Question: most closely related to material usage. Therefore, DDC allocates manufacturing overhead to production based upon kilograms of materials used. ( Click the icon to view

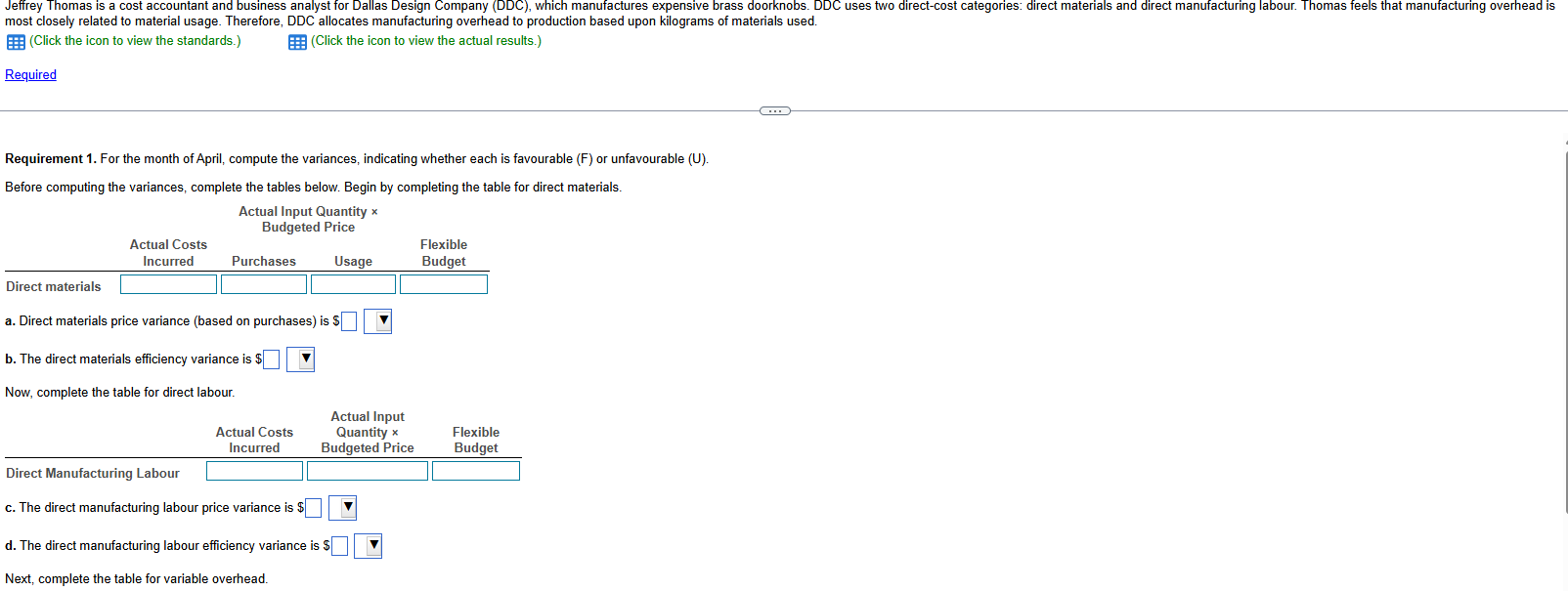

most closely related to material usage. Therefore, DDC allocates manufacturing overhead to production based upon kilograms of materials used. Click the icon to view the standards.Click the icon to view the actual results. Required Requirement For the month of April, compute the variances, indicating whether each is favourable F or unfavourable U Before computing the variances, complete the tables below. Begin by completing the table for direct materials. Actual Input Quantity Budgeted Price a Direct materials price variance based on purchases is $ b The direct materials efficiency variance is $ Now, complete the table for direct labour.Actual Costs IncurredActual Input Quantity Budgeted PriceFlexible Budget Next, complete the table for variable overhead. Next, complete the table for variable overhead.

e The variable manufacturing overhead spending variance is $ square

f The variable manufacturing overhead efficiency variance is $ square

Complete the table for fixed overhead.

g The productionvolume variance is $

h The fixed manufacturing overhead spending variance is $ square

Requirement Can Thomas use any of the variances to help explain any of the other variances? Give examples. efficiency variance

In turn, since variable manufacturing overhead is assigned based on kilograms of materials used, this directly led to the variable overhead efficiency variance. The purchase of this quality of brass may also explain why it took

labour time to produce the doorknobs than expected the direct labour efficiency variance

Actual results

Actual results for the month of April were as follows:

Required

For the month of April, compute the following variances, indicating whether each is favourable F or unfavourable U

a Direct materials price variance based on purchases

b Direct materials efficiency variance

c Direct manufacturing labour price variance

d Direct manufacturing labour efficiency variance

e Variable manufacturing overhead spending variance

f Variable manufacturing overhead efficiency variance

g Productionvolume variance

h Fixed manufacturing overhead spending variance

Can Thomas use any of the variances to help explain any of the other variances? Give examples.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock