Question: Most importantly, good luck!! Question 8 Determine the standard deduction amount for the following individuals in bold. Mary is 1 6 years old and single.

Most importantly, good luck!!

Question

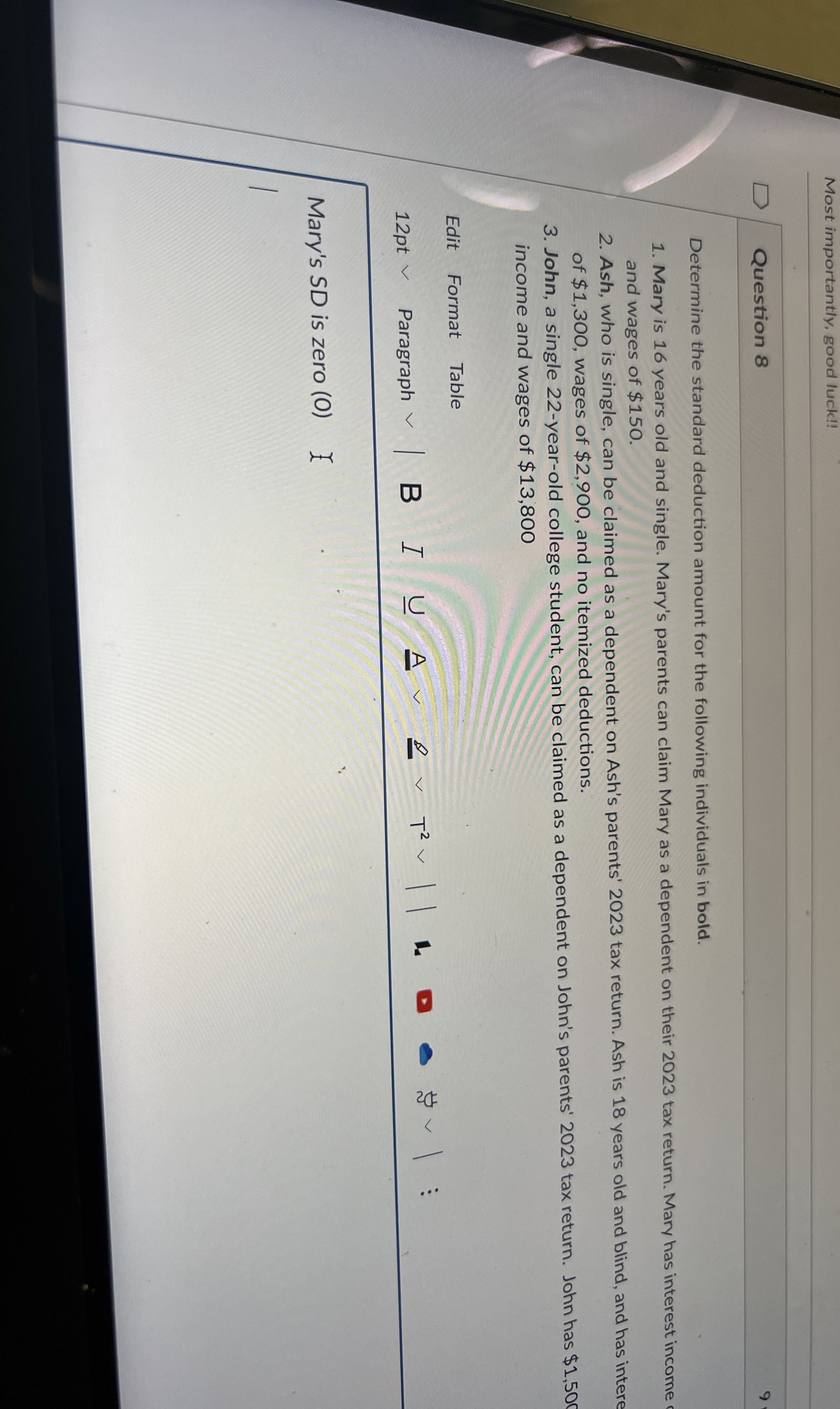

Determine the standard deduction amount for the following individuals in bold.

Mary is years old and single. Mary's parents can claim Mary as a dependent on their tax return. Mary has interest income and wages of $

Ash, who is single, can be claimed as a dependent on Ash's parents' tax return. Ash is years old and blind, and has intere of $ wages of $ and no itemized deductions.

John, a single yearold college student, can be claimed as a dependent on John's parents' tax return. John has $ income and wages of $

Edit

Format

Table

pt

Paragraph

B

A

Mary's SD is zero

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock