Question: Moore Corp. issued 5% seven-year bonds payable with a face amount of S50.000 when the market terest rate was 5% Moore's fiscal year-end on December

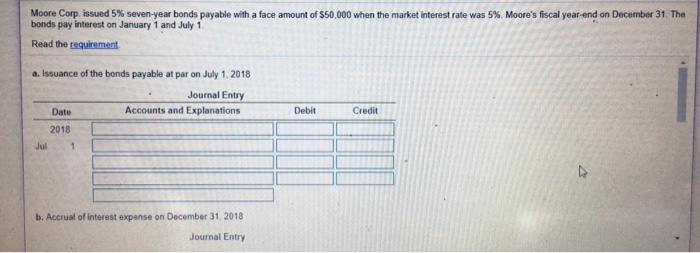

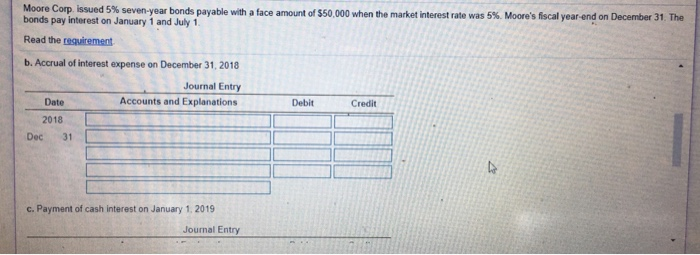

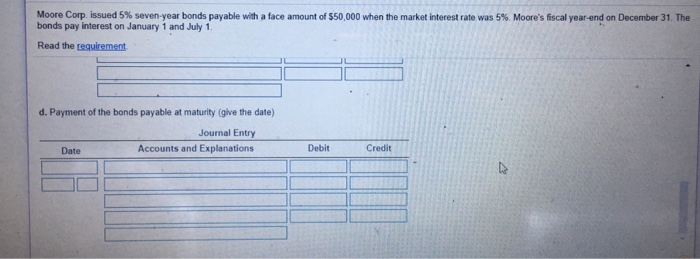

Moore Corp. issued 5% seven-year bonds payable with a face amount of S50.000 when the market terest rate was 5% Moore's fiscal year-end on December 31 The bonds pay interest on January 1 and July 1 Read the requirement a. Issuance of the bonds payable at par on July 1. 2018 Journal Entry Accounts and Explanations Date Debit Credit 2018 Jul b. Accrual of interest expense on December 31, 2018 Journal Entry Moore Corp issued 5% seven-year bonds payable with a face amount of S500 when the market interest rate was 5%, Moore's fiscal yearend on December 31 The bonds pay interest on January 1 and July 1 Read the reguirement b. Accrual of interest expense on December 31, 2018 Journal Entry Accounts and Explanations Date 2018 Dec 31 Debit Credit 10 c. Payment of cash interest on January 1, 2019 Journal Entry Moore Corp ssued 5% seven-year bonds payable with a face amount f S50,000 when the market interest rate was 5%. Moore's fiscal year end on December 31, The bonds pay interest on January 1 and July 1 Read the requirement d. Payment of the bonds payable at maturity (give the date) Journal Entry Accounts and Explanations Date Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts