Question: Monty Company purchased a delivery truck for $31,000 on January 1,2022 . The truck has an expected salvage value of $1,840, and is expected to

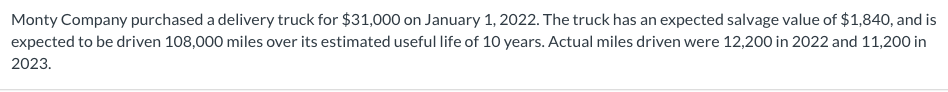

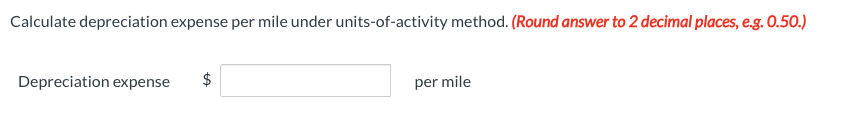

Monty Company purchased a delivery truck for $31,000 on January 1,2022 . The truck has an expected salvage value of $1,840, and is expected to be driven 108,000 miles over its estimated useful life of 10 years. Actual miles driven were 12,200 in 2022 and 11,200 in 2023. Calculate depreciation expense per mile under units-of-activity method. (Round answer to 2 decimal places, e.g. 0.50.) Depreciation expense $ per mile

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts