Question: months and will partially disrupt production. The firm has just completed a $50,000 feasibility study to analyze the decision to buy the XC-750, resulting in

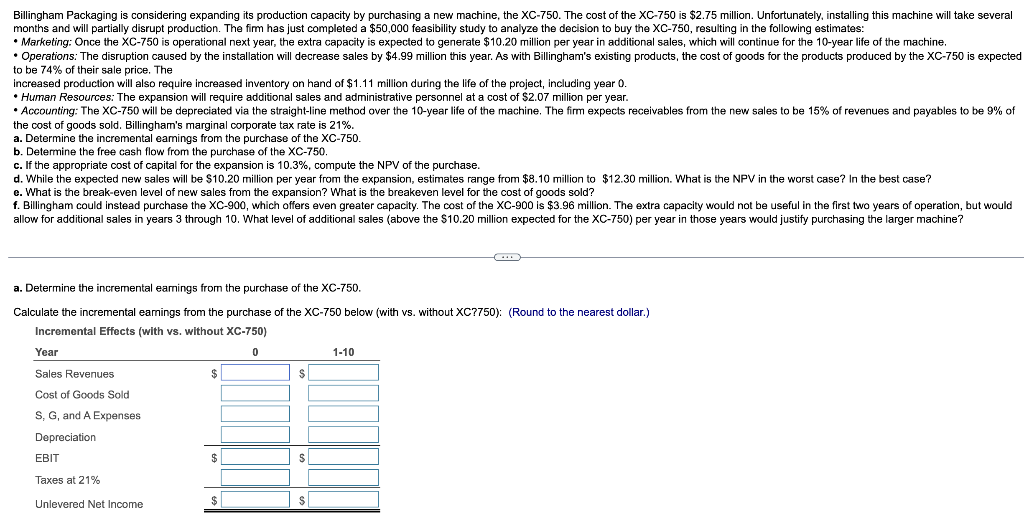

months and will partially disrupt production. The firm has just completed a $50,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates: to be 74% of their sale price. The increased production will also require increased inventory on hand of $1.11 million during the life of the project, including year 0 . - Human Resources: The expansion will require additional sales and administrative personnel at a cost of $2.07 million per year. the cost of goods sold. Billingham's marginal corporate tax rate is 21%. a. Determine the incremental earnings from the purchase of the XC750. b. Determine the free cash flow from the purchase of the XC750. c. If the appropriate cost of capital for the expansion is 10.3%, compute the NPV of the purchase. e. What is the break-even level of new sales from the expansion? What is the breakeven level for the cost of goods sold? a. Determine the incremental eamings from the purchase of the XC750. Calculate the incremental eamings from the purchase of the XC-750 below (with vs. without XC?750 ): (Round to the nearest dollar.) Incremental Effects (with vs, without XC-750) months and will partially disrupt production. The firm has just completed a $50,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates: to be 74% of their sale price. The increased production will also require increased inventory on hand of $1.11 million during the life of the project, including year 0 . - Human Resources: The expansion will require additional sales and administrative personnel at a cost of $2.07 million per year. the cost of goods sold. Billingham's marginal corporate tax rate is 21%. a. Determine the incremental earnings from the purchase of the XC750. b. Determine the free cash flow from the purchase of the XC750. c. If the appropriate cost of capital for the expansion is 10.3%, compute the NPV of the purchase. e. What is the break-even level of new sales from the expansion? What is the breakeven level for the cost of goods sold? a. Determine the incremental eamings from the purchase of the XC750. Calculate the incremental eamings from the purchase of the XC-750 below (with vs. without XC?750 ): (Round to the nearest dollar.) Incremental Effects (with vs, without XC-750)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts