Question: Moon River Adventures is considering the following new project. Project inflows are expected to be $20,000 per year, and project outflows are expected to

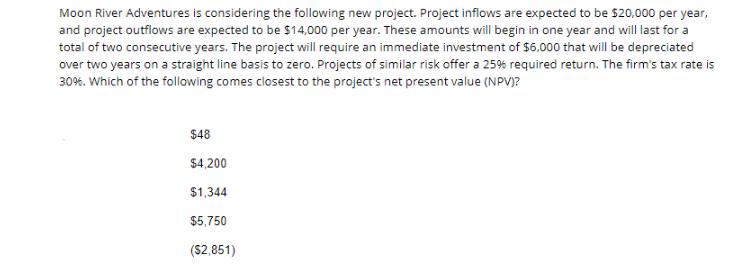

Moon River Adventures is considering the following new project. Project inflows are expected to be $20,000 per year, and project outflows are expected to be $14,000 per year. These amounts will begin in one year and will last for a total of two consecutive years. The project will require an immediate investment of $6,000 that will be depreciated over two years on a straight line basis to zero. Projects of similar risk offer a 25% required return. The firm's tax rate is 30%. Which of the following comes closest to the project's net present value (NPV)? $48 $4,200 $1,344 $5,750 ($2,851)

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

To calculate the Net Present Value NPV of the project we need to discount the future cash flows to t... View full answer

Get step-by-step solutions from verified subject matter experts