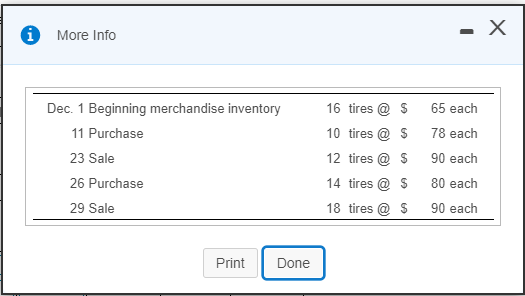

Question: * More Info - X Dec. 1 Beginning merchandise inventory 11 Purchase 23 Sale 26 Purchase 29 Sale 16 tires @ 10 tires @ 12

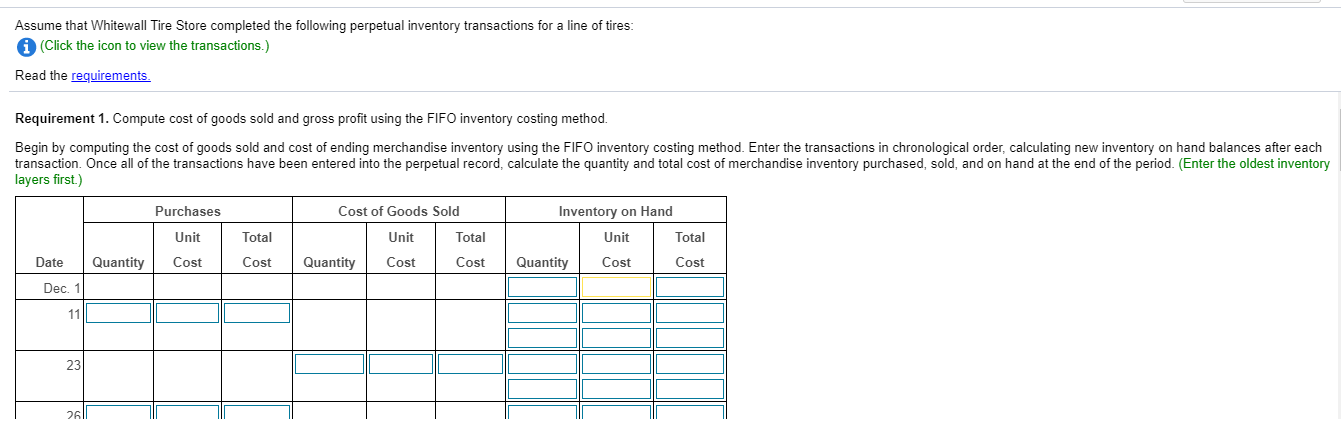

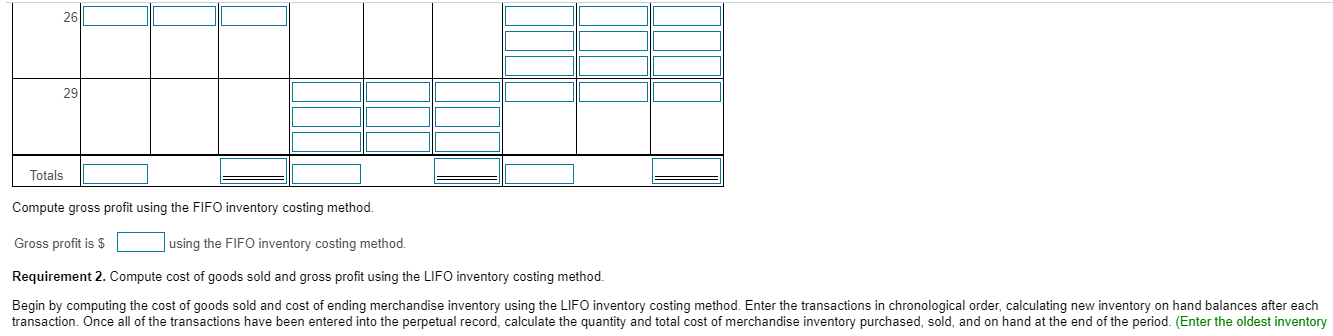

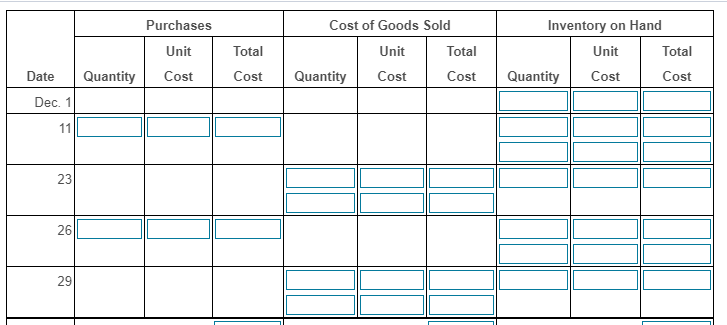

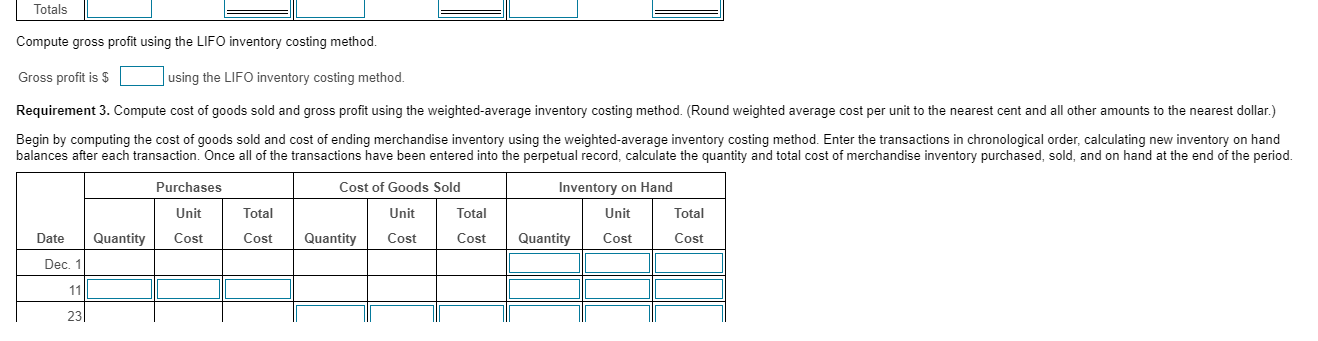

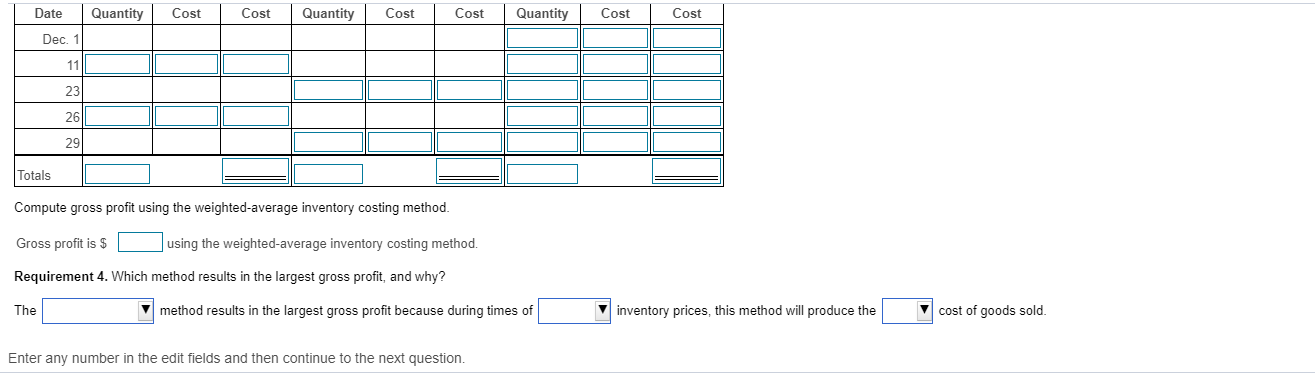

* More Info - X Dec. 1 Beginning merchandise inventory 11 Purchase 23 Sale 26 Purchase 29 Sale 16 tires @ 10 tires @ 12 tires @ 14 tires @ 18 tires @ $ $ $ $ $ 65 each 78 each 90 each 80 each 90 each Print Done Assume that Whitewall Tire Store completed the following perpetual inventory transactions for a line of tires: (Click the icon to view the transactions.) Read the requirements. Requirement 1. Compute cost of goods sold and gross profit using the FIFO inventory costing method. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Inventory on Hand Purchases Unit Cost Cost of Goods Sold Unit | Total Quantity | Cost Cost Total Cost Total Unit Cost Quantity Quantity Cost Date Dec. 1 2011 Totals Compute gross profit using the FIFO inventory costing method. Gross profit is $ using the FIFO inventory costing method. Requirement 2. Compute cost of goods sold and gross profit using the LIFO inventory costing method. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the LIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory Purchases Unit Cost Total Cost Cost of Goods Sold Unit Total Quantity Cost Cost Inventory on Hand Unit Total Quantity Cost Cost Quantity Date Dec. 1 Totals L Compute gross profit using the LIFO inventory costing method. Gross profit is $ using the LIFO inventory costing method. Requirement 3. Compute cost of goods sold and gross profit using the weighted average inventory costing method. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted average inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. Purchases Unit Quantity | Cost Unit Cost of Goods Sold Total Quantity | Cost Cost Total Cost Inventory on Hand Unit Total Quantity | Cost Cost Date Dec. 1 23 Quantity Cost Cost Quantity | Cost Cost Quantity Cost Cost Date Dec. 1 | 26 29 Totals Compute gross profit using the weighted average inventory costing method. Gross profit is $ L u sing the weighted-average inventory costing method. Requirement 4. Which method results in the largest gross profit, and why? The v method results in the largest gross profit because during times of inventory prices, this method will produce the cost of goods sold. Enter any number in the edit fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts