Question: Most clear explanation on how to solve these will be awarded the points. Thanks for your help! Consider the following two mutually exclusive projects: Whichever

Most clear explanation on how to solve these will be awarded the points. Thanks for your help!

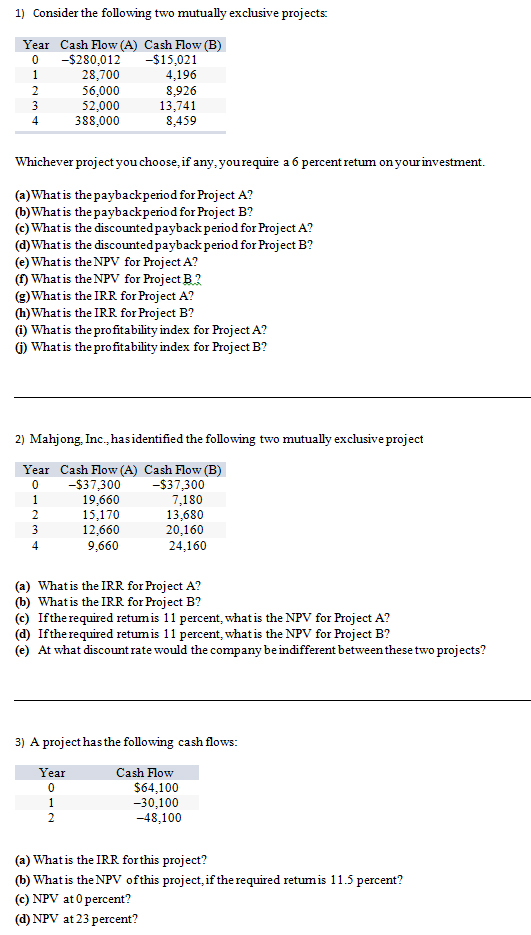

Consider the following two mutually exclusive projects: Whichever project you choose, if any, you re quire a 6 percent return on your investment. What is the paybackperiod for Project A? What is the payback period for Project B? What is the discounted payback period for Project A? What is the discounted payback period for Project B? What is the NPV for Project A? What is the NPV for Project B?. What is the IRR for Project A? What is the IRR for Project B? What is the profitability index for Project A? (j) What is the profitability index for Project B? Mahjong, Inc., has identified the following two mutually exclusive project What is the IRR for Project A? What is the IRR for Project B? If the required return is 11 percent, what is the NPV for Project A? If he required return is 11 percent, what is the NPV for Project B? At what discount rate would the company be indifferent between these two projects? A project has the following cash flows: What is the IRR for this project? What is the NPV of this project, if the required return is 11.5 percent? NPV at 0 percent? NPV at 23 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts