Question: Moorman Corporation has an activity-based costing system wth three activity cost pools - Processing. Setting Up, and Other. The companys overhead costs consist of equipment

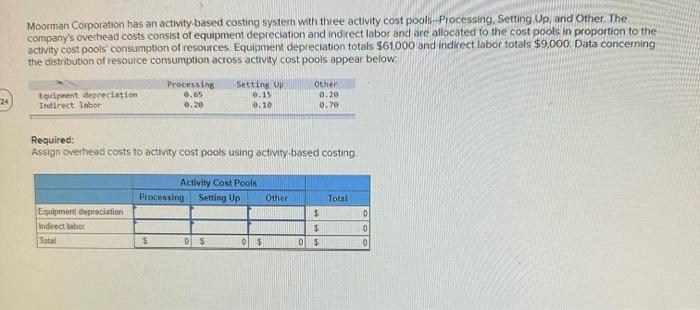

Moorman Corporation has an activity-based costing system wth three activity cost pools - Processing. Setting Up, and Other. The companys overhead costs consist of equipment depreciation and ind rect labor and are allocated to the cost pools in proportion to the activity cost pools consumption of resources. Equipment depreciation totals $61,000 and indirect labor totals $9,000. Data concerning the distribution of resource consumption across activity cost pools appear below: Required: Assign overhead costs to activity cost pools using activity-based costing

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock