} Sales & $45,575 \\ \hline Cost of goods sold & 18,950 \\ \hline Gross profit & 26,625 \\ Salaries expense & 5,550 \\ Depreciation expense & 7,200 \\ \hline Income before taxes & 13,875 \\ Income tax expense & 3,375 \\ \hline Net income & $10,500 \\ \hline \end{tabular} Additional Information on Current-Year Transactions a. No dividends are declared or paid. b. Issued additional stock for $10,000 cash. c. Purchased equipment for cash; no equipment was sold. Required: 1. Use the above information to prepare a statement of cash flows for the current year using the indirect method. (Use cells A4 to A13 from "Cash Flow Items" tab and A3 to B36 from the given information to complete this question. Amounts to be deducted should be indicated by a minus sign.) MONTGOMERY, INCORPORATED Statement of Cash Flows (Indirect Method) For Current Year Ended December 31 Cash flows from operating activities Adjustments to reconcile net income to net cash used in operating activities: Income statement items not affecting cash Changes in current operating assets and liabilities Cash flows from investing activities Cash flows from financing activities Cash balance at beginning of year Cash balance at end of vear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts