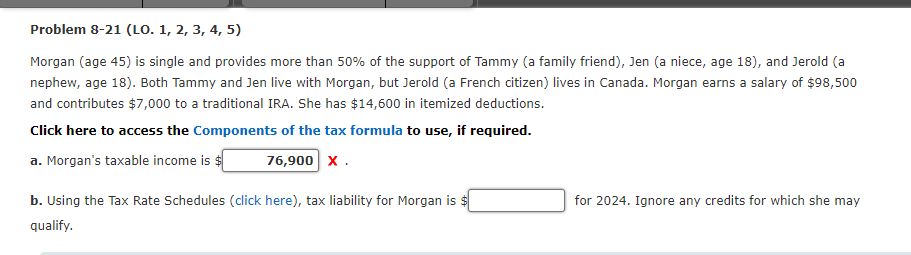

Question: Morgan ( age 4 5 ) is single and provides more than 5 0 % of the support of Tammy ( a family friend )

Morgan age is single and provides more than of the support of Tammy a family friend Jen a niece, age and Jerold a nephew, age Both Tammy and Jen live with Morgan, but Jerold a French citizen lives in Canada. Morgan earns a salary of $ and contributes $ to a traditional IRA. She has $ in itemized deductions.

Click here to access theComponents of the tax formulato use, if required.

a Morgan's taxable income is $

answer is NOT

b Tax liability for Morgan is $ for Ignore any credits for which she may qualify. Problem LO

Morgan age is single and provides more than of the support of Tammy a family friend Jen a niece, age and Jerold a nephew, age Both Tammy and Jen live with Morgan, but Jerold a French citizen lives in Canada. Morgan earns a salary of $ and contributes $ to a traditional IRA. She has $ in itemized deductions.

Click here to access the Components of the tax formula to use, if required.

a Morgan's taxable income is $ mathbfX

b Using the Tax Rate Schedules click here tax liability for Morgan is $ for Ignore any credits for which she may qualify. Tax Rate Schedules

begintabularcccccccc

hline multicolumnlSingleSchedule X & multicolumnlHead of householdSchedule Z

hline If taxable income is: Over & But not over & The tax is: & of the amount over & If taxable income is: Over & But not over & The tax is: & of the amount over

hline $ & $ & & $ & $ & $ & & $

hline & & $ & & & & $ &

hline & & & & & & &

hline & & & & & & &

hline & & & & & & &

hline & & & & & & &

hline & & & & & & &

hline multicolumnlMarried filing jointly or Qualifying widowerSchedule mathbfY & multicolumnlMarried filing separatelySchedule Y

hline If taxable income is: Over & But not over & The tax is: & of the amount over & begintabularl

If taxable income is:

Over

endtabular & But not over & The tax is: & of the amount over

hline $ & $ & & $ & $ & $ & & $

hline & & $ & & & & $ &

hline & & & & & & &

hline & & & & & & &

hline & & & & & & &

hline & & & & & & &

hline & & & & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock